During Times of Market Volatility, Focus on What You Can Control

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

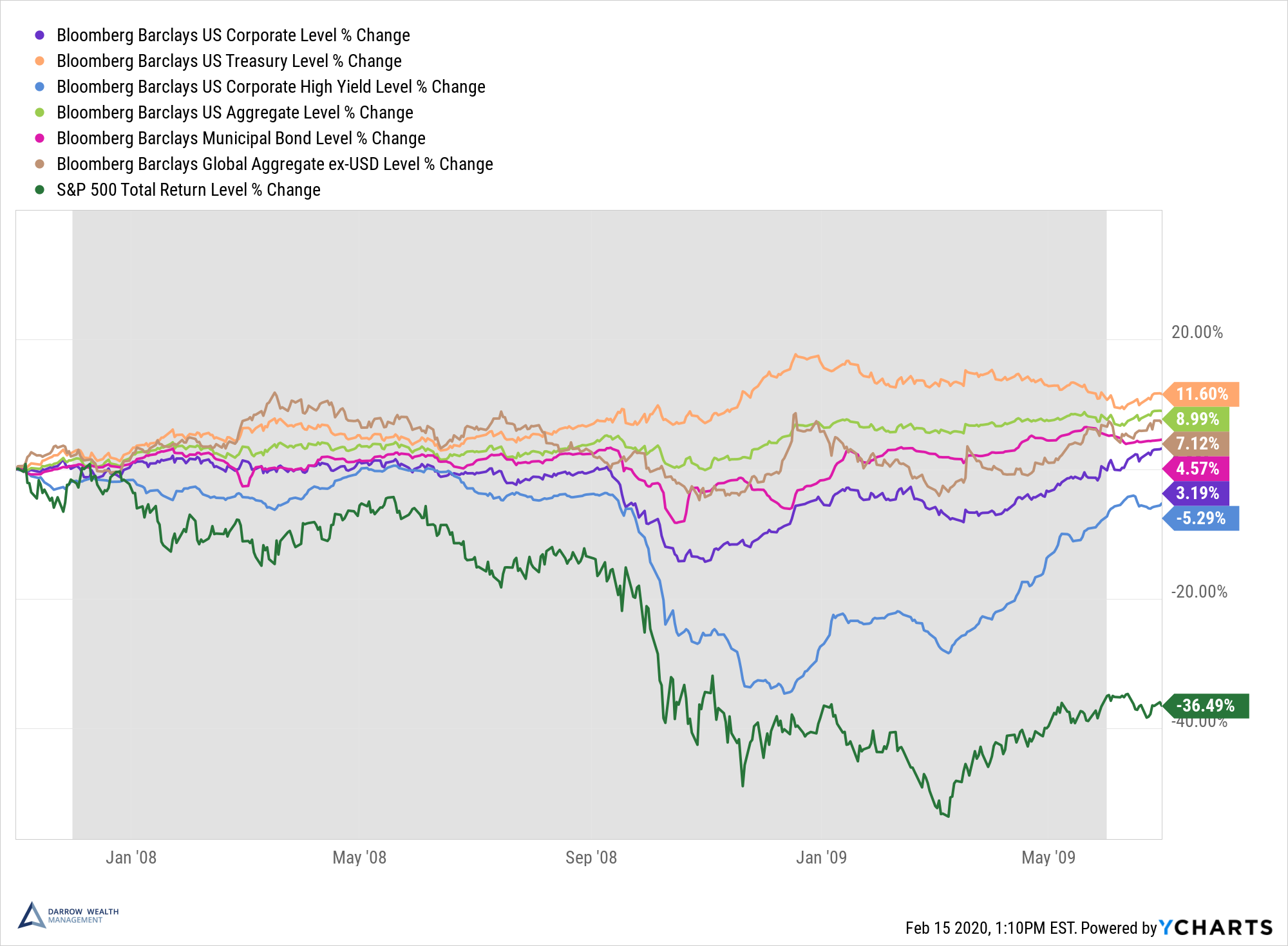

Diversification isn’t a magic bullet, but it is one of the best tools to protect your portfolio from unnecessary losses and volatility. The Darrow Wealth Insights blog covers diversification from several different angles: concentrated stock positions, asset classes, geography, company size, sectors, styles such as factors, and so on. As with anything in investing, consider your personal risk tolerance, time horizon, and circumstances.

