It’s common for employees to move around, especially in tech. Before giving notice, understand what could happen to stock options, RSUs, or other shares if you leave the company. Each company has a unique equity plan. So the rules can vary depending on factors like your role, if the employer is public or private, vested status of your shares, if you have stock options or other forms of equity, etc. Here’s what can happen to your employer shares if you leave the company.

Although this article is designed to serve as a robust introduction, many individuals may want to consider working with their financial advisor and/or attorney to understand how their specific equity plan and employment agreement may affect the treatment of their shares.

Can I keep my employer shares if I leave the company?

There’s a big range of possible outcomes for your stock options after you leave a company. Some of the key factors are:

- Whether your shares are vested and exercised

- What type of equity compensation you have (stock options, restricted stock units, employee stock purchase plan, stock appreciation rights, phantom stock)

- Whether your employer is public or private

- Why you’re leaving the company (retirement, a new job, laid off, terminated with/without cause)

- What (if any) specific terms you negotiated with the company

Due to the company-specific and individualized nature of employment agreements and equity incentive plans, we suggest you consider working with your financial advisor and attorney to fully understand the implications of taking a new job.

Is It Worth It To Work With A Financial Advisor?

Organizational tip: before you change jobs, make sure you download and securely save all your stock plan documents. This includes the stock plan document, grant agreement(s), employment agreement, and so forth. It’s key to remain on good terms with the company, especially for employees of private companies, as you may need to reach out down the road if there’s a liquidity event. Get a contact information if you can.

Tips for Negotiating Equity at Your Next Job

What happens to vested shares if you leave the company?

Typically, employees will have some time to manage vested shares or options. The most common reason employees and executives lose their stock options, RSUs or restricted stock awards is the shares were unvested when they quit. Most employers only requires time-based vesting. So you’ll need to stay at the company long enough to earn your shares. Typically, a portion of the grant will begin to vest after one year of service, but your vesting schedule will detail the terms of your grant.

If your shares are vested, that’s a good thing, but there are often still a number of other considerations. Also, keep in mind that vesting ends the day you leave the company.

Vested stock options when you change jobs

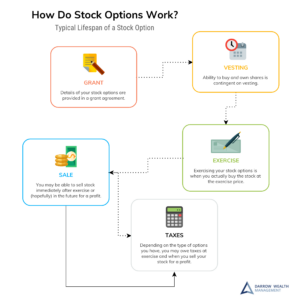

If you have vested stock options (incentive stock options (ISOs) or non-qualified stock options (NQSOs)) that you haven’t exercised, you may have the opportunity to do so before you leave the company or within a defined period of time after you leave.

If you have incentive stock options, you may be able to exercise your shares up to 90 days after your final day with your previous employer, but it could be less. Equity plans may also allow a longer exercise window after leaving the company, but ISOs lose their “qualified” status and potentially favorable tax treatment after 90 days.

Non-qualified stock options may be more flexible, although you’ll need to review the terms as outlined in your company’s equity plan.

Typically, employees don’t have the same 10 year window until expiration as listed on the grant. When leaving the company, you may only have a few months to exercise vested stock options before they expire.

Either way, before exercising, make sure you know the company’s rules on repurchases and clawbacks. There’s no point in exercising if the company is just going to buy the shares back at the same price (or less).

What happens to unvested shares if you leave the company?

Generally, if you leave a company with unvested stock options, restricted shares, or restricted stock units (RSUs), you will lose the shares. After all, that’s the whole point of vesting! If you have an annual cliff vesting schedule, keep that in mind as you consider when to give notice.

Should you exercise after leaving the company? How long do you have?

Remember, even if you can exercise and keep your vested options, it doesn’t necessarily mean you should. Whether or not you should exercise vested shares will depend on many factors. At the top of the list will be the cash requirements and tax implications.

Timing is crucial if you have vested stock options and are changing jobs. You can still exercise vested stock options after quitting, but you may only have one to three months.

Especially for private companies, there may not be a market to sell your shares if you have liquidity needs later. If you’ll maintain the right to exercise for several more years even after leaving, that optionality has value. Consider speaking with your financial advisor to discuss your entire situation and financial goals before acting.

Exercising Stock Options: What You Need to Know

Employee stock purchase plans (ESPP) shares when you quit

With employee stock purchase plans (ESPP), when you leave, you’ll no longer be able to buy shares in the plan. Depending on the plan, withholding may occur for months before the next pre-determined purchase window. Any funds withheld from your paycheck that were not used to purchase shares during the next window will likely be returned to you. The outstanding shares that you own will not change.

Vested RSUs, restricted stock, phantom stock, stock appreciation rights when you change jobs

In most equity plans, restricted stock units (RSUs), phantom stock, restricted stock awards, and stock appreciation rights (SARs) will deliver shares of stock or settle in cash upon vesting. So there typically isn’t a scenario where people hold onto these types of vested stock, as they’ve most likely already become shares or cash.

However, if you are planning a job change, it’s advisable to review your vesting schedule and grant to help ensure that you’re not unwittingly leaving money on the table, especially if your shares only vest once per year. Restricted stock units are typically awarded using a time-based vesting schedule. However, phantom stock and stock appreciation rights may also include time-based and performance-based vesting requirements.

Different rules for stock options if you leave a startup

Equity options or awards can be a lucrative part of a compensation package. For employees of private companies, there’s a few extra layers of risk which require careful planning.

Double-trigger vesting of restricted stock units

For employees of private companies with restricted stock units, you probably have double-trigger vesting. To own the shares (or receive cash), you must satisfy two vesting requirements: usually time and liquidity. So if you leave the company before a liquidity event, it’s highly likely that you’ll forfeit your time-based vested RSUs.

