How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

Restricted stock is a type of equity compensation typically awarded to founders and executives. Learn more about financial and tax planning considerations for restricted stock, 83(b) elections, tax planning strategies, Section 1202, considerations during a lock-up, and what to do with the proceeds. The blog also discusses liquidity events such as IPOs, mergers, or acquisitions and what happens to stock if you’re laid off or leave the company. Key insights for founders and executives on strategic stock option planning and strategies to best manage sudden wealth from restricted stock awards. Insights from Kristin McKenna CFP®, a nationally recognized expert in employee stock options and equity compensation.

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

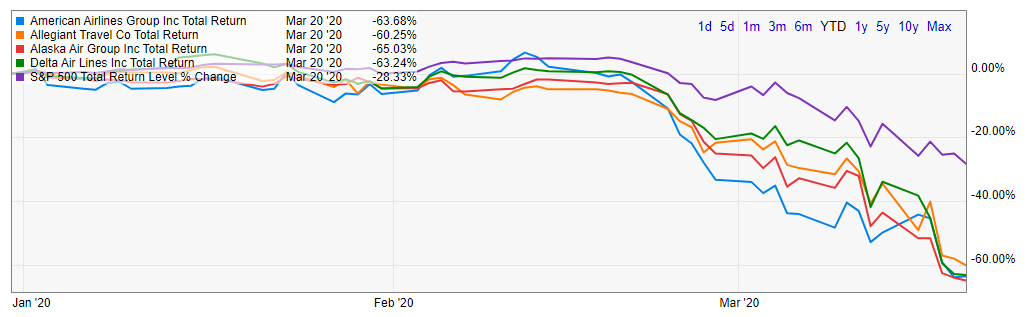

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

What’s your post-IPO stock liquidation strategy? Working for a company as it goes public can be a very exciting and rewarding experience. If you have

A restricted stock award is a type of stock compensation where founders or employees are granted shares of company stock subject to vesting requirements. Recipients