Losing a spouse can be an overwhelming and emotional experience. While it’s possible to organize financial documents ahead of time, there’s no way to truly prepare for the death of a spouse. Unfortunately, during the grieving process surviving spouses also need to navigate the complex financial issues that arise after the death of their partner. Here’s a financial planning checklist for surviving spouses.

Kristin McKenna, CFP® first published an abbreviated version of this article on Forbes.

Checklist: What to do After the Death of a Spouse

Let’s face it, there’s a lot to do after the passing of a spouse. But not everything needs to get done today. In addition to making funeral arrangements and notifying family and friends, another priority is alerting your estate planning attorney and financial advisor.

Download Checklist: What to do After the Death of a Spouse

Also consider:

- Getting multiple copies of the death certificate, at least five

- Asking a friend/relative to watch the house during the funeral or memorial service. As sad as it is, burial plans are publicly available, and robberies occur

- Arrange to have any pets taken care of in-home or boarded

- If you’re planning to visit family away from the home, have the mail forwarded to that address, or to the executor, if that isn’t you

Most Common Missteps

There’s a lot to do after the death of a spouse. But there’s also things to avoid doing. Kristin Dzialo, Trust and Estates attorney and Partner at Rubin and Rudman, LLP in Boston, MA shares the top five most common mistakes she sees new widow(er)s making:

- Letting fear and grief delay important action

- Failing to update accounts to remove spouse’s social security number, and request basis adjustments

- Missing tax and other important deadlines

- Not confirming whether required minimum distributions from retirement accounts were taken before death

- Giving away property too soon. You need to be sure the estate plan authorizes you to do this, obtain appraisals and valuations, and adhere to creditor claim periods in the event of a valid claim against the estate. You may want to give that Rolex to a nephew as a sentimental gesture, but always consult with your attorney before doing so. Small tangibles can cause big issues.

Get Organized and Understand Your Financial Situation

After the death of a spouse, take steps to organize and take stock of your financial situation. You’ll need to gather a lot of financial documents and statements, including:

- Bank statements

- Investment account statements (brokerage and/or trust accounts)

- Retirement account statements and beneficiary designations

- Life insurance policies and beneficiaries

- Pension details

- Estate planning documents

- Tangible assets and your spouse’s personal property

- Outstanding debts or liabilities, including any mortgage or loan balances, credit card balances, and unpaid bills

Also determine how the bills are being paid, either from joint bank accounts, your spouse’s or your own account. For help finding all the accounts, ask the credit bureaus for a report and notify them of your spouse’s passing. The funeral home typically notifies the Social Security Administration. Notify current/former employers; it’s common to have employer-provided life insurance, stock options, and other benefits that may require your attention.

It’s important to make a list of everything and discuss with an attorney. For example, is a joint bill paid from a bank account your spouse owned individually? If so, you’ll likely want to update that to ensure payments will continue. Regarding credit cards, if you’re an authorized user and not the primary cardholder, you’ll also want to discuss whether or not you should make payments or even continue to use the card.

Asset Titling, Beneficiary Elections, and Probate

The estate planning attorney is going to be critical here. Hopefully, your spouse had a will and perhaps a trust set up and funded. Assets owned by your spouse individually, that don’t pass through a beneficiary designation like on a retirement account or life insurance policy, or through a transfer-on-death or payable-on-death arrangement, will likely go through probate. It may be helpful to familiarize yourself with concepts like how a trust differs from a will.

There are many factors to consider, which is why it’s so important to have an attorney. Some include the state you live in, ownership at death, if there’s a will, if the asset was in a living trust, etc. The attorney will be able to advise you on everything. Typically, joint bank accounts will be updated to reflect ownership in your name only, the same for non-retirement investment accounts.

Retirement Accounts

If you’re the primary beneficiary of an IRA, 401(k) or other type of retirement account, work with your financial advisor and attorney to discuss your options. Surviving spouses have a lot of choices after inheriting a retirement account. The rules regarding inherited retirement accounts have changed significantly in the last few years so don’t rely on prior guidance. For example, mandatory distributions from retirement accounts don’t begin until age 73 if your spouse was born between 1951-1959.

It’s really important to take your time and consider the options. Once you take action, it can’t be undone. Also consider your cash flow needs if your spouse died before age 59 1/2.

Sometimes, surviving spouses inherit assets they don’t need. Speak with your advisors about strategies to disclaim these assets sooner than later, as you’ll only have nine months from the date of death to do so.

Cash Flow Considerations

One of the important considerations in the weeks and months after the death of a spouse is cash flow. Can you maintain your lifestyle? This is particularly important for younger couples.

Review your past income and expenses and consider how it may change going forward. It may change dramatically; it might not change much at all. Every family is different. During this process, cancel subscriptions and other expenses that you no longer need. Also investigate new sources of income, such as a pension, Social Security, annuity, etc.

Having a strong sense of where you stand financially will help prepare you to make important financial decisions ahead.

Social Security

Assuming the deceased was eligible for Social Security benefits on their own work record, the benefits you could receive depend on your age, the age of your spouse, whether you are caring for dependents, if you remarry (and at what age), are disabled, etc.

But generally, excluding any nuances, a surviving widow(er) who is at least full retirement age (FRA) will get 100% of the highest benefit you or your spouse was receiving. But you only get one benefit. So, if you were both receiving Social Security, you’ll only get one check going forward (the highest one). Benefits are reduced before FRA but can’t be claimed before age 60 unless disabled and at least 50.

Social Security is paid in arrears. For example, a payment in June would be for the month of May. Social Security will only make a payment if the individual was alive the entire month. There are no partial payments.

