How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

The Secure Act 2.0 was signed into law December 29th, 2022, bringing more major changes to tax law. Among the most notable changes include a

If you have company stock in your 401(k), consider the pros and cons of net unrealized appreciation at retirement. Under the net unrealized appreciation rules,

Which is better, a Roth or traditional 401(k)? The central difference between a Roth 401(k) and traditional 401(k) is the tax treatment of your contributions.

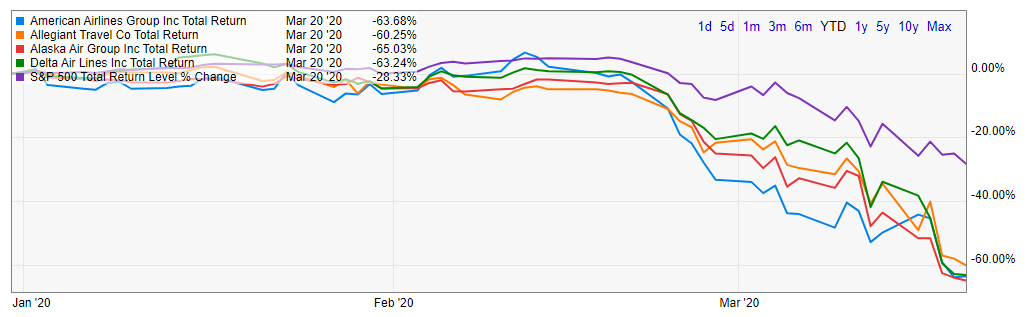

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

The economy has been booming since the financial crisis but tough times are back. Broad economic conditions impact hiring or layoffs for many workers, but

What’s the best retirement plan for small businesses? Business owners with employees have several options: traditional 401(k) plan, SIMPLE 401(k), SIMPLE IRA, and SEP IRA

Should You Take a Pension or a Lump Sum? Deciding between a lump sum or receiving pension benefits monthly requires careful planning and consideration. Though

What Happens to Stock Options After a Failed IPO? WeWork (now called The We Company) was just steps from a historic initial public offering when

Ways to get the most out of employer 401(k) matching contributions Employers can choose to match their employee’s 401(k) contributions in several ways, should they