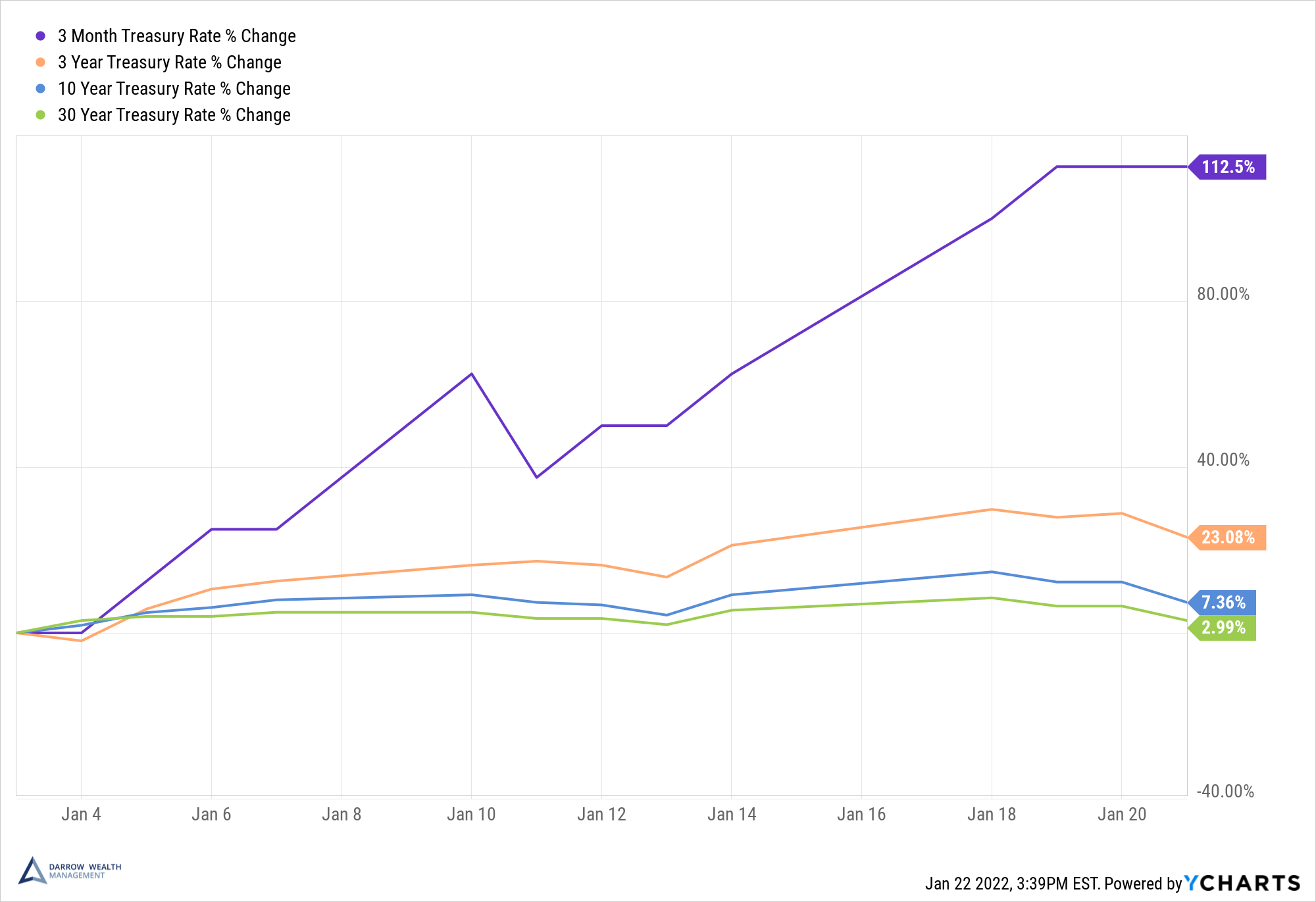

How Do Stocks Perform When Interest Rates Rise?

The Federal Reserve is planning to raise interest rates (the Federal Funds rate) earlier than expected to cool down the hot economy. The stock market

Diversification isn’t a magic bullet, but it is one of the best tools to protect your portfolio from unnecessary losses and volatility. The Darrow Wealth Insights blog covers diversification from several different angles: concentrated stock positions, asset classes, geography, company size, sectors, styles such as factors, and so on. As with anything in investing, consider your personal risk tolerance, time horizon, and circumstances.

The Federal Reserve is planning to raise interest rates (the Federal Funds rate) earlier than expected to cool down the hot economy. The stock market

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

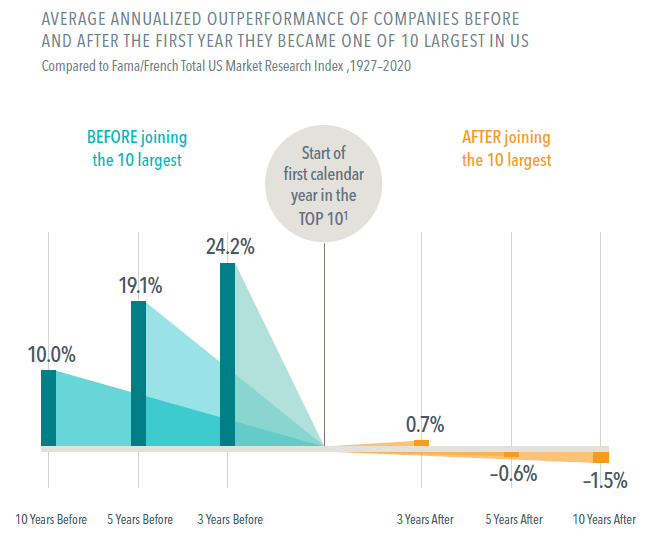

Since 2019, the total return on the S&P 500 is nearly 97% (almost 27% on an average annualized basis).¹ This outperformance is leaving many investors

