Although the most common way for a company to go public is through the traditional initial public offering (IPO) process, it’s not the only method. Although SPACs (special purpose acquisition companies) were first created in 1993, they’ve recently became a very popular way for a company to go public. This happens when a private company merges with or is acquired by the SPAC (which is similar to a blank-check company). If you’re an employee and work for a target company of a SPAC, you may be wondering what happens to stock options in a SPAC merger.

What is a SPAC?

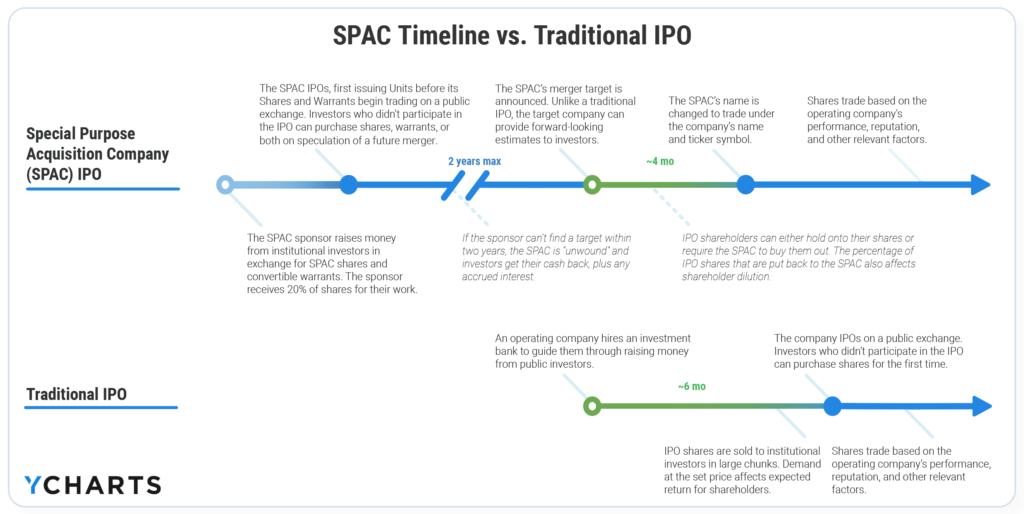

SPACs are essentially shell companies. Their ‘special purpose’ is to acquire/merge with a private company and take it public. SPACs raise capital through an IPO. When a SPAC goes public, it cannot have a target company already identified. The new capital from the IPO is kept in trust and the SPAC must get shareholder approval and complete an acquisition/merger with the target company within 2 years. A complete transaction is called de-SPACing.

By merging with a public blank-check company, a private company can go public without a traditional IPO. A direct listing is another option to go public without an IPO, though only a handful of companies have gone public this way. The most notable direct listing was Coinbase.

SPAC vs IPO Timeline

What happens to stock options in a SPAC merger or acquisition?

As with many things in the land of mergers and buyouts, it depends! If your employer may be planning to go public by de-SPACing, consider taking steps to get a plan in place. What should employees with stock options do after a SPACquisition?

5 Stock Option Mistakes People Make When Their Employer Goes Public

Converting shares upon de-SPACing

Depending on the valuation, employees with equity or stock options will likely have the number of shares adjusted up or down. The exchange ratio will be finalized when the deal is. After the target company goes public via SPAC merger, the market will decide how to value the shares. There will be dilution to compensate SPAC sponsors and redemptions. According to research, SPAC public investors (vs the founders or target company) often pay the price of dilution.

Lockup period after SPAC merger/acquisition

Unlike the traditional IPO process where the lockup period is usually 180 days, after a SPAC merger, employees with stock options may have to wait 6 months to a year for all restrictions to be lifted. Sometimes employees are able to sell a preset number of shares after closing in a tender offer. There could also be price-based targets where options can be sold once the stock reaches a target stock price (and sustains it for a period of time).

Accelerated vesting of stock options

Will the vesting of outstanding stock options automatically accelerate when the SPAC merger is complete? This is a key issue for employees with unvested equity. Refer to your stock plan documents to see if there are provisions for unvested options to vest upon change of control. If it does, ensure that the potential SPAC acquisition will meet the definition of a change in control (CIC).

