Major Tax Changes Are Coming in 2026. Are You Ready?

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. The TCJA has many

Kristin McKenna, CFP® is frequently published in the national news media. She’s a Senior Contributor at Forbes and has been published by U.S. News & World Report, TheStreet, Business Insider, and the National Association of Personal Financial Advisors Magazine, with quotes in Bloomberg, Kiplinger, MarketWatch, GOLF Magazine, and Huffpost, among others. Kristin has also been invited to be a panelist for several events around stock option financial planning.

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. The TCJA has many

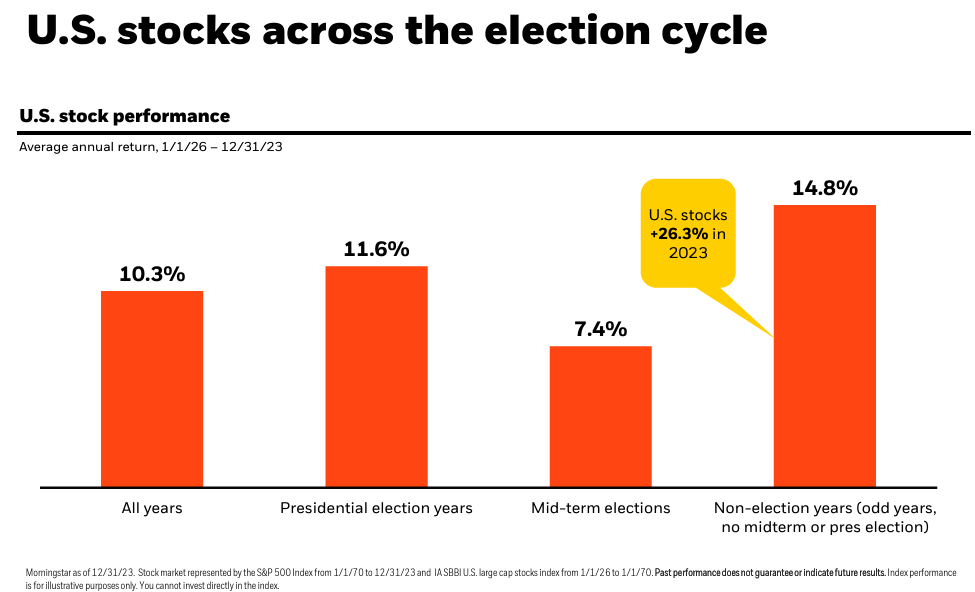

Investors shouldn’t fret about the upcoming presidential election. And they definitely shouldn’t let politics upend their long-term financial plans. Why? Because historically, financial markets have

If parents have the means to pay for all college costs, should they? The answer will be different for every family. There are plenty of

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in

A securities-backed line of credit is like a home equity line of credit in many ways, though with this type of loan, the collateral is

With so many misconceptions around trusts, it’s easy to understand the confusion about the benefits of a revocable living trust. A living trust (also called

It’s hard to come up with good gift ideas, especially over the holidays if you have a lot of people to shop for. Unfortunately, giving

If you think retirement planning moves stop at retirement, think again. For high earners, converting an IRA to a Roth IRA while you’re still working

Of all the types of assets, real estate is usually the most emotional. It is, after all, difficult to make memories in a mutual fund

More homeowners have been renovating their homes instead of buying due to housing prices. While continuing to build equity in your home can be advantageous