If you have company stock in your 401(k), consider the pros and cons of net unrealized appreciation at retirement. Under the net unrealized appreciation rules,

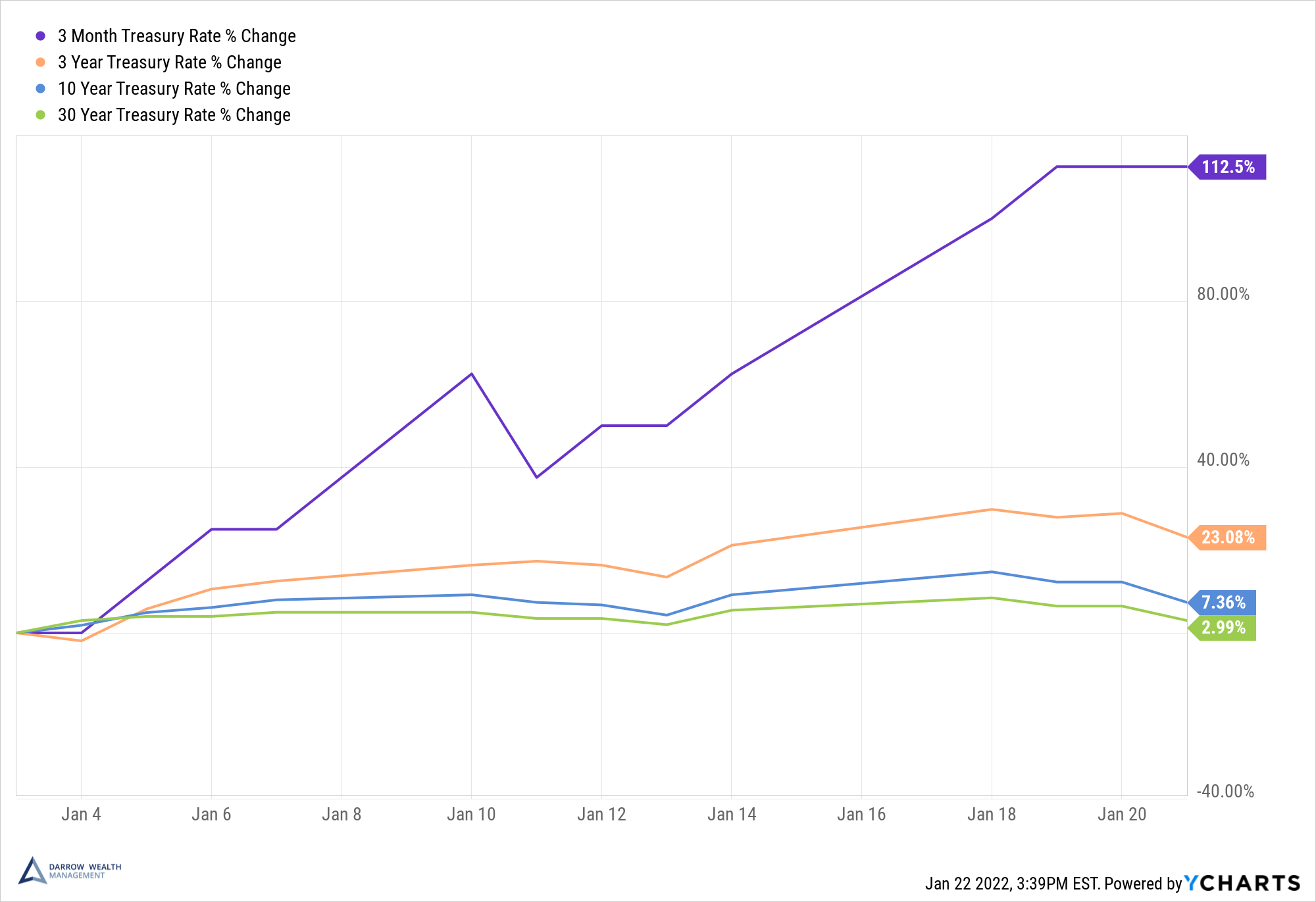

With the dominance of the largest U.S. stocks often occupying headlines, it’s worth remembering that the biggest companies don’t always produce the best returns. In

Tesla, GameStop, Hertz, Dogecoin: retail traders continue to dominate headlines in the financial news media. Some individuals may be wondering, how is trading different from

What happens to stock options if a company goes public without an IPO? A Direct Public Offering (DPO) or direct listing is a way for

It was almost a year ago when the Covid-19 induced selloff in the financial markets reached a bottom. The S&P 500 fell from its February

We’re all ready to put 2020 behind us. But before closing the books, it’s worth reflecting on what was a crazy year in the stock

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors