Why do you need to rebalance your IRA?

Setting up an asset allocation for your traditional or Roth IRA is important to diversify your investments to meet your long terms goals and manage risk. Asset allocation is the composition of your portfolio – the percentage of your investments that will be put into different asset classes, such as equity or fixed income (at a very high level). Over time the market value of your investments will likely change, which will also impact the weight of each asset class your portfolio is comprised of.

Portfolio rebalancing is the process of buying or selling assets to return to your original asset allocation. Why does this matter? Because without rebalancing you may be taking on more risk than necessary to meet your goals.

Here’s why you need to rebalance your IRA

There are a couple main reasons to rebalance your investment portfolio. First, your investment goals or risk tolerance might change, requiring your asset allocation to be updated. As people approach retirement they often opt for a less volatile mix that is more heavily weighted in fixed income investments than when they were just starting out and had a much longer time horizon to weather market volatility.

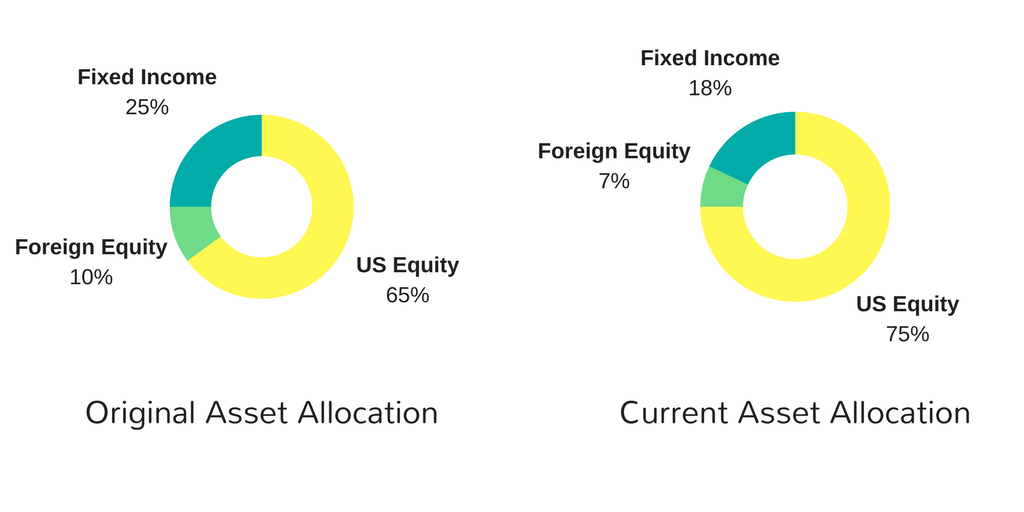

Another reason to rebalance is because the investment performance of your portfolio has caused the asset allocation to shift. Consider the following:

The equity portion of the portfolio has grown at a much higher rate than the bond returns, creating an investment mix that is more heavily weighted in equities than planned. Why does this matter?

The equity portion of the portfolio has grown at a much higher rate than the bond returns, creating an investment mix that is more heavily weighted in equities than planned. Why does this matter?

Because past performance doesn’t always mean future results. If the stock market were to suffer a decline, the unbalanced portfolio would be exposed to much more risk than intended.

To correct this, portfolios are often rebalanced at a predetermined interval. In the sample closing balance portfolio above, an asset manager would determine which equities should be sold, reinvesting the proceeds in the purchase of additional bonds to restore the original weights of each asset class.

When to rebalance your retirement accounts

Unless you’re working with a financial manager, you’ll need to set a schedule to rebalance your IRA. The timing of a rebalance can vary. One way is to schedule a periodic review of your account, like once a year. At this point, you would check to see whether your asset allocation has changed and can adjust your portfolio if necessary.

Another option is to set maximum thresholds for changes. If an asset group in your portfolio falls off its target by more than your acceptable threshold, then you would rebalance. For example, if you have a 5% threshold for changes and a target allocation of 50% for stocks, you would rebalance whenever stocks make up more than 55% of your total portfolio or less than 45% of your total portfolio. A common strategy employs both of these methods. It can be difficult to rebalance during market volatility so carefully consider your approach.

Have a retirement plan at work? Don’t forget that rebalancing your 401(k) is an equally part of managing your retirement savings.

The costs of rebalancing

There are costs to rebalancing your investments, which should not be overlooked. Trading costs and commissions (if you’re not working with a fee-only advisor) can add up with a lot of activity and reduce your overall returns. Also, if you are investing through a regular brokerage account and not a retirement account, rebalancing may also have tax implications. Consider the pros and cons of rebalancing in conjunction with tax-loss harvesting.

If after selling overweighed assets you end up with a net gain for the year, you’ll owe taxes on the capital gains. The taxes apply even if you just made the sale to reinvest the funds into another asset class.

Coming up with an asset allocation and effective rebalancing strategy can be quite complex and should be done with a lot of consideration. Selecting the specific investment products for your portfolio can be daunting – and evaluating which outperforming asset should be sold during rebalancing also requires a lot of thought. Working with a qualified professional will help ensure your investments stay on track.