Figuring out what you can spend in retirement is challenging. So is calculating what you might want to spend. Spending in retirement isn’t level, and what you end up spending money on will also change as you get older. If investors are concerned about running out of money in retirement, they might assume that poor investment performance towards the end is the main concern. But that’s not the case.

When you retire, you are most vulnerable financially in the beginning. According to data, this is also when retirees have the highest expenses. Managing expenses at the beginning of retirement is key to ensure you don’t run out of money.

It’s not just how much you spend in retirement — it’s when you spend it

Here’s why overspending at the start of retirement isn’t a good idea:

- When your retirement savings are the greatest, you’re most exposed to losses

- Fixed costs force retirees to keep drawing from their accounts, even in down markets

- Data shows spending is highest in the years before and after retirement

- You can only spend a dollar once. An invested dollar can continue producing income and price appreciation

- Compounding magnifies the benefits of staying invested over time, making it easier to meet income goals

The timing of withdrawals in retirement matters

Sequence risk describes how the order of investment gains or losses and timing of cash flows affect portfolio values.

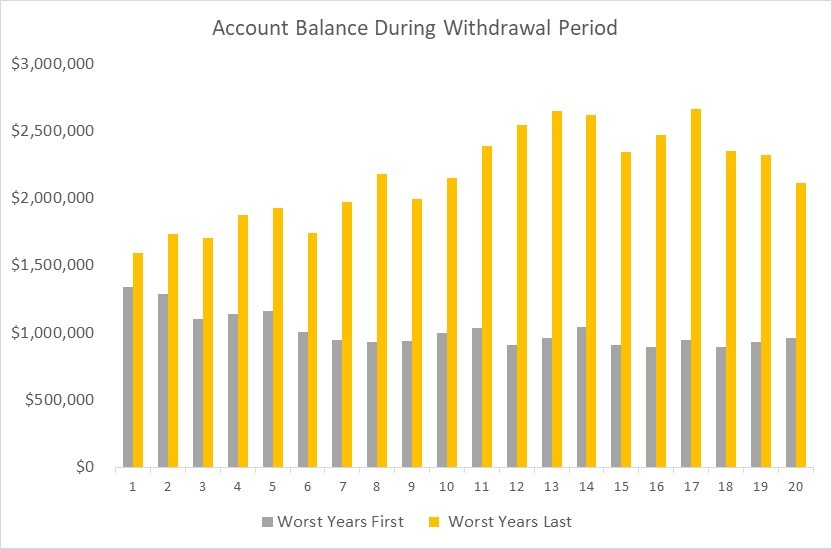

To illustrate, assume two retirees, Mary and Peter, each have an account worth $1.5 million and require $75,000 from their account at the beginning of each year for 20 years. Each retiree has a total time-weighted rate of return of 5.55% over the 20-year period.

Mary’s account performs worse than Peter’s for the first 10 years and better over the last 10 years; Peter’s account does the opposite and has the worst performance in the second half.

After 20 years, Peter has nearly $1.15M more than Mary because during the last 10 years when his returns were worse, there were fewer dollars left to lose from a down market.

Here’s what their accounts would look like after 20 years:

Note: the analysis excludes the impact of inflation, taxes, dividends, or capital gains. For simplicity, the projections assume funds are invested at the beginning of each year and compounded annually. Returns reflected as an annualized time-weighted rate of return (TWRR). TWRR is typically used to measure fund manager performance as it excludes the timing of cash flows and geometrically links each sub-period to reflect the impact of compounding. Notably, because the TWRR excludes the impact of cash flows, the sequence of returns risk is not identifiable in the calculation.

Managing expenses at the beginning of retirement is key to maintaining your lifestyle

Note, if there are no cash flows in or out of the account, there’s no sequence risk.

Following on the example above, if Mary, who suffered the worst performance at the beginning of retirement, had withdrawn $100,000/year during the first three years of retirement before dropping withdrawals to $75,000, her account would be worth $229,000 less after 20 years.

Put another way, the $75,000 in additional income ended up costing her nearly $154,000. It’s because the dollars weren’t invested when the market recovered. Uncaptured investment growth alone marks a -16% reduction in her ending account balance vs the original scenario when spending was $75,000 every year.

Had Peter taken $100,000 out the first three years of retirement, his unrealized investment growth would equal less than 6% of his ending account balance.

Retirement expenses are typically the highest in the beginning

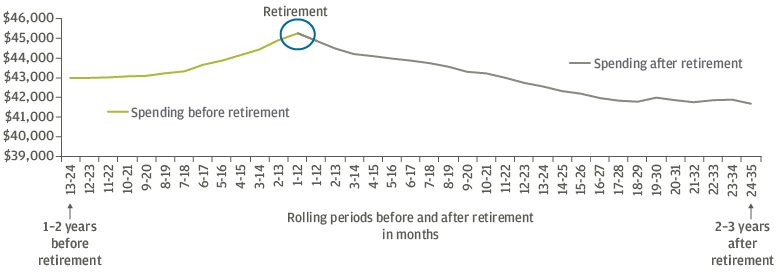

According to data from Chase, spending peaks for individuals just before and after retiring. Therefore, the sequence risk is also the greatest.

Rolling Monthly 1-Year Median Spending Before and After Retirement (Retirement age 60-69)

Source: Chase credit card, debit card (excluding some co-branded cards), electronic payment, ATM withdrawal and check transactions from October 1, 2012 to December 31, 2016.

The data makes sense; retirees are adjusting to their new lifestyle and big-ticket items like a retirement home or extensive travel itinerary are often priorities.

This doesn’t mean retirees shouldn’t enjoy their success or live in constant fear. But it does highlight the importance of planning and remaining flexible, especially at the onset of retirement.

A retirement spending plan can reduce the risk of running out of money later on

Estimating your spending in retirement is difficult, but a comprehensive retirement plan can help investors work through the numerous financial, economic, and lifestyle decisions that will need to be made before and during retirement.

Having flexibility in your monthly cash flow is a terrific way to protect yourself from a recession or market crash during retirement as you won’t be forced to make large withdrawals from your accounts to pay bills.

Flexibility generally means avoiding high fixed costs. If you have high fixed expenses, it can be impossible to reduce spending when finances are strained. Typically, the largest fixed expenses for retirees are housing (mortgage, property tax, maintenance, insurance), health care, and taxes.

There’s not much you can do about health care and tax planning has limits.

Retirees concerned about withdrawals during market volatility may decide to hold off on a major purchase or big trip. Even if you can cut back, you may not have to, depending on your financial resources and the depth of your pre-retirement planning.

Robust financial modeling can help

Using a Monte Carlo analysis to stress test a financial plan helps to identify the probability of certain outcomes to mitigate risk and allow retirees to feel confident that they aren’t over-spending.

Simulations can test the viability of an income stream in retirement under various market conditions.

Retirement planning is part art and science. There’s no prize for being the richest person in the graveyard. It defeats the purpose to work hard for all those years just to stress about money in retirement.

In retirement planning, we focus clients on the elements they can control. We help clients build strategies to address the factors they cannot. Since spending is a choice, it’s usually the best way to avoid running out of money in retirement.