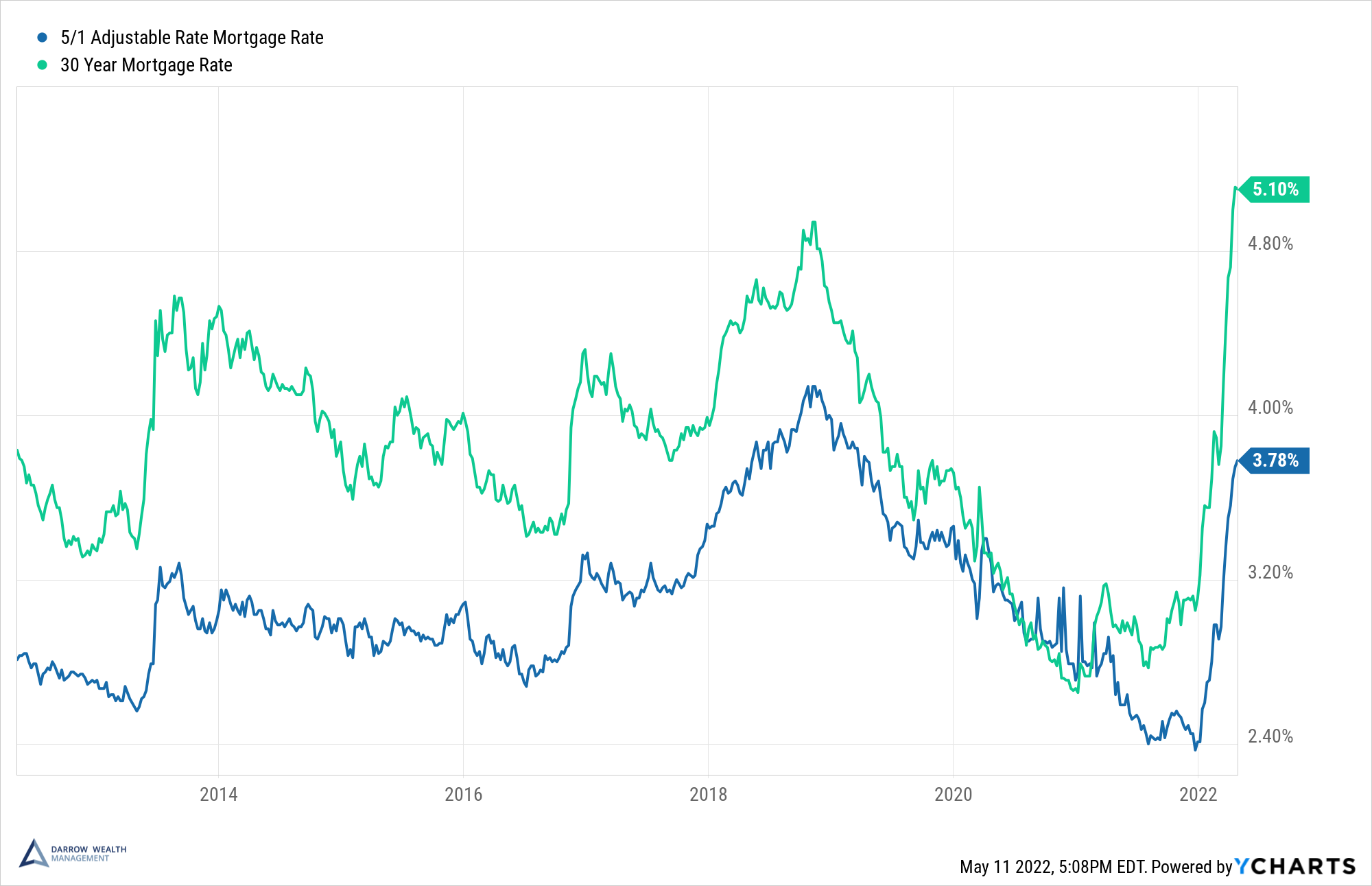

Interest rates are rising, and that’s bad news for homebuyers. The national average rate on a 30-year fixed mortgage is now over 5%. After being in the 2% range for much of the Covid era, buyers are now facing a one-two punch: a red-hot housing market and rapidly rising rates. For some buyers, it may make sense to consider an adjustable rate mortgage (ARM) instead of a fixed loan.

Features of an adjustable rate mortgage

As the name implies, when you get an adjustable rate mortgage, you don’t have a fixed interest rate for the life of the loan. Instead, the interest rate is only set for a certain number of years before moving to a variable rate. For example, a 7/1 ARM is fixed for seven years, before turning into a variable rate that adjusts once per year.

When considering an adjustable rate mortgage, understanding the terms of the variable portion of the loan is critical. Some key questions to ask include: how much higher the initial variable rate can go above the fixed rate, limits on the annual increase, lifetime rate caps, and floors. Ask what index is used to determine the base rate and what your margin will be. Do research to get a sense of how rates move over time.

Why consider an ARM?

Getting an adjustable rate mortgage makes the most sense in situations where there’s a big gap between fixed and variable mortgage rates and an expectation that at least one of the following situations will occur during your fixed term:

- You’ll sell the property

- Interest rates will decline, giving you the opportunity to refinance into a fixed mortgage

- Your rate caps are manageable and you can still afford the home during the variable period, assuming a worst-case scenario

Interest rate spreads

For comparison, look at the difference between average 5/1 ARM mortgage rate and a traditional fixed rate. The gap is over 1.3%. On a hypothetical $1M loan, the adjustable rate could save nearly $10,000/year during the fixed years.

Note that the rate you may qualify for will depend on your credit, purchase price, location, down payment, and terms of the loan. The fixed rate period is an essential part of this equation. For example, Zillow estimates the national average 7/1 ARM rate is currently 4.82% on a conforming loan.

When rates are low, or when the spread is small, adjustable rate loans don’t usually make sense. It’s often better to lock in the sure thing – even if you wind up moving in a few years, it’s essentially a free option. Especially if there’s a potential to keep the property as a rental, since investor loans aren’t as favorable and typically require additional equity or money down.

But again, factors unique to your situation and purchase change the outcome. For example, Zillow reports the average rate on a 7/1 ARM for a jumbo loan is just above 4%, which is over 1% less than the 30 year fixed. Conforming loans are mortgages under $647,200 for most of the U.S.

Risks

An ARM makes it more affordable to buy more house. That may not be a good thing. It’s important to assess your means and not over-extend. Further, remember that you can’t control where interest rates head. Being able to refinance during the fixed period is not guaranteed like a fixed rate mortgage is. Always make sure to consider the possibility that you’ll want to stay in the home when the loan is variable. Can you afford it?

Fixed vs adjustable rate mortgage: the bottom line

Before making any financial decision, you should always consider your options. For many Americans, a home is their biggest asset and a major purchase, so investigating the pros and cons of your financing options, including whether to buy with cash or a mortgage, is only prudent. And don’t be afraid to shop around! It’s generally advantageous to speak with a range of lenders from a local regional bank to a national mortgage broker. Even for the same loan product, quotes can vary considerably.

There are plenty of other things to consider when getting a mortgage, but the bottom line for fixed vs adjustable rate mortgages is this: when rates rise, it’s definitely worth considering an ARM.

Article written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes.