Wealth Management Insights

Sign Up for Weekly Investing Insights

Sudden Wealth: Managing a Large Financial Windfall

Next steps after a sudden wealth event or cash windfall Wondering what to do with a sudden financial windfall? Whether the windfall was expected, perhaps

Should I Put My Assets in a Trust? Top 3 Benefits of Living Trusts

Do I need a revocable living trust? Choosing whether to fund a trust with your assets is an important decision in the estate planning process.

What to Do After Maxing Out Your 401(k)

Wondering where to invest after maxing out your 401(k)? If you’re looking for ways to invest after your 401(k) or 403(b) at work, you likely

SEP IRA for the Self-Employed: Tax & Retirement Planning for Small Business Owners

Updated for 2024. The Simplified Employee Pension (SEP IRA) is a type of a traditional IRA adopted by self-employed small business owners (sole proprietors, partnerships, C

What to do After Inheriting a Retirement Account from a Parent

Just inherited an IRA from a parent? Here are the distribution rules. If you’ve just inherited a retirement account like an IRA or 401(k) from

83(b) Election: Tax Strategies for Unvested Company Stock

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

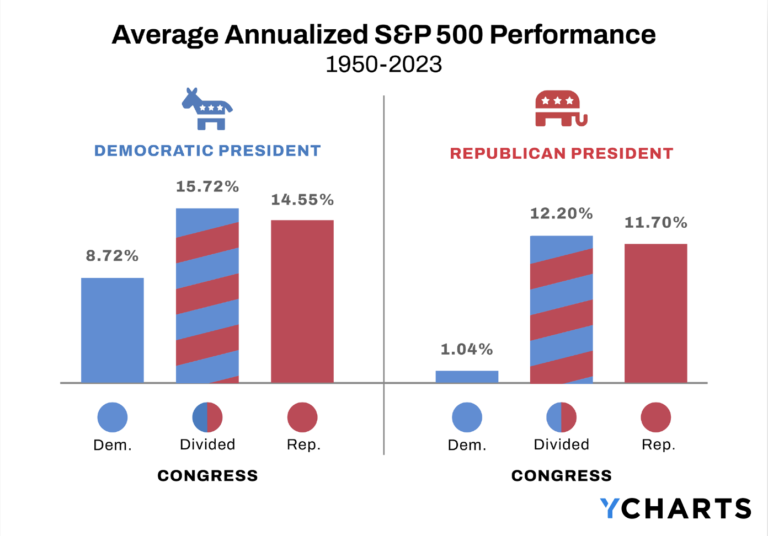

Stock Market Performance by President (in Charts)

As the next U.S. presidential election nears, investors may be wondering what the implications are for their investments. How will the stock market react if

What to Do When a Parent Dies and You’re the Executor

Losing a parent is emotional. It can also be overwhelming for adult children when they’re the executor of the estate. Settling an estate is a

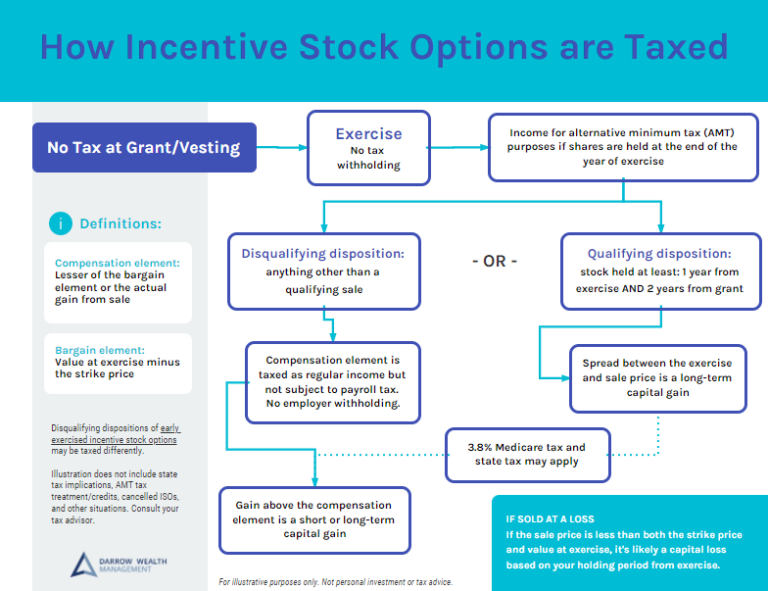

Incentive Stock Options: Navigating AMT and AMT Credits

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.

6 Tax Strategies for Incentive Stock Options and AMT

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to

Using a Securities-Backed Line of Credit to Buy a Home

A securities-backed line of credit is like a home equity line of credit in many ways, though with this type of loan, the collateral is

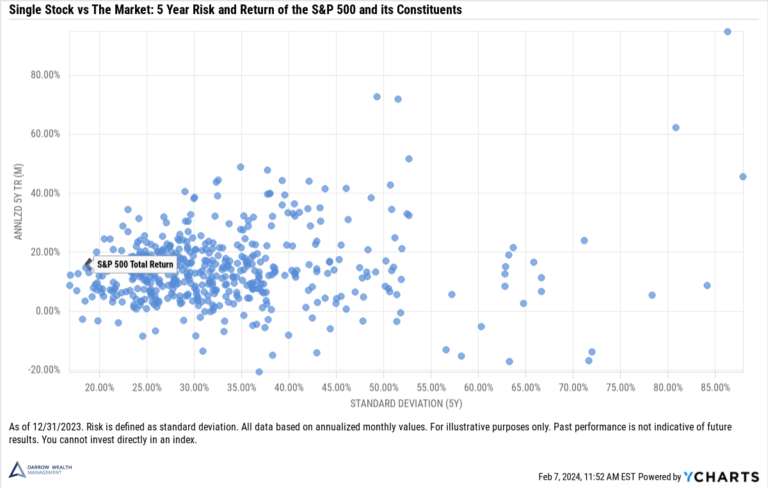

5 Ways to Manage a Concentrated Stock Position

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

2024 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments. Also, the 2024 income tax brackets and long-term capital gains

Should You Exercise Stock Options During a Pre-IPO Window?

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they

Selling a Business? Brokers Share Tips on How to Maximize the Sale Price

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a

What to do After the Death of a Spouse

Losing a spouse can be an overwhelming and emotional experience. While it’s possible to organize financial documents ahead of time, there’s no way to truly

Financial Planning for a Divorce

There are many financial planning considerations before, during, and after a divorce. A key part of the process from a financial standpoint is dividing the

How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job