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

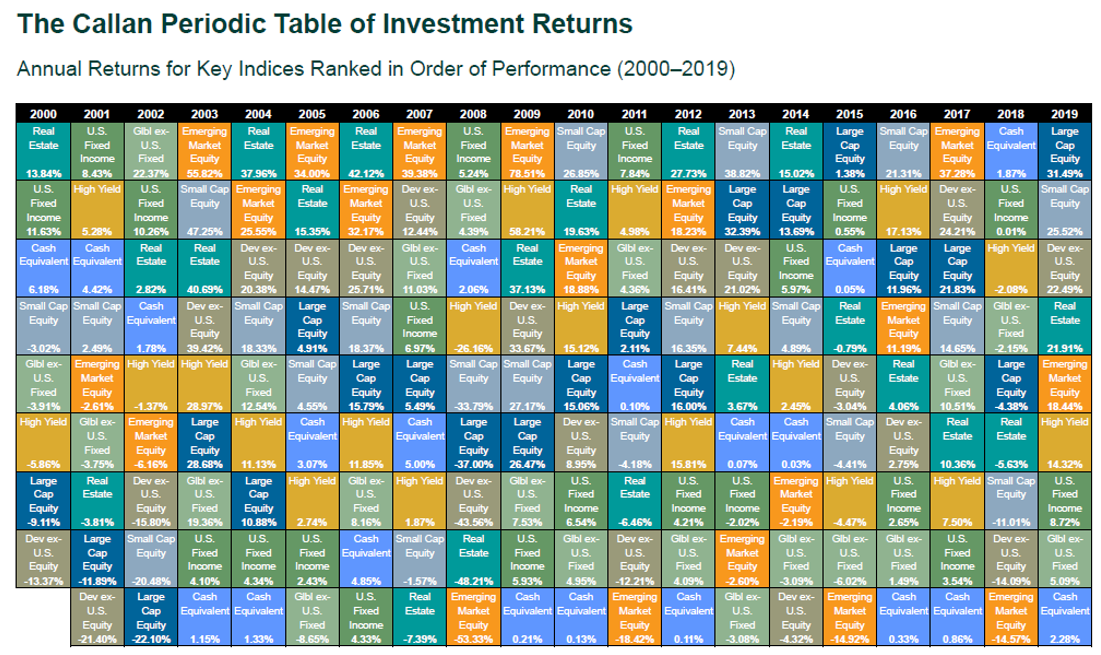

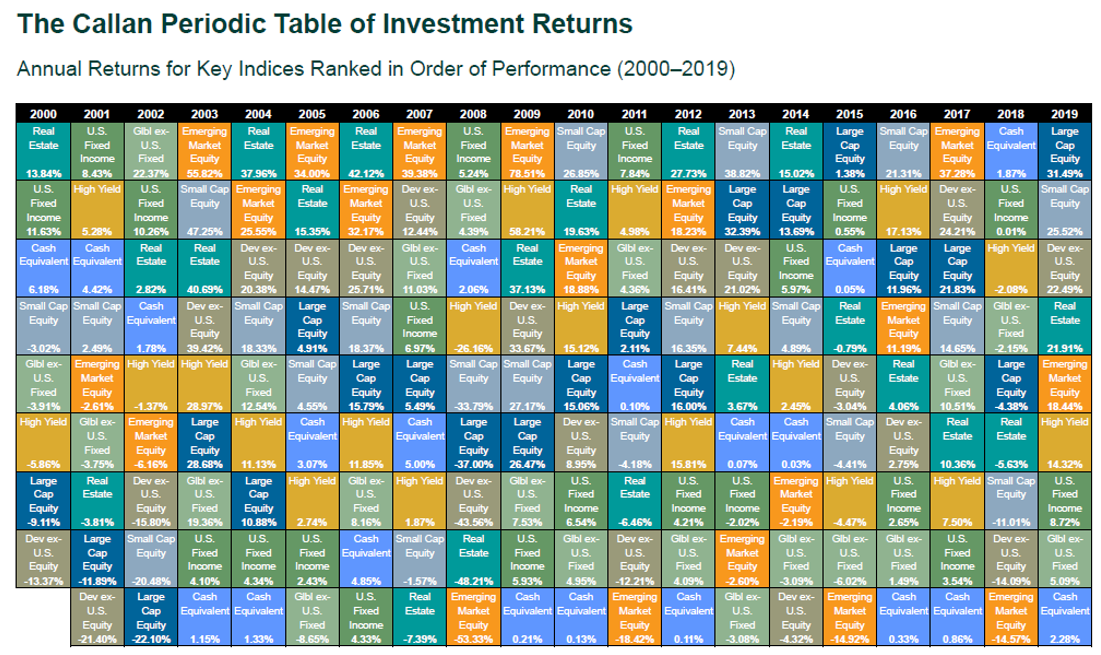

The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful

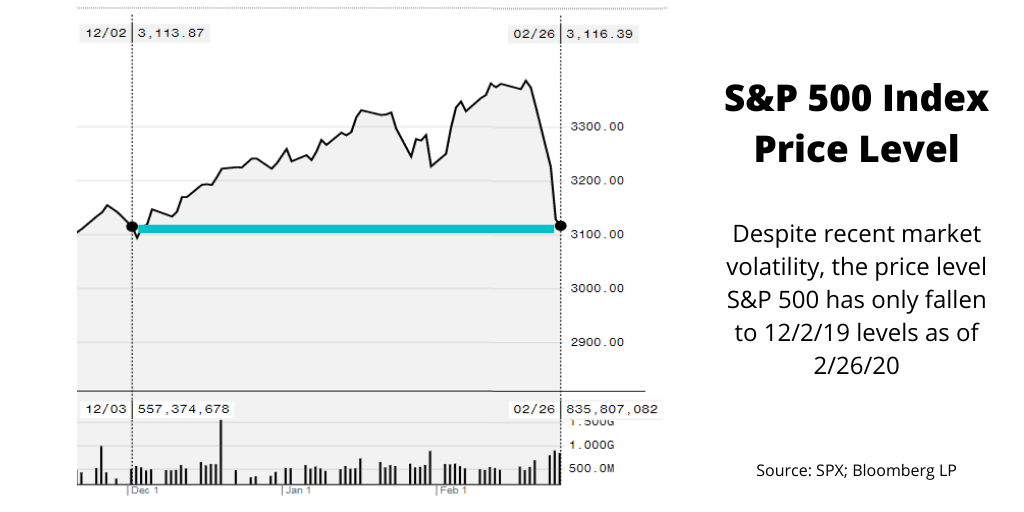

Putting recent volatility into perspective The COVID-19 virus has roiled the global financial markets in recent days, dominating the headlines. Although the virus does present

Setting your asset allocation is like drafting architectural plans when building a home; it provides a map to guide the construction of your investment portfolio.

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could

5 Most Common Financial Mistakes Investors Make Money management without the support of a financial advisor is hard. Things can easily fall through the cracks.

Why is it important to diversify your investments? The answer is simple: to manage risk. Diversifying your investments is about more than holding different stocks

Like many things in life, managing your own investments becomes more complex as you get older. For young professionals just starting out, it makes sense