Given today’s ultra-low interest rate environment, there’s a unique opportunity for some professionals to refinance their student loans. Since doctors and dentists have some of the largest outstanding student loan debts, these professionals in particular may benefit from refinancing their student loans. However, refinancing isn’t right for everyone. As you weigh your options, understand how refinancing impacts your eligibility for certain benefits only available for federal borrowers.

When should dentists and doctors refinance student loans?

When should dentists and doctors refinance student loans?

Timing is everything, but so is cash flow. At nearly any income level, managing a six-figure debt load is hard. Since many doctors and dentists already have a late jump on saving for retirement and other goals by the time they enter the workforce, managing monthly student loan payments is especially important.

When you refinance your student loans, you’ll have options to weigh. Generally, the longer the loan term, the higher the rate. If you currently have federal loans, you may need to accept a shorter repayment period in order to refinance with a private lender. Repayment periods usually range from five to 15 years, though some lenders offer 20-year repayment periods.

Depending on the terms of your current loan, this could really increase your monthly payment, even with a multi-point reduction on your interest rate. You’ll want to make sure you still have enough flexibility to save for other goals and manage unexpected changes to your financial situation.

If you have more than one loan (which you probably do), remember that you don’t need to refinance all your student loans at once. When cash flow is tight, consider starting with loans with the highest interest rates. If you have a mix of loans with different interest rates, it may not make sense to ever refinance low-cost debt.

Depending on your other financial goals and career plans, timing could be a bigger factor. If you’re starting a business or buying a practice, refinancing may tie up needed cash flow, ding your credit, or tighten debt-to-income ratios with higher monthly payments.

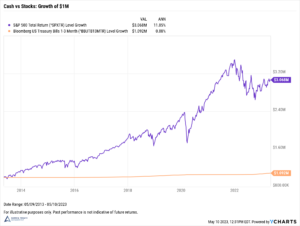

Interest rates on private education loans are usually tied to the 1-Month LIBOR. In today’s low-rate environment, it may be a good time for some professionals to consider refinancing their debt.

Other ways to pay off student loans

Prepaying loans in addition to, or instead of, refinancing

Depending on the details of your financial situation, the best strategy for managing your student loans may be a combination of refinancing and prepaying loans. Prepaying loans won’t lower your interest rate, but it helps you save on interest expenses over the life of the loan. You’ll also become debt-free more quickly.

Since refinancing usually means changing your monthly payment, prepaying loans instead of or in addition to refinancing can provide flexibility to pay off debt more aggressively as cash flow allows without locking in a higher monthly payment.

Depending on the mix of your loans, available cash flow, current interest rates and refinance rates, it may not be worth refinancing at all, so you’ll have to run the numbers.

There’s no one-size-fits-all approach, which is why it’s important to work with your financial advisor and to analyze the pros and cons for your unique situation.

Think twice (or three times) before consolidating your loans

When you consolidate federal loans with a Direct Consolidation Loan, all the loans are rolled into one and the interest rate is the weighted average of all the loans. The loans stay with the federal government. The benefit is simplification more than anything, but borrowers may inadvertently sacrifice flexibility in doing so, such as only refinancing loans with the highest rates.

If you keep your loans separate, once you set up automatic monthly payments, the hassle of having multiple loans is more or less over, even if you never refinance.

Similar to when you refinance your home, when you refinance student loans, the new lender pays off your existing loan. You’ll start with a new loan, lower rate, and different payment terms. Refinancing federal loans to a private lender can’t be undone.

Choosing not to consolidate loans provides the flexibility to refinance some of your loans or slowly refinance over time. If you consolidate into a big loan, refinancing might not be financially feasible with a shortened repayment period.

Refinancing student loans away from federal loans means losing unique benefits

There’s always a downside, right? Refinancing education debt impacts your eligibility for certain benefits only available for federal borrowers. Some of these safety-net programs include loan deferment, forbearance, student loan forgiveness, income-based repayments, and discharge at death or disability.

While some of these benefits can be replaced (such as carrying additional life insurance early in your career to match student loan liabilities) there isn’t a workaround for everything, so you’ll want to carefully weigh the pros and cons.

Among other considerations, federal borrowers may want to take advantage of the recent announcement that interest on federal student loans will be waived for 60 days.

When should dentists and doctors refinance student loans?

When should dentists and doctors refinance student loans?