“Remember, your Social Security number dies with you,” Dzialo says. She always advises clients to remove their spouse’s social security number from joint accounts and close any of their spouse’s individual accounts to avoid income tax complications in the future.

Consider Your Housing Options

As the surviving spouse, you’ll need to consider housing options, like whether to sell or keep the home, or downsize. Mortgages aren’t transferrable, even if both your names are on the loan. You’ll need to pay the mortgage off or refinance into a new loan supported by your assets and income as a widow(er).

If you decide to sell the marital home, you’ll have two years from the date of death to sell and keep the full $500,000 federal gain exclusion for married couples. To do this, both spouses need to pass the use test (house was your primary home for at least two of the last five years).

Dzialo has two key pieces of advice for individuals seeking to sell the marital home. First, update your homeowners’ insurance. “This is especially important if you plan on vacating the home before it’s sold as your coverage could be voided if no one is living in the property,” she says. Second, be aware than an automatic 10-year estate tax lien release applies on all real estate. To ensure the closing isn’t delayed, “You will need to release this lien by an affidavit if no estate tax return is required, or obtain a lien release if an estate tax return is required,” Dzialo says, noting the importance of discussing this with the closing attorney.

Filing Taxes for the Year of Death

When a spouse passes away, the surviving spouse may need to file taxes for both themselves and their deceased spouse for that tax year (by April 15th of the following year). Obtain all relevant tax documents, including W-2s and 1099s, and consult a CPA for help. Also discuss with your attorney whether you need to file a federal or state estate tax return (due nine months after death). Dzialo says clients are often surprised when an estate tax return needs to be filed, even when no tax is due.

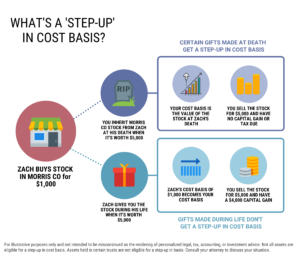

Certain non-retirement assets owned by your spouse will also be eligible for a step-up in basis to the fair market value at the date of death. In most states, the step-up portion will be 100% of eligible individually owned assets, or 50% of jointly owned assets. In community property states, the survivor will get a full step-up in basis. But regardless of where you live, it doesn’t happen automatically. Your financial advisor can help with brokerage and trust accounts, but also consider other property.

For example, Dzialo says “If you’re not selling your house right away, an appraisal will be necessary to determine the value for the basis adjustment. Even if you’re not filing an estate tax return, it’s important to assess the value of all of the assets and request basis adjustments as needed.”

If you’re a beneficiary of a retirement account, you may need to take a required minimum distribution from the account in the year of death. Consult a financial advisor to discuss what rules apply to you.

Finally, consider any deductible medical expenses that were paid for the deceased spouse during the year of death. Medical expenses have a special exemption and can be deducible even if paid up to a year after death. Discuss with your CPA as you may want to consider an extension to have more time for bills to trickle in.

Understand Health Insurance and Medicare Coverage

Understanding your health insurance and/or Medicare coverage options is also an important checklist item after the passing of a spouse. If you were on your spouse’s health insurance plan at work, you may be eligible for 36 months of coverage under COBRA. Contact the employer or insurance provider to determine eligibility and discuss any health savings account or flexible account arrangements.

Notify Medicare and Medigap to reduce premiums and whether you still have the same Part D coverage needs.

Review Stock Options

If the deceased spouse had stock options or equity compensation, contact the employer and review plan documents to understand what happens to these assets. The treatment of stock options and equity depends on the terms of the specific plan/company, circumstances, and the individual’s estate planning documents. Stock options and equity compensation may have been missed in an estate plan, but that doesn’t mean they doesn’t exist!

Vested stock options will most likely be available for exercise by an estate or beneficiaries, perhaps within 1-3 years after death. After exercising the options, cash or shares will be delivered. Depending on the situation, restrictions may require you sell or retain the stock if there isn’t a liquid market.

If the employee’s stock options aren’t fully vested, unvested options can be forfeited. However, many stock option plans accelerate vesting upon the death of the employee. Restricted stock or restricted stock units often have similar treatment. Again, discuss the situation with the employer, your attorney, and financial advisor.

Review Your Estate Planning Documents

As a surviving spouse, you’ll need to revisit your estate planning documents too. Wills, trusts, and other estate documents contain key provisions and name people to crucial roles. Most couples name each other in these positions. So updating your estate plan is a really important part of this process. You’ll need to name new beneficiaries, healthcare proxy, power of attorney, potentially trustees, a personal representative, and so on. Work with your financial advisor after to implement changes.

Digital Assets

Digital assets can include pictures, videos, email, document storage, social media, and websites. Dzialo stresses the importance of managing the online presence of your spouse and closing down accounts, first downloading personal material such as pictures. She also suggests looking for money in a PayPal or Venmo account and other benefits, such as credit card points or miles.

Gaining access to online accounts can be tricky. Dzialo says, “it’s illegal to use someone else’s password, but you can gain access if you were named as a legacy contact, through court order, or submitting a death certificate.” Since each company has its own process and requirements, this could take some time.

Abandoned Property

An astonishing number of people have rights in abandoned property, says Dzialo. She recommends checking your state’s abandoned property website right after your spouse dies, and also periodically after – for both you and your spouse. Keep checking because if your spouse had accounts you couldn’t locate or weren’t aware of, they will eventually be turned over to the state and claimed through this process. “Though it’s usually small amounts, I’ve also seen very large accounts discovered this way,” says Dzialo.

You Don’t Have to do it Alone

The financial planning moves for surviving spouses after the death of a spouse can feel endless. However, support is available. Don’t rush into important financial decisions and consult with financial and legal professionals who can help you make informed decisions and secure your financial future. If you need help navigating your path forward, please contact us to schedule a consultation.