How to Donate Stock to Charity: Donor-Advised Funds

Giving appreciated stocks can be a great way to maximize your gift to charity and your tax benefits. When you donate cash, you’re giving after-tax

Tax planning and wealth building strategies from Kristin McKenna, CFP®. Tax-conscious wealth planning is critical for any high-income taxpayer: asset location and tax-efficient investing, stock option and equity compensation exercise and sale strategies, qualified small business stock, retirement income tax planning and bucketing strategies, deferred compensation, employer plans for business owners, charitable tax planning and donor-advised funds, reducing taxable income, changes in tax law.

Giving appreciated stocks can be a great way to maximize your gift to charity and your tax benefits. When you donate cash, you’re giving after-tax

Updated for 2024. Anyone with earned income can make a non-deductible (after tax) contribution to an IRA and benefit from tax-deferred growth. But it may

Updated for 2024. Many individuals have heard of the backdoor Roth before, but the mega backdoor Roth is getting a lot of attention recently. Here

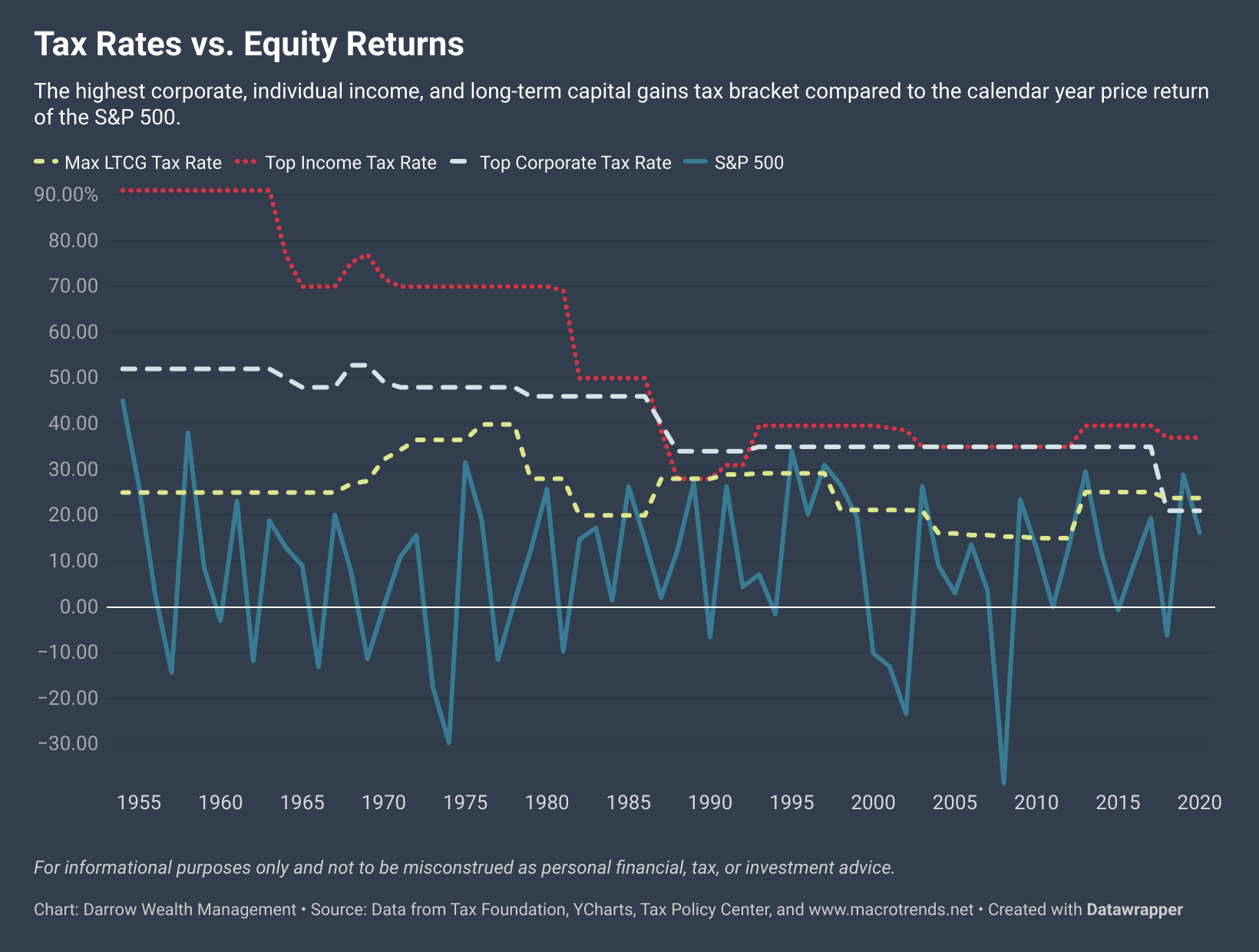

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

If you’ve inherited a 401(k) from a parent, you likely have questions about your options for the account and the tax impact. Luckily, non-spouse beneficiaries

The end of the year is a busy time for most people. Unfortunately, it is usually also the last opportunity to make financial moves that

Which is better, a Roth or traditional 401(k)? The central difference between a Roth 401(k) and traditional 401(k) is the tax treatment of your contributions.

Updated for 2023. What is a capital gains tax? When you sell an asset like a stock or a home, your gain could be taxable.

How are stock options taxed? If you have stock options or equity-based compensation as a large part of your income, the tax treatment of your stock

As you approach retirement, it’s important to have a strategy to minimize the taxes on your withdrawals. Keeping in mind a few key points can