An interest-only home loan is an alternative to a traditional mortgage. Interest-only mortgages provide homeowners and investors with the opportunity to own property with lower monthly payments. While fixed-rate, or amortizing, mortgages offer fixed monthly payments of the principal plus interest, over a period of 10 to 30 years, interest-only loans require the borrower to pay off solely the interest for a specific time period, typically between five and seven years.

After the term of the interest-only loan is over, homeowners have several options: refinancing, selling the house, paying off the remaining balance in full, or starting to amortize their loan by paying off the principal and the interest monthly. However, there are caveats to all of these options. If the value of the house depreciates, it will make refinancing and selling the house problematic, as the loan on the property will be higher than its current market value. Paying off the balance in full is not possible for most borrowers, as the cash required would likely be in the hundreds of thousands.

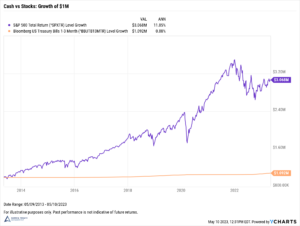

The last option, paying off the balance plus interest, will create considerably higher monthly payments, since not only will the principle have to be repaid, but the associated interest rates may be higher, based on the current rates. To try and avoid this, the borrower has the option to pay more every month during the interest-only period to bring down the principal; however some lenders may charge a penalty for prepayments. The potential benefit of this type of home loan is that the homeowner has the option to pay only the interest, possibly freeing up some cash for other investments.

Americans today don’t typically reside in one home throughout their adult life, and tend to move every five to seven years. In this situation, an interest-only mortgage can be appealing because the borrower would be able to pay lower monthly payments, and then, before the loan amortizes, would sell the home. However, extreme caution should be used with this plan since property values tend to fluctuate, and a home’s value can dip. In this case, the borrower would face choosing to either keep the home and start paying higher monthly payments, or possibly default on the loan. This scenario was one of the catalysts of the U.S. subprime mortgage crisis, which started in 2007.

Since interest rates have been historically low since 2008, this deterred many homeowners from choosing interest-only mortgages, but the rumors about higher rates coming are resulting in their return. Current lenders have stricter guidelines for how they approve borrowers now, to try and prevent another crisis. First, the increased risk of default results in higher interest rates for interest-only versus fixed-rate mortgages, which deters some borrowers from choosing this option. Second, lenders are looking for homeowners with excellent credit scores. Third, while before the housing crisis lenders qualified applicants based on whether they can afford to pay solely the interest-only loan, they now calculate their debt-to-income ratio according to the total sum of the interest plus the principal, although they are not obligated to pay both for the duration of the interest-only loan.

Interest-only mortgages can provide an advantage for owners and investors who have sufficient funds to afford the property, but, instead, may choose to use the excess cash for other investments in the interim. Lenders have recently made some efforts to better target this profile, instead of homebuyers seeking out an interest-only loan because the monthly payments in a traditional mortgage were beyond their means. Once the interest-only period comes to an end, homeowners or investors with sufficient capital would likely have no problem affording the higher payment. However, it is important to note that all investments carry a potential risk, which is something buyers should consider if they are planning to invest a significant portion of funds that will ultimately be needed to pay off the mortgage.

For many people, the added risk and higher cost of an interest-only mortgage is not worth it. It can be much more difficult to sell or refinance your home if you’re not able to build much equity. If you’re considering an interest-only loan, do a lot of research. Ensure the decision is not based on making a dream home affordable, but rather a strategic, calculated decision, based on the availability of other investment opportunities.