How to Negotiate Equity in a Private Company or Startup

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

Restricted stock units are a type of equity compensation typically awarded to employees. The blog also discusses what happens to RSUs during liquidity events such as IPOs, mergers, or acquisitions, or what happens to RSUs if you’re laid off or leave the company. Key insights for founders and executives on strategic stock option planning and strategies to best manage sudden wealth from RSUs. Insights from Kristin McKenna CFP®, a nationally recognized expert in employee stock options and equity compensation.

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

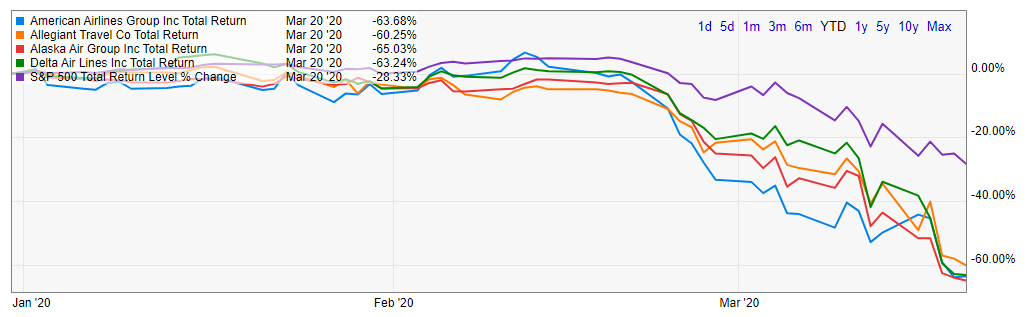

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

What’s your post-IPO stock liquidation strategy? Working for a company as it goes public can be a very exciting and rewarding experience. If you have

It’s common for employees to move around, especially in tech. Before giving notice, understand what could happen to stock options, RSUs, or other shares if

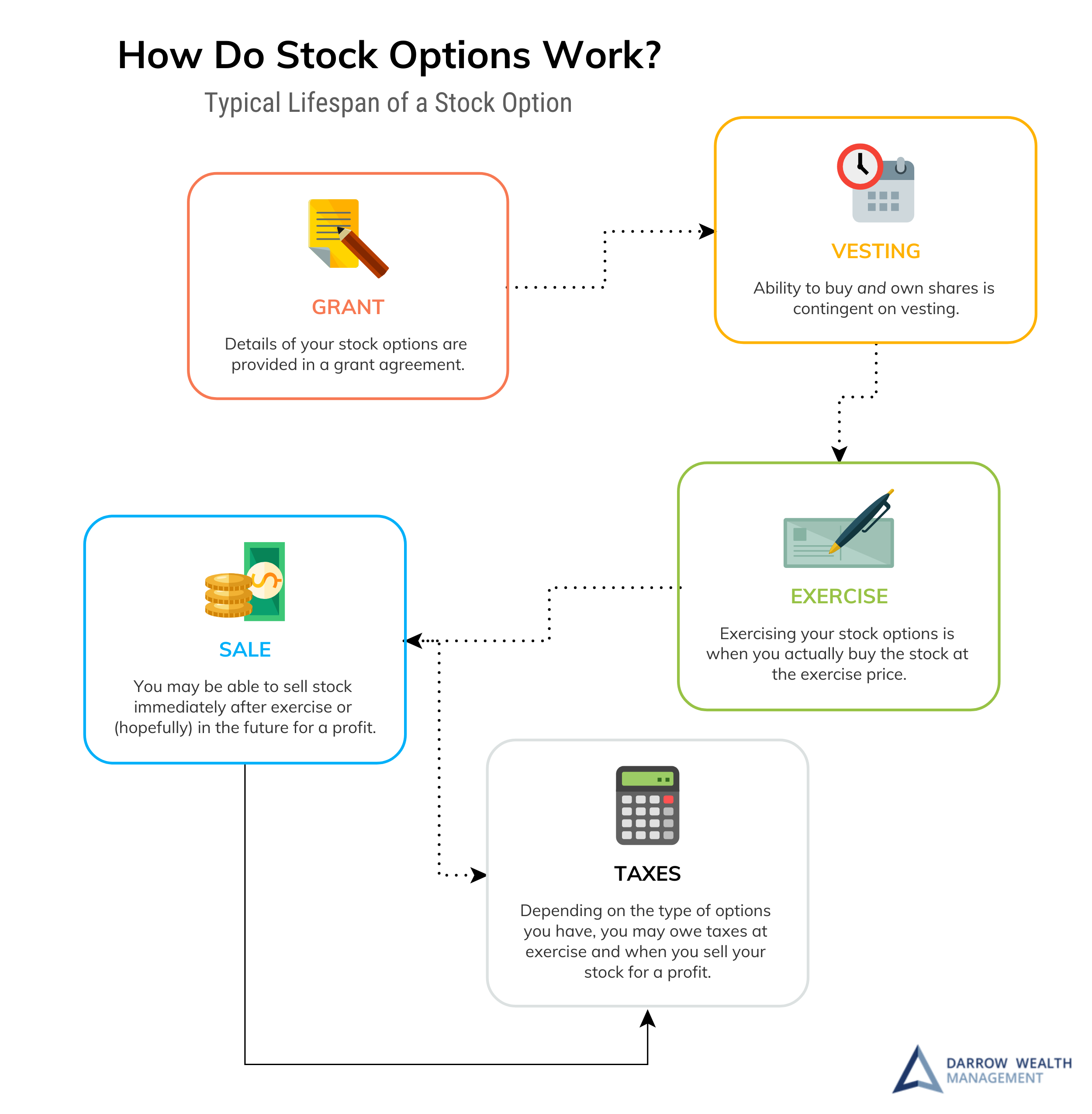

Stock options or awards can be quite complex. But it’s important to understand how stock options work, especially if it’s a big part of your

Whether you work for a company that is pre-IPO or has recently gone public, you may wonder what that means for your stock options or

It is not uncommon for employees with stock options or equity based compensation to hold too much employer stock. Employees don’t often realize how much

Investing your 401(k) in company stock can be quite risky. Although companies are scaling back on the practice, there are still many big U.S. firms

Darrow Wealth Management’s Kristin McKenna explains what can happen to restricted stock units (RSUs) after an acquisition during a podcast interview for MyStockOptions.com.

Updated for 2022. Restricted stock units are equity grants from your employer. When granted, the shares have no tax or income implications as they are