What does it mean for investors, homebuyers, and individuals with short-term cash deposits when the Federal Reserve raises interest rates? While rates don’t move in lockstep with the Federal Funds rate, they do tend to take a similar path. The magnitude of moves will differ and in many cases, mortgage and treasury rates will move in advance of the Fed raising rates. If you’re excited about the prospects of higher interest rates in your savings account or concerned about rising rates in the mortgage market, here’s what you need to know about how the Fed Funds rate can affect interest rates on loans and deposits.

What happens when interest rates go up?

First, some terminology. The Federal Reserve doesn’t directly dictate interest rates. The Federal Funds rate is the Fed’s suggestion of what banks should charge each other to borrow money overnight to meet reserve requirements. It is the shortest of short-term rates. The Fed Funds rate is extremely important though, as borrowing costs and interest rates on cash deposits are often driven by, or at least influenced by, the current Fed Funds rate and critically: Fed guidance/expectations of future rate moves.

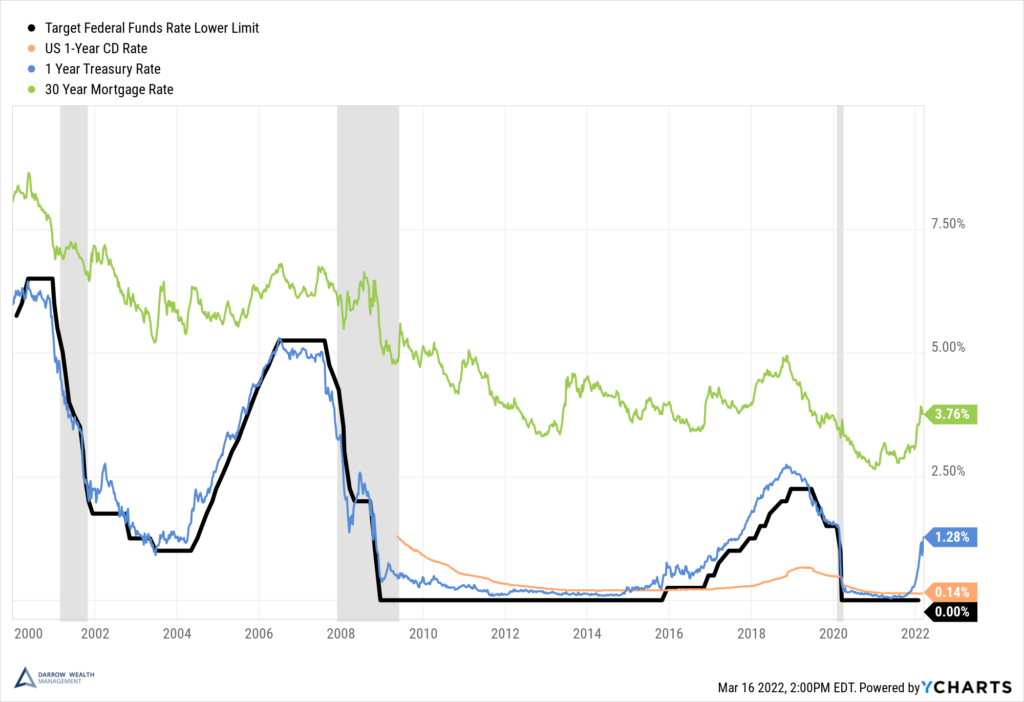

Federal Funds Rate vs Mortgage Rates vs Interest on Deposits vs 1-Year Treasuries

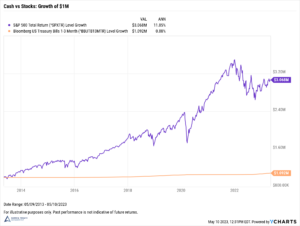

In the chart above, it’s clear that directionally, all rates tend to follow the same path. Rates have been declining since the 1980s. The Federal Reserve is the biggest driver of these moves, but it’s not the only one.

Mortgage rates (30Y fixed)

Mortgage rates are influenced by several factors including consumer demand, the economy, the Federal Funds rate, and investor demand to name a few. Mortgages must serve two different clients at the same time: borrowers, who want low rates, and investors (who buy mortgage bonds) who want an appropriate risk-adjusted return. The required return will change relative to yields on other fixed income investments and with the broad-based economy and future expectations.

Unlike a treasury bond, which if held to maturity, will produce the stated yield to maturity when an investor purchased it, mortgage bonds don’t have the same guarantees. When interest rates go down, people refinance. The bondholder gets paid back and must reinvest the proceeds at the current (lower) rates. Compensation for the reinvestment risk is one reason mortgage rates are higher than the Federal Funds rate.

Mortgages are also sensitive to the economy. The Great Financial Crisis (GFC) in 2008-2009 is a perfect example. Before the recession, the spread between the average 30-year fixed mortgage rate and the lower target limit Fed Funds rate was quite low, about 1%. As the crisis deepened and the recession continued, spreads widened, even as far as 5%. The Fed was cutting the target rates to support the economy, but with the housing bubble bursting and the US getting farther into recession, lenders and investors needed to be compensated for their risk.

How Do Rising Interest Rates Affect Stocks and Bonds?

1-Year Treasuries (T-Bill)

T-bill rates are excellent guides for near-term interest rates. The rates are ‘set’ by market participants as forward-looking expectations for short-term rates (like the Fed Funds rate) changes. So when the market believes the Fed is going to raise rates, it will price it in before it happens. In this way, T-bills usually move in advance of any official announcement by the Fed.

For context, it’s important to understand how bonds are affected by interest rates and what the rate (or yield) means. T-bills are easy examples as they are issued below par, don’t pay a coupon, and mature at par ($100). The yield-to-maturity (YTM) is your annualized rate of return.

In mid-January 2022, 1-year treasuries were yielding roughly .50%. This means an investor would have to pay roughly $99.50 to buy a bond that would pay them $100 if they held it to maturity.

By mid-March, 1-year treasuries were yielding 1.28%, meaning an investor could buy a 12-month T-bill for only $98.74. Given the market expectations that the Fed was going to raise rates, investors demand a higher yield (therefore lower price), outstanding bonds were repriced to reflect the expectation that newly issued T-bills would soon be available in the primary market at these higher, comparable yields. Looking at the end of the chart above, it’s clear to see when the 1-year treasury rate began increasing rapidly in advance of any movement by the Fed Funds rate.

It’s important to note that the discussion above has centered around how the Fed raising rates may affect T-bills. Bonds yields in general will fluctuate based on the current interest rate environment but also other factors, like market sentiment and risk. US government bonds are often havens during volatile markets. Demand increases prices and drives down yields. There are always multiple narratives at play in the financial markets.

Savings account rates and interest on cash deposits

Savings accounts, certificates of deposit (CDs), and other short-term interest payments on consumer deposits also fluctuates for various reasons. Banks will offer teaser rates on savings accounts, particularly high-yield savings accounts if they are looking to attract new deposits. If banks can pay a tiny amount of interest and lend money to borrowers for much more, it can be advantageous. But not always. Banks have strict reserve requirements and sometimes having too many cash deposits can be problematic.

Unlike T-bills and other bonds that typically move in advance of the Fed Funds rate, interest rates on deposits typically lag the market and don’t have the same magnitude of movement. In 2022, banks are still flush with cash from a period of record consumer savings. So they don’t have much incentive to pay customers more for their deposits.

Markets don’t always move the way you expect them to.