The Stock is Down, But You’re in a Post-IPO Lock-up

More companies entered the public markets in 2021 than any other year on record. From traditional IPOs or SPACs, and even direct listings, it was a banner

More companies entered the public markets in 2021 than any other year on record. From traditional IPOs or SPACs, and even direct listings, it was a banner

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business

When should you exercise stock options? With stock options, employees have the right (not obligation) to buy the shares (called exercising). Vesting is often the

If you work for a private company or startup, you may be able to exercise your stock options early. With an early exercise, employees buy

What happens to stock options if a company goes public without an IPO? A Direct Public Offering (DPO) or direct listing is a way for

What does an IPO mean for employees? And what should you do when your company is about to go public? For early-stage employees and executives with

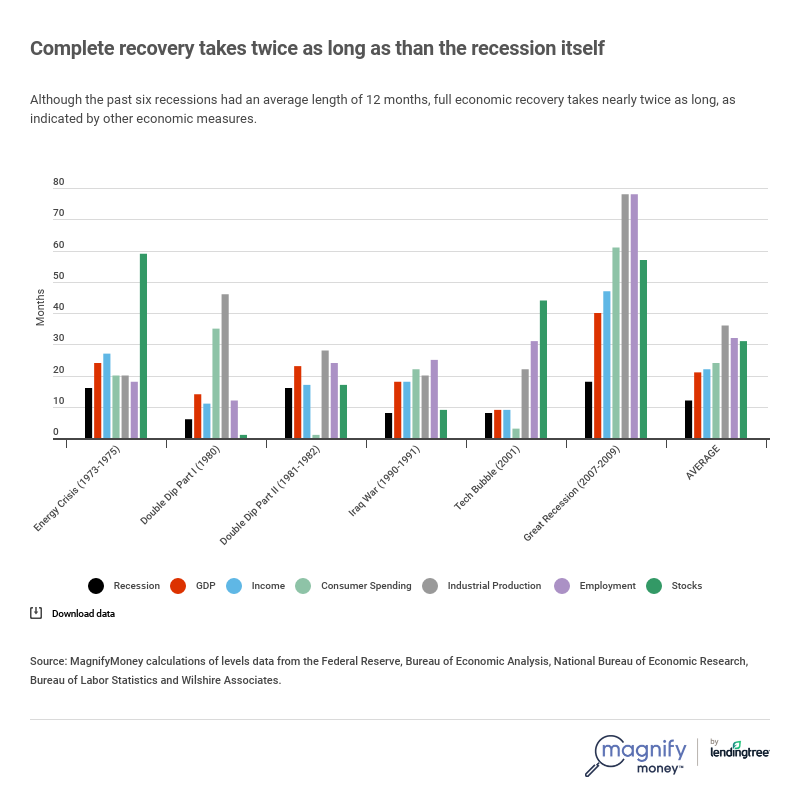

What’s happening in the stock market today? Is the recession over? Here are 5 charts to help explain what’s going on in the stock market

The selloff in the financial markets triggered by the coronavirus outbreak has been historic. Here are some statistics about March Madness 2020 in the stock

What’s your post-IPO stock liquidation strategy? Working for a company as it goes public can be a very exciting and rewarding experience. If you have

A restricted stock award is a type of stock compensation where founders or employees are granted shares of company stock subject to vesting requirements. Recipients