Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock. Or a long-term investor bought shares years ago, the stock did well, and the investor simply never took profits. But because stocks don’t only go up, it’s important to have proper risk mitigation and diversification strategies once a concentrated stock holding is identified. Here are five ways to manage a concentrated stock position.

Why diversify? Individual stocks vs the index

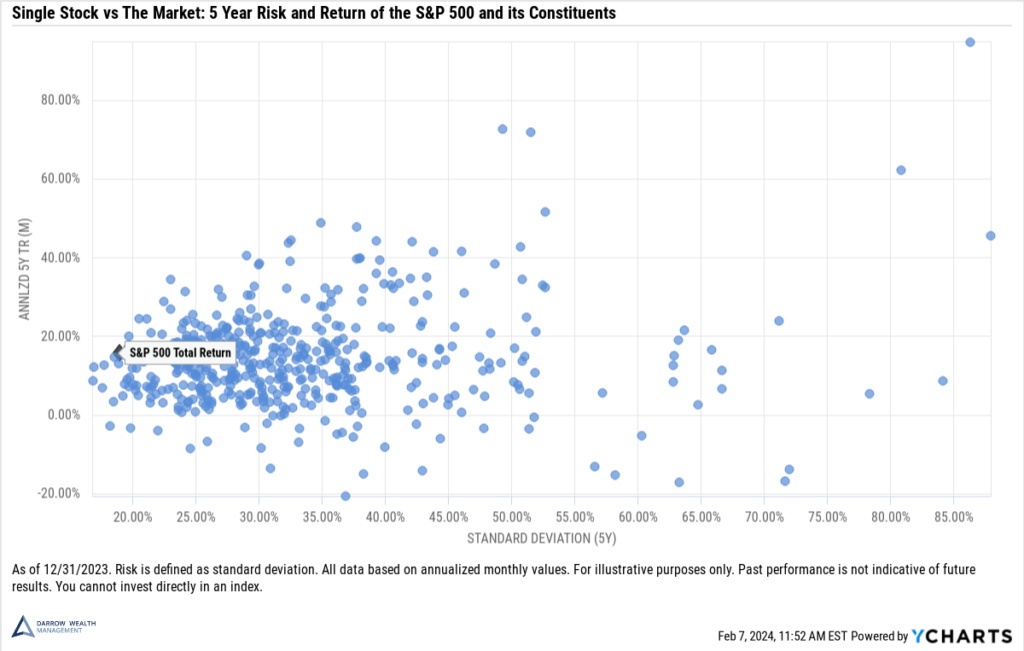

Historically, on average, the S&P 500 has been positive three out of every four years. But that’s across the largest 500 public companies – not just one. There’s a significant amount of dispersion within that. Particularly for newer and smaller companies, there’s greater risk and volatility. Of course, greater upside potential is the goal, but emphasis is on the potential.

Here are some sobering statistics about the performance of individual companies:

- How many single stocks stay public and outperform the market? Roughly 35% over rolling five year periods, 29% over 10 years, and 21% over 20 years.¹

- The stock is down so much, it has to go up from here. Wrong. Past performance (whether good OR bad) is not indicative of future results! Between 1947 and 2020, of the stocks that either outperformed or underperformed the market over the last 20-year period, only 30% would outperform as a public company over the next 10 years.²

- Big losses are common. Between 1980 – 2020, nearly 45% of all companies that were ever in the Russell 3000 Index experienced a 70% decline in price from the peak and never recovered. When considering the distribution of excess lifetime returns of individual stocks vs the Russell 3000, the median underperformance was almost -10%.³

5 ways to manage a concentrated stock position

In no particular order, here are some strategies to reduce the risk of concentrated stock wealth. Although all these approaches won’t be right for all investors, often it’s advantageous to consider multiple strategies to diversify. A deep discussion of these strategies is outside the scope of this overview, and because every situation is so different, be sure to discuss your situation with your tax and financial advisor.

- Outright sales

- Using options strategies

- Loss harvesting

- Investment choices in other portfolio holdings

- Other potential solutions

Before diving into these five strategies, let’s first review some special tax situations that could prove highly beneficial for certain investors.

Preferential tax treatment for some inherited stock and start-up shares

In most cases, the primary hurdle in diversifying a single holding is the tax implications. Founders and early investors often have super low basis stock to the point where virtually the entire gain is taxable. Taxes should always be a component of any investment decision — but not the main driver.

Individuals who inherit a concentrated stock position should speak with their estate planning attorney to confirm whether they’ll receive a step-up in basis. If so, there might not be any material tax impact from selling shares. For company founders and early employees, another consideration is whether the stock qualifies for Section 1202 and can potentially be sold tax-free.

