Here’s Why it Might be a Good Time to Rebalance Your Portfolio

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

Whether the market is setting new highs or in the midst of a downturn, investors need to think a few steps ahead to ensure they’re

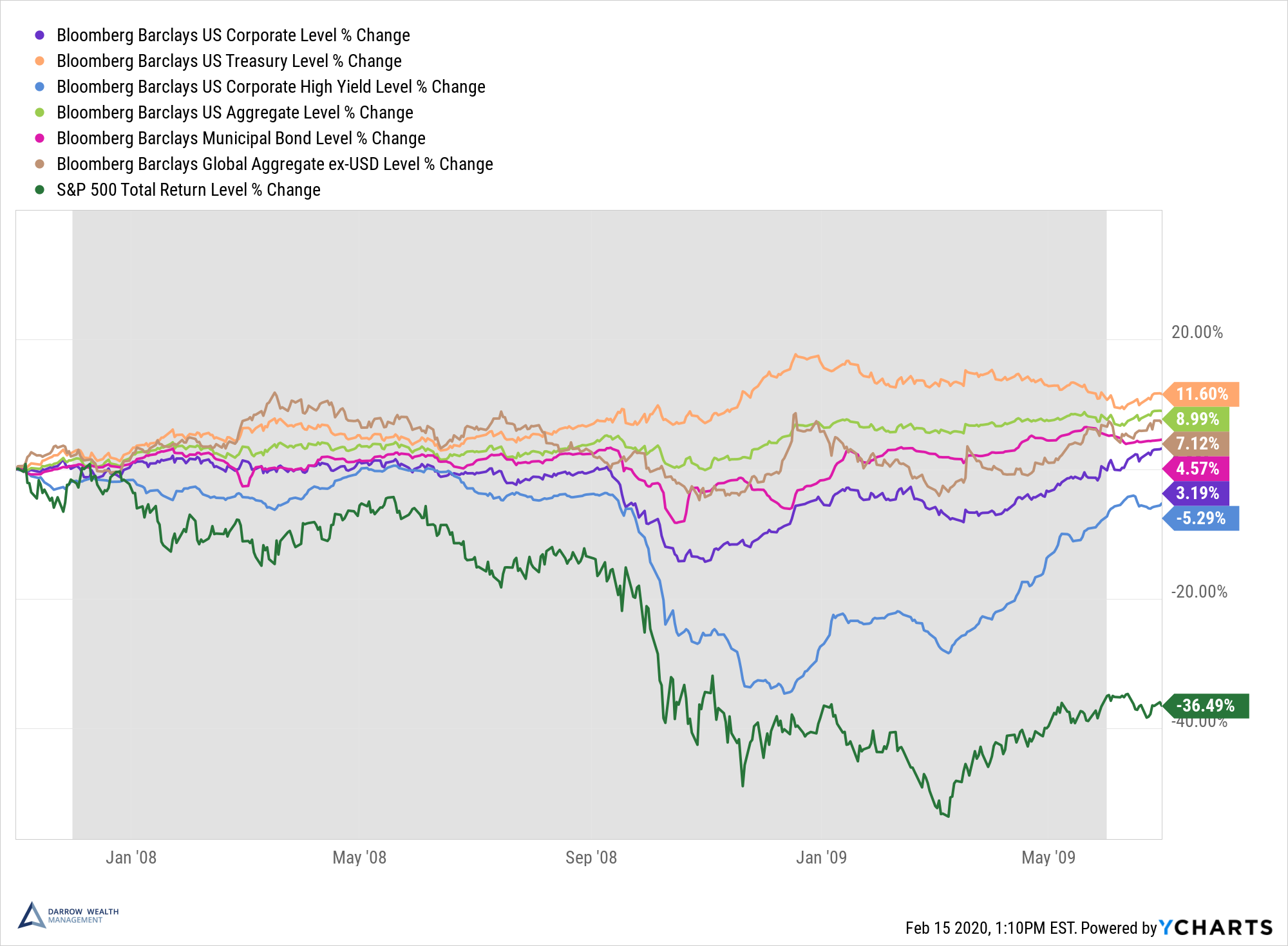

The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful

Tax-loss harvesting is the process of selling an investment that has lost value in your portfolio to ‘realize’ the loss for tax purposes. Investors can

Like any investment account, rebalancing your 401(k) or 403(b) retirement plan is an important part of a successful strategy. An asset allocation is the percentage

Why do you need to rebalance your IRA? Setting up an asset allocation for your traditional or Roth IRA is important to diversify your investments