Stocks Down, Yields Up: Looming Rate Hikes Bring Market Volatility

The Federal Reserve plans to raise interest rates more quickly than the market expected a couple of months ago. This is sending shock waves into

In a world where rising and falling interest rates can drastically change your plans, the Darrow Wealth advisors offer insights on rising rates, mortgages with adjustable or fixed rates, changing opportunities in fixed income, refinancing, structuring major purchases, student loans, cash versus debt considerations, and more.

The Federal Reserve plans to raise interest rates more quickly than the market expected a couple of months ago. This is sending shock waves into

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

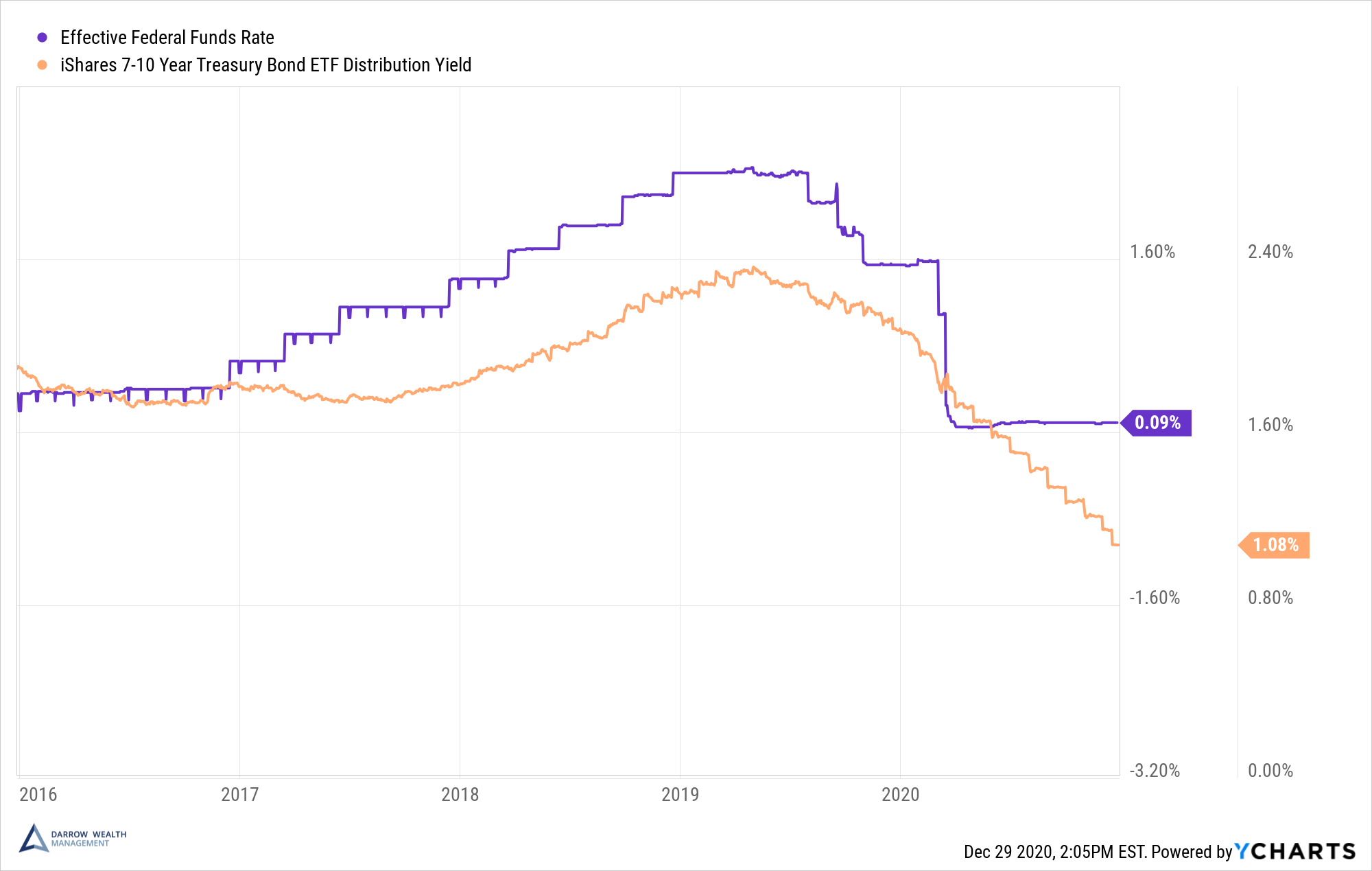

One of the most important things to know about bonds is how changes in interest rates affect bond prices, and therefore yields (unless held to

Putting extra cash towards your mortgage doesn’t lower your payment If you have extra cash and are considering putting it towards paying down your mortgage

With 30-year fixed mortgage rates currently averaging below 3%, it might make sense for homeowners to consider refinancing. Depending on several factors, such as your

Given today’s ultra-low interest rate environment, there’s a unique opportunity for some professionals to refinance their student loans. Since doctors and dentists have some of

How much can refinancing your mortgage save you? Mortgage rates are currently very low – the average 30-year mortgage is now below 3%. It might