Before you quitting a corporate job to start a business, it’s important to properly prepare for the transition. Getting your personal finances organized and properly set up before making the jump helps reduce risk and gives you more time to focus on the new venture. Take stock of what you’ll need to set up your business from a financial and legal standpoint. Here’s what you need to do before quitting your job to start a business.

What to do before leaving your job to start a business

What to do before leaving your job to start a business

Consider how timing will impact your bottom line

If you leave your job prior to the vesting of certain benefits, they will be forfeited. Depending on the amount of money and time frame until you vest, it may make sense to wait. New business owners need all the start-up capital they can get! Here are some common employee benefits where the timing of your departure could mean leaving money on the table:

Stock options and equity compensation.

If you leave the company before you vest in stock options or awards (such as restricted stock units or restricted stock), you will lose this part of your compensation. When you leave your job with stock options that have already vested, you’ll generally have a period of time to exercise the options. If you work for a privately-held company there likely isn’t a market to sell your stock, which can have negative tax implications. Start-ups can also have clawback or repurchase rights, so it’s important to read your equity agreement.

401(k) vesting.

Most companies have a 401(k) vesting schedule where employees earn company profit sharing or matching contributions over time. If you have an anniversary coming up, it could be worthwhile to stick around. Another month or two might mean getting 20% more in employer retirement dollars.

Timing of bonus income.

Employees don’t usually forget about a big bonus when deciding when to break out on their own. However, some bonuses, like a signing bonus, have service requirements. Before giving your notice, you’ll want to confirm how long you must stay in order to keep it.

Getting your personal finances in order before quitting your job

As you’re undoubtedly aware, launching a company is a lot of work and involves a significant amount of financial risk. Getting your personal finances in order beforehand can save you headaches (and money) down the line.

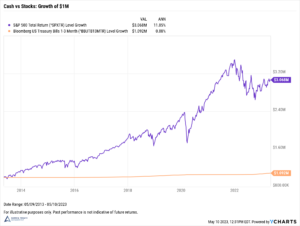

Diversifying your other investments.

Your business will likely become your most concentrated asset, that’s just the nature of it. So it’s important to make sure your other investments are very well diversified, including any concentrated stock positions from previous employers. Starting a business can be risky enough. Why add more by holding significant amount of your wealth in 1-2 other companies? Volatility can take a chunk out of your portfolio, particularly if the businesses are in the same industry.

Old retirement plans.

Consider consolidating and cleaning up any old retirement plans like a 401(k) or 403(b) into a new rollover IRA which you can open at the financial institution of your choice. It’s challenging to manage investments when you have multiple logins.

Getting everything at one place is an easy way to help ensure nothing falls through the cracks, especially when you’re busy. By starting this process before you quit, once you leave, all you need to do is roll over one old account.

Reconsider your asset allocation.

As previously discussed, business owners take on much greater risk than employees. Depending on how much of your own money you’ll need to put into the business, your other income streams/assets, business partners, and so on, it may be advantageous to reduce the risk in your investment portfolio. Consider the main asset classes (e.g. stocks and bonds) then the composition of the funds within each asset class – the range of returns can be significant!

Cash in the bank.

Generally, two-income households should have between 3 – 6 months of non-discretionary expenses set aside in cash emergency reserves. One-income households may require up to a year. Business owners, especially new founders, should ideally be able to fund at least a year’s worth of essentials: mortgage payments, groceries, utilities, and so on. Especially at the beginning, revenues will likely be irregular and modest, so it may take time until you can begin to draw a salary and it’s best to avoid building up a lot of credit card debt.

Insurance coverage.

If you’re on your employer’s health insurance plan, you’ll want to consider your options before quitting. If your spouse has health insurance at work, you may be able to get on their plan without needing to wait until open enrollment. Losing health insurance is considered a qualifying life event for health insurance.

Continuing coverage on your current plan for 18 months under COBRA is usually an expensive option as former employees could pay up to 102% of the premium.

If your only life insurance coverage was from your employer, you’ll also need to assess your options. Often, it makes sense to get private life insurance coverage so when job changes occur it doesn’t impact your ability to get insurance. You never know how health can change over time, so it’s important to have adequate coverage in force. Other options include: benefits from a spouse’s company or potentially purchasing your company policy, though that doesn’t always make sense financially.

Setting up your new business

It takes effort to get your business set up properly. But it’s worth it. Going back to fix it later is more expensive. While not an exhaustive list, here are several items to get you started.

Consider legal structure.

Anyone can start a business as a sole proprietor without the help of an attorney – but it doesn’t mean you should. Different corporate structures (LLC, LLP, C or S Corporation) offer different tax benefits and liability protections. A sole proprietor is simply an individual, entitled to no special tax or legal benefits. From a liability standpoint, this matters in a number of ways.

For example, assume you’re at fault in a car accident while driving your personal car. Your insurance policy only pays part of the settlement. Depending on how your business is structured, creditors may be entitled to assets of the business (property, equipment, stock, etc.).

The reverse can also happen. Take the last example but now assume you’re driving a delivery vehicle. Depending on the legal structure of your business, your personal assets (real estate, bank accounts, investments, etc.) could also go to creditors. (These examples also highlight the importance of having enough personal and commercial insurance and the role of the personal umbrella liability policy.)

It is strongly advised you work with a corporate attorney to discuss which type of entity may be the best fit for your business. You probably don’t need council from the most prestigious (and expensive) law firm in the area, but you do need to work with an experienced and reputable attorney. This isn’t a good place to save money by going to Legal Zoom or the like.

Separate your business expenses from your personal ones.

Making sure that your business is set up cleanly and transparently from the beginning saves a lot of hassles and even cost. The easiest way to separate your business and personal expenses is to get a new credit card and bank account for the new business. Work with your CPA or accountant to understand what’s a business vs personal expense and how to allocate costs that fall into both categories. Business expenses reduce your taxable income, but without proper documentation and records you either lose the deduction or risk an audit.

Benefits

Benefits

Once your company is up and running, it’s time to think about ways to save for retirement and whether you plan to hire staff. For companies without employees (other than a spouse) a SEP IRA or a Solo 401(k) make it easy to save for retirement and reduce your taxable income for your personal and/or corporate tax year.

If you hire an employee and are considering offering benefits, there are a number of considerations and it may be advisable to contact a HR consultant first. Unfortunately, there are various regulations regarding employee benefits: eligibility, notifications, recordkeeping, and so on when these benefits are offered.

The rules will vary depending on the type of benefit. But in general, business owners need to be aware that they cannot discriminate when deciding employee eligibility and it may not be possible (from a legal standpoint) to limit access to themselves. The regulations are complex and change over time, which is why you need to work with someone familiar with the compliance side of benefit programs.

Starting out on your own is an exciting time in your life. To help ensure your new business is setup for success, be methodical about how you manage the transition. Getting the right advisory team and protocols in place will help support future growth and limit your exposure to unnecessary risks.

Learn more about wealth management for business owners and self-employed individuals.

What to do before leaving your job to start a business

What to do before leaving your job to start a business