How much money do you need to retire at 60? That depends entirely on how much you plan to spend in retirement. Absent a large pension or other source of income, as your expenses grow, your retirement savings must also. While retiring at 60 isn’t terribly early, it is before Social Security and Medicare eligibility begins.

4 factors that drive your ability retire at 60

- Your income requirements to support your lifestyle in retirement

- Level of additional portfolio withdrawals at the start of retirement (when spending is typically the highest anyways) before Social Security eligibility begins at 62

- Your options for health care coverage before Medicare begins at 65

- If you invest outside of retirement accounts

Spending drives how much money you need to save to retire at 60

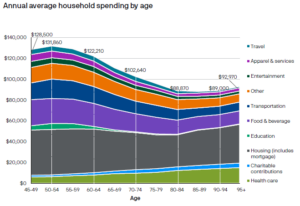

Estimating expenses in retirement is difficult. Some outflows (like 401(k) contributions) will stop while others (the prized travel budget), appear. While some investors overestimate retirement spending needs, others underestimate at least one major category: housing. As indicated by the Chase data below, the majority of retirees pay housing costs throughout life as a major expense.

Before getting consumed with your travel budget, recognize that where you’ll spend money will change throughout retirement. As some costs increase (like healthcare), other expenses (like food and travel) decrease.

While expenses will ebb and flow over the years, it’s most important to monitor spending just before and after retirement. This period is pivotal because retirement savings are generally at their highest levels, making you most vulnerable to stock market volatility. If retiring at 60 is your main priority, reducing your spending assumptions during retirement might be an acceptable trade-off to make the numbers work.

Planning to Retire Early? Now You Need to Figure Out What to Do Next

Your spending will have longevity, too

Here are some statistics according to 2024 data from J.P. Morgan and Longevity American Academy of Actuaries and Society of Actuaries, Actuaries Longevity Illustrator.

Assume a 65-year-old couple are non-smokers in excellent health:

- The female has a 72% probability of living until 85 and 31% chance of living until 95

- The male has a 63% probability of living until 85 and 22% chance of living until 95

- There’s a 73% chance at least one person lives until 90 and the odds are 19% of living until 100 (that’s one in five!)

- The probability of both living to age 85 is 46%, dropping to 23% by age 90, and falling to 7% at 95

60 may not be too early to retire, but it is too early for Social Security

The good news is that retiring at 60 is much easier than retiring at 55, as penalty-free withdrawals from IRAs begin at age 59 1/2. But that’s not to say it’s always easy.

As you work to figure out if you can retire at 60, cross Social Security benefits off your list of potential income sources. Eligibility for Social Security benefits starts at 62 for retirees. Also, you’ll want to weigh whether you should file for benefits as soon as possible or hold off for larger checks. This might mean taping retirement accounts to delay Social Security longer.

Another consideration is spousal benefits. Claiming benefits before full retirement age not only reduces your retirement benefits, but it’ll also reduce spousal benefits. If your benefits from your own working record are likely to be roughly equal, this won’t matter much. Remember, Social Security projected benefit statements assume you work until your claiming age.

Social Security benefits include 35 years of average earnings, which might not be an issue for individuals who started working before 25 without interruption. But if you took a break to raise a family, go to law school, etc., the Social Security Administration might have to use $0 salary for a few years when calculating benefits.

To retire at 60, you’ll need more saved to bridge the gap before Medicare

If your spouse is still working, you can probably get health insurance there. If not, paying for medical insurance until Medicare at age 65 may be prohibitive. In general, early retirees have five options for health insurance before Medicare:

- Retirement health insurance continuation from your employer

- COBRA coverage

- Public exchanges

- Private insurance exchanges

- A spouse’s plan

COBRA coverage generally only lasts for 18 months if you retire early. If you retire at 60, you need five years. Obamacare exchanges are usually more affordable than private insurance, but it’s still really expensive. The cost also varies by state. Check costs in your area with this calculator from the Kaiser Family Foundation.

Saving outside of retirement accounts may be key to retiring comfortably

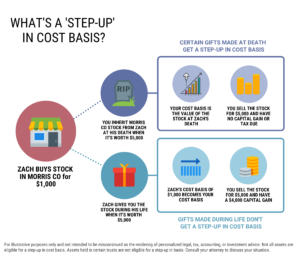

You’ll generally have the best opportunity to retire early if you have investment assets outside of retirement assets. Taxable investment assets offer tax planning opportunities in retirement and also increase overall savings. Especially for high earners or one-income households, maxing out your retirement accounts probably isn’t enough.

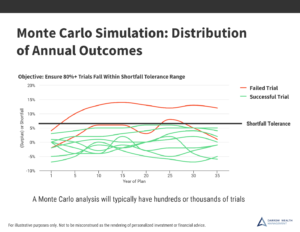

As I illustrate in this analysis for Forbes, a couple both maxing out their 401(k)s from age 35 to 65 are likely to attain a safe retirement income of $65,000 annually, increasing by inflation. Why not more? Because we ran a Monte Carlo simulation, which more accurately represents how the market moves.

If we ran the same analysis but using a static return with no deviation to account for down years, (much like the calculators found online), the couple would think they could spend $100,000 per year instead. At this level of spending, there’s a 50% chance they would run out of money during retirement under normal market conditions. More on stress testing a retirement plan below.

A taxable brokerage account is the most flexible type of investment account. There is no contribution limit or rules about when you can sell funds and withdraw the cash. In exchange for flexibility, you sacrifice the tax-deferred growth and tax deduction you get with 401(k) contributions.

But that’s not to say a brokerage account is tax inefficient, either. Long-term capital gains tax rates are much more favorable than 401(k) or IRA withdrawals which are taxed as ordinary income. In fact, a married couple filing jointly in 2024 with income under $94,050 is in the 0% tax rate on long-term capital gains!

How to figure out if you can retire comfortably

Stress testing retirement projections can help investors feel more confident they won’t run out of money under different conditions in the financial markets. Again, basic online calculators don’t account for the variability in investment returns or the timing of down years. The only factor is a static average annual return. Put another way, simple compounded return calculators only assume your investments grow, ignoring the downside produces the average.

For guidance that takes your entire situation into account, consider working with a CERTIFIED FINANCIAL PLANNER™ professional to develop a financial plan and help ensure you stay on track throughout retirement with ongoing investment management and advisory support.

To feel confident that 60 isn’t too early to retire, your plan should include a Monte Carlo simulation to stress-test a retirement plan for market volatility.

Putting everything together in a comprehensive financial plan is often the best way to determine how much you need to retire. Running the numbers will help you understand what trade-offs exist and what options best suit your needs and goals.

About Darrow Wealth Management

Darrow Wealth Management is an independent fee-only financial advisor and full-time fiduciary offering ongoing investment management and financial planning services for individuals and families in Greater Boston and across the U.S. Learn more about our Wealth Management Services or schedule a phone consultation with a CERTIFIED FINANCIAL PLANNER™ professional.

Sources

¹ Source: J.P. Morgan Asset Management, based on internal select data from JPMorgan Chase Bank, N.A. and its affiliates (collectively “Chase”) including select Chase check, credit and debit card and electronic payment transactions from January 1, 2017 to December 31, 2023. Check and cash distribution: 2019 CE Survey; J.P. Morgan Asset Management analysis. Information that would have allowed identification of specific customers was removed prior to the analysis. Other includes: tax payments, insurance, gambling, personal care and uncategorized items. Asset estimates for de-identified and aggregated households supplied by IXI, an Equifax Company; estimates include all financial assets except employer-sponsored plans and do not include home equity.

Last reviewed February 2024