Liquidity issues

If you have vested stock options, you may be wondering if you should exercise or hold the shares or risk forfeiture. Again, there are strict time limitations set in the equity agreement. The following are some considerations as you make your decision:

- Is your grant underwater? If your exercise/strike price is higher than the latest valuation of the stock, then the decision will be much easier. It doesn’t make sense to pay more than the shares are worth.

- Do you have the cash to buy the shares? Even if your grant has value, you still need to have the funds required to buy the shares. If your savings are light, really consider whether it makes sense to exercise your shares. Although employers will withhold a standard amount for taxes for non-qualified stock option holders, it may be insufficient. Incentive stock option holders may have greater tax and liquidity concerns, as discussed below. There are ways to get loans for this type of thing, but that’s yet another financial risk.

- For incentive stock option holders, taxes are a particular concern. There are no tax consequences at exercise, but holding the shares at the end of the year could trigger the alternative minimum tax (AMT). Stock in a private company is typically a very illiquid investment, although sales on the secondary market might be possible. The stock of a publicly traded company could potentially be worth less at the time of sale than you paid for it on exercise. Having savings to cover any potential tax due without the need to sell shares will be critical.

- What’s the end game? In a world where more companies are staying private or delisting, it is wise to seriously consider the likelihood that the company will go public, an event that will bring liquidity and (hopefully) a financial windfall. Although M&A activity could also yield a windfall, the outcomes are more unclear.

Clawback provisions and repurchase rights

If you work for a startup, often the greatest value of your stock will follow an exit event such as a merger or acquisition or an IPO. However, if you leave the company before one of these exit events, you may miss the upside, even if you’ve already exercised your options. When you sign an offer letter, you likely receive high-level information about your stock option grant, but typically not the entire equity plan agreement or related documents unless requested. Unfortunately, it is usually these documents that contain language about clawback or repurchase rights.

With clawback or repurchase rights, after a triggering event, the company has the right to repurchase vested shares, whether exercised or not. The repurchase price is typically the lesser of the exercise price or the current value of the stock.

Also, if you did an early exercise by purchasing stock options before they vested, the company will generally repurchase any shares that haven’t vested when you leave your job.

Why matters when determining what happens to stock options if you leave

Adding to the complexity, the treatment of your stock options may vary depending on the reason you’re leaving the company. Thus far, we’ve focused the discussion on what could happen if you quit and take a new job with another employer. But what happens if you get fired or go work for a competitor? Or retire? There are a number of events that can cause someone to end their employment with a company. And in this case, the “why” often matters.

Important note: This section begins to introduce elements which cross over into employment law. This article is for general information only as to some of the financial planning considerations of equity compensation. It is not personal legal or tax advice. Consult an attorney in your state to discuss your situation.

Can you keep employer shares if you’re fired?

Without getting into the specifics of employment matters, employees can generally be terminated either with or without cause. Depending on the reason you are no longer with the company, the treatment of your stock options may differ. Typically, termination for cause will result in a cancellation of any vested or unvested options that have not been exercised.

If you are not fired for cause (e.g. laid off), you may have a set time to exercise vested options. The equity plan agreement will have more details about what can happen in these types of situations.

If you have RSUs, SARs, or phantom stock, you will very likely receive nothing from any outstanding/unvested award.

If you leave to work for a competitor

Without getting into the specifics of employment law which also varies by state, in some situations, if you quit to work for a competitor the company may have the right to clawback your vested options and/or cancel any outstanding vested awards. This depends on several factors, such as whether you have signed a noncompete agreement and the laws in your state. Consult an employment attorney in your area to discuss your personal situation.

If you retire with stock options

If you retire, you may have more favorable terms to exercise your vested options, perhaps even the full option term. Some companies may also have different rules depending on whether they consider it an early retirement or not.

If you have RSUs, RSAs, SARs, or phantom stock, you may want to consider the vesting period as you plan your retirement date. Are you close to having a large number of shares vest? If so, it could very well be worth delaying your retirement for a few months.

Before considering retirement, think about how equity compensation fits into your overall financial plan. Since holding single stocks carries more risk than a diversified fund, consider the pros and cons of exercising and holding stock options, versus liquidating and diversifying the proceeds into other investments.

Death or disability

When someone dies or becomes disabled, what happens to their stock options or equity compensation? Much like the other events in this section, each company will have their own rules about what happens following an employee’s death or disability. You can find terms in the equity plan agreement.

Employers may offer periods between 3-6 months for disabled employees or representatives of a deceased employee to exercise vested options.

Important estate planning note: If you have stock options or equity compensation, consider adding a provision in your will or estate planning documents authorizing your estate to exercise any stock options on your behalf. The company may request a copy of the will to verify. See if you can add a payable on death assignment to your stock plan accounts online. When individuals pass in their working years, it’s often difficult for family to sort through everything. Adding this to your estate plan can help alert the executor that you may have outstanding stock options if they weren’t aware.

Work with a stock option advisor

Darrow Wealth Management is a fee-only financial advisory firm specializing in stock options and stock-based pay. By integrating financial planning with investment management, our goal is to help busy professionals build and grow their wealth. As an independent full-time fiduciary, we have a duty to act in the sole benefit and interest of our clients. This is the highest act of loyalty, trust, and care under the law.

Work with a Stock Option Advisor

This article is for general information only and should not be misinterpreted as personal financial, tax or legal advice.

Last reviewed April 2024