With so many nuances in the tax system, always consult your tax and financial advisor before taking action. For example, individuals considering moving to a low or no tax state before realizing capital gains must ensure those gains won’t still be sourced (and taxable) to their former home state.

1. Strategies for selling concentrated stock

There are more ways to sell stock than just placing one big market order. The main benefit of selling a portion of your concentrated stock is eliminating the downside risk on those shares by locking in gains. Some ways to sell a concentrated holding include: limit orders and stop orders and dollar-cost averaging out of the stock at pre-determined intervals using market orders. The various types of limit and stop orders can help automate the process by only triggering an order to sell if a price gets above or below a specific threshold. Though these can be great tools, it isn’t a bulletproof strategy as there’s no way to guarantee the order will be filled.

Unwinding a concentrated holding in a thinly traded stock is a more difficult task. This is another situation where having professional support can make a big difference. You’ll want to consider the trading volume as part of the approach to avoid putting downward pressure on the stock price.

2. Using options to diversify

In some cases, investors can use various options strategies to diversify, reduce the risk of, and/or generate income from a large concentration in one stock. It’s important to note that there isn’t an options market for every stock. Stocks with a smaller market cap or newly public companies might not have a market. Further, an options strategy is an advanced trading mechanism that isn’t appropriate for every investor. And since every option has a term, it’s usually most effective as a short-term solution versus long-term strategy.

Here are a few simple examples depending on the goal(s).

Cashless collar: cap downside risk in a cost-neutral way

With a cashless collar, an investor could sell a call option on a stock they own and simultaneously buy a put option with the proceeds. In English, this means selling someone the right to buy the stock from you at a specific (higher) price for a certain period of time, and in turn, you’d buy the right to sell someone the stock at a specific (lower) price for a certain period of time. As with anything, there are pros, cons, and limitations to this. For one, the pricing may not be cash neutral, especially if trying to limit your downside and preserve more upside.

Sell a call option: earn income from your concentrated position and potentially sell for a higher price

Instead of using both legs of the cashless collar, investors could earn income from the stock by just selling a call option. If the option becomes ‘in-the-money’, it will be called (sold) at the strike price, typically when the option expires. If not, you keep the shares. Either way, you can keep the premium from selling the call option and use it to buy diversified investments. Again, and as with any investment, this strategy has risks and drawbacks, most notably the total lack of downside protection. Options are priced on volatility and the premiums aren’t always worth it.

Buy a put option: downside protection on some of your stock

In this example, an investor would forgo the income-generating call option and only buy a put (explained in the collar example) to reduce their risk. This approach could be attractive to investors who aren’t looking to sell but want some price protection on a portion of their shares. However, there are drawbacks of going this route. First, it doesn’t help diversify the concentrated holding. Further, it means selling other diversified assets (or using cash) to fund the put option purchase, essentially furthering the concentration in the stock. Ultimately, weigh the merits of paying money to sell the stock for less than you could today, if you could just sell it today instead.

There are other strategies to consider as well, including ways to get exposure to the broad-based market without actually owning it. As with any financial decision, there are many considerations to evaluate before deciding on an action plan. Further, some investment managers and brokerages may charge hefty additional fees to implement an options strategy. Again, every situation is different, so be sure to discuss your situation with your tax and financial advisor.

3. Harvesting losses from other investments to offset gains

Offsetting gains from a highly appreciated stock sale by harvesting losses from other investments can be a good tax strategy when diversifying a concentrated holding. Here’s a simple example of how tax-loss harvesting works.

Assume a portfolio has the following long-term holdings:

| Investment | Shares | Cost Basis | Market Value | Gain/(Loss) |

| A | 800 | $150,000 | $100,000 | ($50,000) |

| B | 4,000 | $700 | $500,000 | $499,300 |

| C | 600 | $300,000 | $400,000 | $100,000 |

Based on market value, Investment B is 50% of the portfolio. If the investor wanted to reduce their concentrated stock position in a tax-neutral way, they could harvest losses in Investment A by selling all 800 shares and realizing a ($50,000) long-term capital loss. Given the ultra-low cost basis in Investment B, only 400 shares (10%) of this holding can be sold for a truly tax-neutral offset. The corresponding trade would result in a $49,930 long-term capital gain. The net result (assuming no other realized gains or losses for the year) is a net long-term capital loss of ($70).

Tax-loss harvesting can be a great tax strategy to consider alongside larger portfolio and financial conversations. But it isn’t always a no-brainer. For example, imagine this investor wanted to diversify their portfolio but also needed income from their portfolio. Following on the previous example, if the $150,000 proceeds wasn’t reinvested, it would actually increase the weight of Investment B in the portfolio to 53%.

