Sudden Wealth Financial Advisors

Home » Sudden Wealth Financial Advisors

Sudden Wealth Financial Advisor

Darrow Wealth Management specializes in helping individuals expecting a sudden wealth event or financial windfall from company stock options during an IPO or acquisition, sale of a business, an inheritance, trust fund distribution, or other major wealth event. We’ll work to help you develop a strategy to make the most of the windfall and develop an investment plan going forward.

Types of Sudden Wealth and Liquidity Events

If you’re expecting a lump sum from an inheritance, sale of a business, trust, or stock options after an IPO, you’ll want to get a plan in place to best utilize your sudden wealth. An unexpected windfall can change your life.

You can only spend a dollar once, so it’s important to have the support of a fiduciary financial advisor who will prioritize your goals and provide honest advice about what is – and isn’t – financially feasible.

Financial Planning and Investing After a Liquidity Event or Sudden Windfall

A major liquidity event can transform your financial life. To maximize the opportunity, it’s critical to get the right team of advisors in place before making an irreversible decision. Through an ongoing advisory relationship, we aim to help ensure you are well-positioned to meet your short and long-term goals.

Our team of sudden wealth financial advisors can work to help you:

- Discuss how a windfall changes your goals and identify how to best utilize your new wealth in your financial plan or retirement plan

- Decide on a strategy to best use the proceeds, including funding multiple goals and investment management services to help you diversify sudden wealth

- Understand the tax implications of the windfall including options to reduce tax

- Analyze different holding periods when developing a liquidation strategy, factoring in risk, cash needs, and taxes

- Implement a multi-year diversification strategy through an ongoing wealth management advisory relationship

- Consider various investment or trust vehicles to meet charitable or legacy objectives

- Ensure existing strategies (estate, insurance, tax) are aligned with your post-windfall financial situation

- Coordinate approach with your tax preparer and estate planning attorney

Our approach in navigating a sudden wealth event is customized based on your needs and the nature of the windfall. As you might imagine, the planning opportunities and considerations after receiving an inheritance from a parent is usually quite different from an employee with stock options during an IPO. Explore the types of sudden wealth events below for more information.

Sudden Wealth Management: Putting New Wealth to Work

Your planning needs will depend on the nature of your windfall and your overall financial situation. Darrow Wealth Management is a fee-only financial advisory firm and full-time fiduciary. We specialize in helping individuals after a sudden wealth event from an IPO, selling a company, or inheriting a trust fund.

By integrating financial planning with investment management, our goal is to help you build and grow your wealth. Learn more about our Wealth Management Services and how we may be able to help you.

Meet the Advisory Team

Our team of advisors have broad and deep experience and education in the fields of investment management and financial planning. Our advisors include a CERTIFIED FINANCIAL PLANNER™ professional, CPA, and Chartered Financial Analyst® designations. Learn more about the Darrow team of financial advisors.

Nationally Recognized Wealth Advisor in Stock Compensation

Selection of media appearances by Kristin McKenna CFP®, President of Darrow Wealth Management and a nationally recognized specialist in employee stock options and equity compensation.

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.

Sudden Wealth Financial Advisors Related Articles

What Should You Do with a Cash Windfall?

What to Do With a Sudden Cash Windfall Wondering what to do with a sudden financial windfall? The first step is to hold off on making any major purchases or decisions until you’ve had time to consider your options. Whether the windfall was expected, perhaps from the sale of a

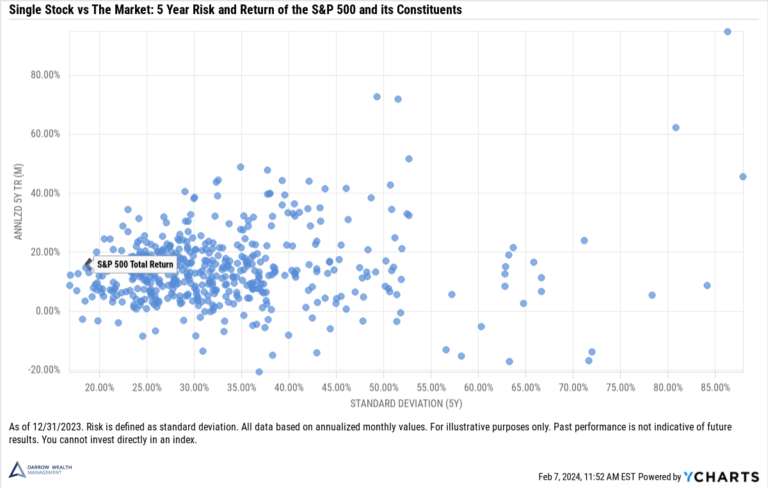

5 Ways to Manage a Concentrated Stock Position

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock. Or a long-term investor bought shares years ago, the stock did well, and the investor simply never took profits. But because stocks don’t only go

Should You Exercise Stock Options During a Pre-IPO Window?

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they should exercise before the company goes public (perhaps during a final open window) or wait until after the IPO. Assuming you have the cash on

Selling a Business? Brokers Share Tips on How to Maximize the Sale Price

The sale of a business marks a major life event. It’s emotional, stressful, and exciting all at the same time. And unfortunately, it’s often a lot of work. Most business owners will only experience the process of selling a business once in their life. This is both good and bad