Keep in mind that the terms of business combination could ultimately override your stock plan documents. Nothing is final until it’s done!

When working for a startup, if stock options are a big part of your compensation package, it’s often worth working with an employment attorney to understand the terms of the offer. Depending on your anticipated role with the company and leverage, you may be able to negotiate better terms.

If the plan doesn’t provide for accelerated vesting, the company could always decide to offer it or amend grant agreements prior to the closing of the deal. A company may do this to retain key employees. After all, the company still needs to operate after it goes public!

Other options for equity compensation in SPAC mergers: converting equity to the new public company, cashing shares out, or perhaps even cancelling unvested options or awards without payment. Vested shares can’t be cancelled without consideration unless underwater.

Special tax planning considerations

The acceleration of vesting can trigger other issues. Incentive stock options (ISO) can lose their favorable tax status if more than $100,000 in ISOs will be eligible for exercise in a year. This is based on the value at grant.

When unexercised ISOs are cashed out, it’s considered a cancellation of stock options for tax purposes, not a disqualifying disposition. This is important, as the former will be subject to payroll tax. Exercising shortly before the deal closes can prevent this from happening. However, if the deal fails, you may trigger the alternative minimum tax if you hold the stock past the end of the year.

Especially for employees with restricted stock units (RSUs), accelerated vesting can create issues with 409A. RSUs can become subject to Section 409A if they are not settled shortly after vesting. It’s possible for other types of stock options to trigger 409A. Another issue is Section 280G: an excess 20% excise tax on ‘golden parachute’ amounts, so it’s important to work with your team of tax, legal, and financial advisors.

Stock option planning after a SPAC merger

Planning to maximize the value of your stock options after your employer goes public via SPAC merger is essential. Much like a typical IPO process, employees will have to make several important decisions after a SPACquisition.

Understand what will happen to your shares

As explained above, step one is to understand your stock option plan and what the company plans to do with unvested stock options. Executives may have more leverage early on to negotiate over employees. But at some point when the merger is looming, it may be too late to try and change the terms. This is especially important if you plan to leave the company before it goes public.

The terms of the deal will also impact your shares and tax implications (e.g. if you are fully cashed out). There’s not usually much you can do to control the situation, but you’ll want to set expectations for yourself. It’s also important not to pre-spend proceeds!

It’s official once it’s official

Just because your company is the target of a SPAC merger, doesn’t mean it’s going to happen. Recall the deals must usually be complete within 24 months or funds returned to shareholders.

According to YCharts, since 2009, 474 SPACs went public and raised capital, but only 188 SPACs mergers were successful. This means about 60% of the time, the target of the SPAC merger doesn’t end up going public, or at least hasn’t already (as of February 2021).

Planning for sudden wealth after your company goes public

So many different things can happen when a company goes public. It’s really important to have a team of financial, tax, and sometimes legal advisors in place to assist you in making major decisions, like when to exercise and sell shares or calculate your tax bill. When the lockup period ends, consider ways to begin to take profits (assuming you have gains, of course).

SPAC performance has been choppy. Due to the unique structure with warrants, delay between SPAC IPO and merger agreement (de-SPACing), as well as the extended lockup period for insiders, a lot can happen. Especially if you own a lot of stock in the company relative to your other assets, you’re exposed without a plan to diversify.

When working with investors after a sudden windfall, we’ll review their entire financial situation and goals. Most of our new clients haven’t worked with a financial advisor before, so they lack an investment strategy and coordinated asset allocation. Our financial x-ray aims to help clients identify risks and take advantage of money-saving planning opportunities at every meeting.

In planning for the proceeds, balancing lifestyle upgrades with the opportunity to save for long-term money goals and the risk from outstanding shares is critical. Remember, paper-profits aren’t realized gains.

Financial advisor for stock options

Darrow Wealth Management is an investment management and financial advisory firm. We regularly work with employees and executives with stock options, particularly after a sudden wealth event. Learn more about our services and schedule a consultation with an advisor.