Social Security And Recessions: Study Shows How COVID-19 May Impact Your Benefits

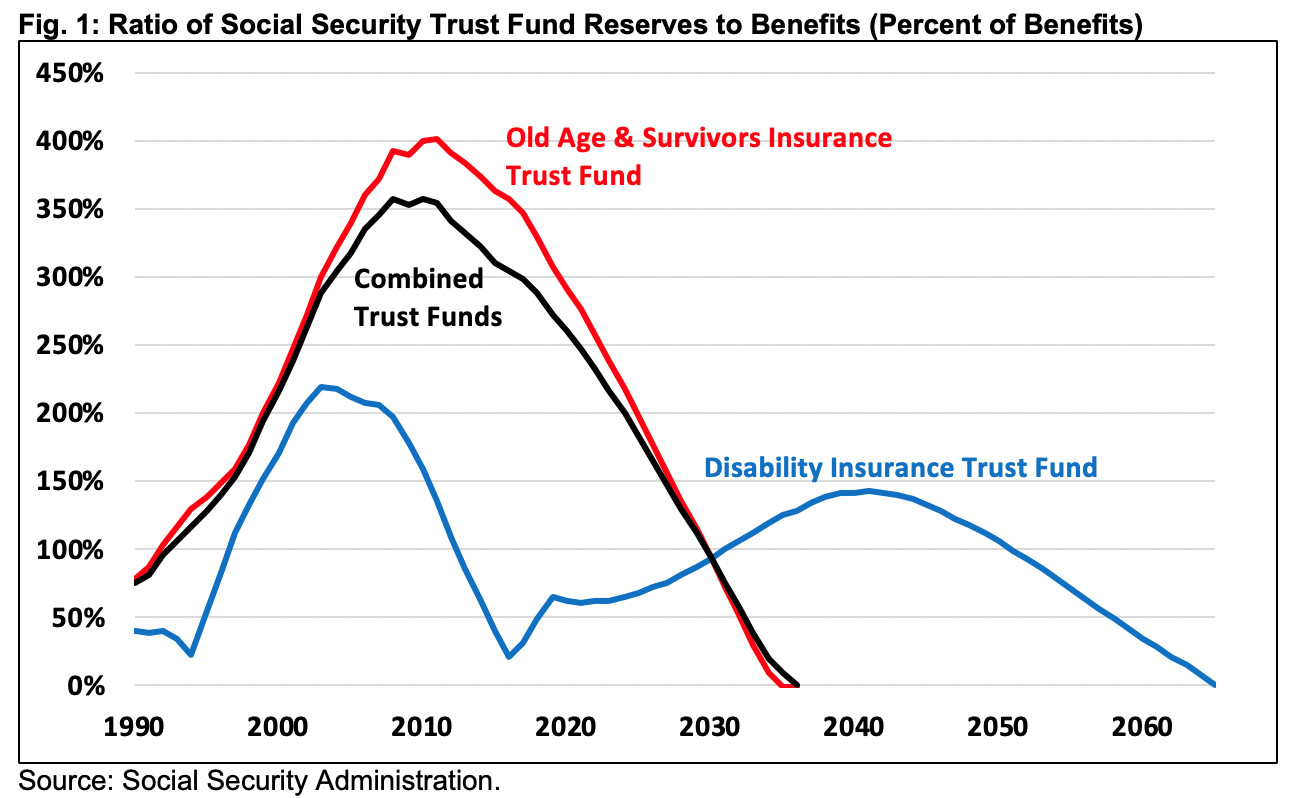

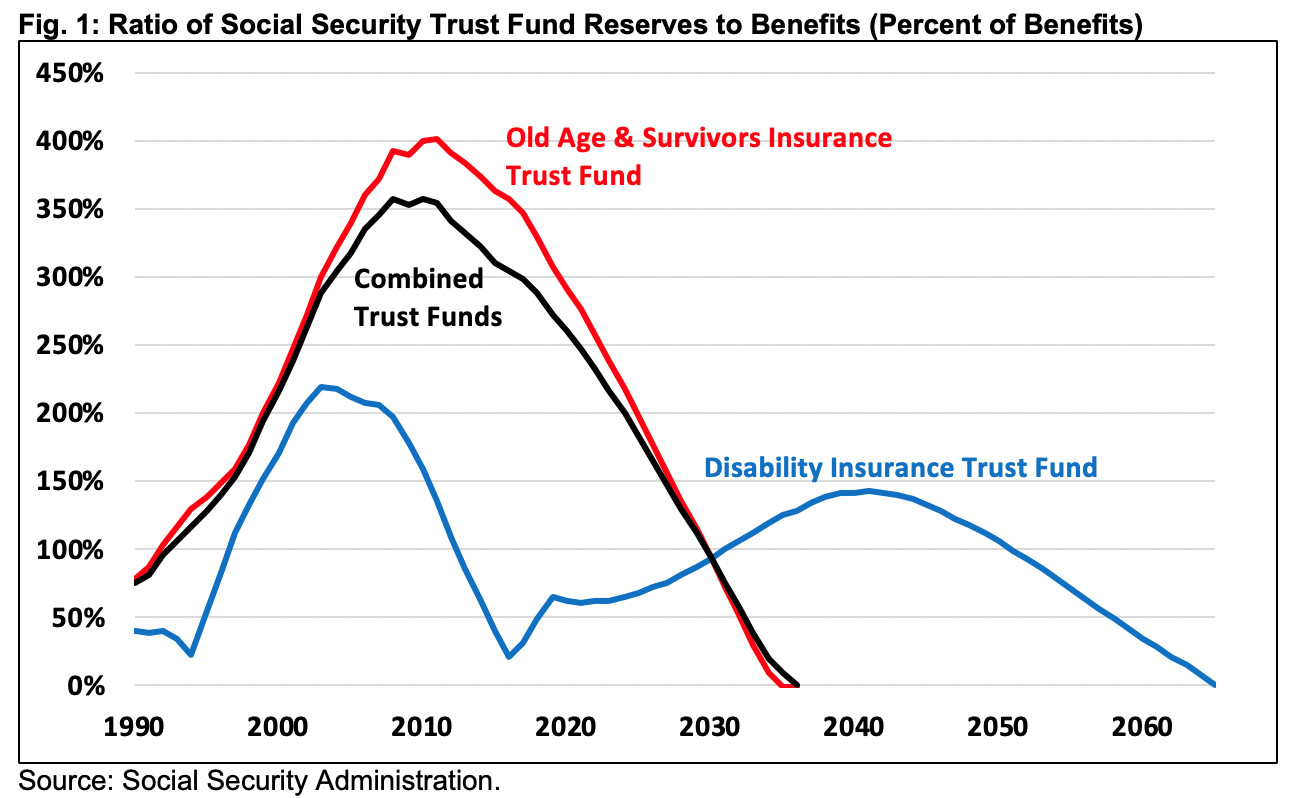

It was already projected that Social Security would begin to tap its trust fund to pay for benefits starting in 2020. That was before the

Retirement planning is an essential aspect of financial planning, as it helps ensure you can maintain your lifestyle and cover your expenses when you are no longer working. Darrow advisors share retirement planning insights for executives and business owners. Saving for retirement can include a multitude of strategies including: portfolio income, stress testing a retirement plan, tax planning and bucketing, Social Security timing, pension income, Roth conversions, plans for business owners, risk tolerance changes later in life and more.

It was already projected that Social Security would begin to tap its trust fund to pay for benefits starting in 2020. That was before the

Could you have planned for this? Investors of all ages are thinking it: could I have done anything to protect my investments from the swift

What happens if…? That’s the million-dollar question. Stress testing a financial plan and retirement projections can help investors feel more confident in the likelihood they

There’s a lot we know about the current state of the stock market, but we can only make an educated guess as to where the

A study from the Urban Institute tracked over 20,000 adults over age 51 between 1992 and 2016 to identify trends in employment. The findings revealed

A SEP IRA offers business owners the benefits of accelerated retirement contributions from a workplace retirement plan with the simplicity and flexibility of a regular

When should you buy your retirement home? Buying a retirement home too early could be short-sighted, despite long-term intentions. Whether you’re in your 30s or

The Secure Act increased the required minimum distribution (RMD) age from 70 1/2 to 72, marking the first change to the RMD age since first

There are plenty of ways to buy a home, but for many pre-retirees, it may be a good idea to wait until you’re much closer

What’s the best retirement plan for small businesses? Business owners with employees have several options: traditional 401(k) plan, SIMPLE 401(k), SIMPLE IRA, and SEP IRA