Tax-loss harvesting can also create unnecessary turnover in a portfolio and large gaps between the current and target asset mix. Always consider your entire situation and goals.

4. Managing around a concentrated holding

Again, when considering ways to manage a concentrated stock position, the best approach is typically to employ several strategies at once. Although this strategy doesn’t reduce the overweight stock, without considering how to manage around it, investors might inadvertently increase their exposure.

To illustrate, consider the following simple hypothetical example:

Imagine your portfolio holds: 20% Microsoft stock, 40% a S&P 500 fund, and 40% in bond funds. In February 2024, Microsoft is the largest company by market cap in the world with a 7.3% weighting in the S&P 500. After considering the overlap of all holdings in your portfolio, the exposure to Microsoft is closer to 23%. In contrast, if 40% of the portfolio was in the equal weight S&P 500 index instead, the underlying exposure to Microsoft would be mostly unchanged (20.08%). [See disclosure 4]

Obviously, there’s a lot more to consider when making an investment decision than this singular component, and neither of these hypothetical portfolios constitute any real or recommended investment strategy. But it illustrates the importance of looking under the hood of any potential investment to identify holding overlaps between ETFs, mutual funds, and direct ownership of individual stocks in a portfolio.

Other potential ways to manage around a concentrated holding include underweighting similar characteristics in the diversified allocation. This can include industry, sector, company size, and other stocks that are highly correlated.

5. Other possible solutions for large individual stock positions

Depending on your situation and goals, you might have additional options to consider. Here are a few:

- Exchange (swap) fund. At a high level, with an exchange fund, individuals contribute stock to a private fund in exchange for an ownership in the fund. The objective is to create a diversified basket of stocks this way. After a seven-year (yes, 7!) period, individuals receive a diversified mix of stocks. A complete discussion of the pros and cons and workings of swap funds is outside the scope of this article, but there are many things to consider, such as: liquidity, fees, unregulated nature of these funds, and availability/access. Further, exchange funds don’t alter the investor’s original underlying cost basis from the contributed shares, so that could still be a hurdle to address.

- Accomplish charitable goals. If you have charitable goals, your concentrated stock position will likely lend itself nicely to furthering these objectives. Consider donating highly-appreciated securities (instead of cash) using a donor-advised fund. If you itemize your tax deductions, you may be able to take a charitable deduction for the fair market value of the asset, up to 30% of adjusted gross income (AGI). There is a five-year carry forward for unused deductions. Only long-term securities are eligible (e.g. holding period of over one year). Given the tax deduction, you may be able to maximize the benefits of a donor-advised fund alongside a large sale of stock.

- Further estate planning objectives. Consider speaking with an attorney to evaluate estate planning opportunities. For example, it may make sense to consider putting certain shares in trust for family to remove the value from your estate. There are estate tax and gift tax implications embedded in most complex trust strategies, so work with an attorney in your state to understand the benefits and implications.

Final word on ways to manage a concentrated stock position

The situational nature of planning to diversify one large stock position cannot be over-emphasized. For simplicity, this article has only focused on situations where the holding was fully unrestricted. Executives and insiders will typically have different (albeit fewer) options available to reduce risk on shares of their current company. Regardless of the situation, it’s important to remember two key things: stocks don’t only go up and taxes alone shouldn’t drive the decision.

Kristin McKenna, CFP® originally published an abbreviated version of this article at Forbes

References

¹ Dimensional, using data from CRSP and Compustat. The US market includes all US common stocks without gaps in monthly data for a given rolling period. Delisted stocks with delisting code between 200 and 399 are considered good delists; bad delists are 400 or greater. Outperformance defined relative to the value-weighted market at each cross-section. Statistics reported are averages computed across rolling multiyear periods formed monthly from the cross-section of stocks available at the start of that month. Rolling monthly periods between January 1927 – December 2020. Article

² Dimensional, using data from CRSP and Compustat. Includes all US common stocks. Delisted stocks with delisting code between 200 and 399 are considered good delists; bad delists are 400 or greater. Stocks with complete prior 20-year monthly data classified as past outperformers and underperformers relative to the value-weighted market. 10-year survivorship and outperformance defined relative to the value-weighted market at each cross-section using stocks without gaps in the following 10-year monthly data. Survivorship and outperformance and bad delists are averages computed across rolling 10-year periods formed monthly from the cross-section of stocks available at the start of that month. Rolling 10-year periods between January 1947 – December 2020. Article

³ J.P. Morgan Private Bank. 1980-2020. Article.

[4] The ETF SPY represents the S&P 500; data from YCharts updated 2/8/24. The ETF RSP represents the equal weight S&P 500 index; data from YCharts updated 2/7/24.

Important disclosure

This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.