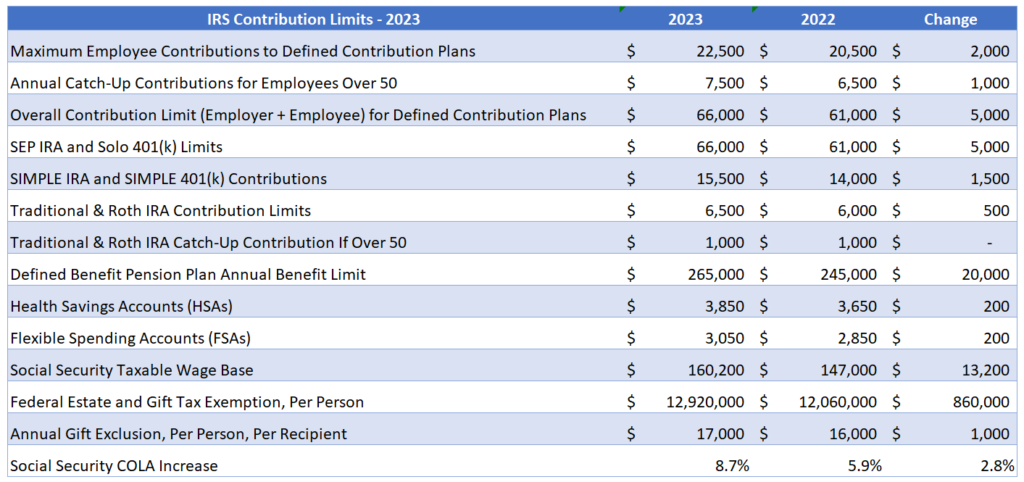

The IRS has released the 2023 contribution limits for retirement plans and other cost-of-living adjustments. The agency also released tax brackets for ordinary income and long-term capital gains.

Learn more about how the recent passing of the Secure Act 2.0 changes retirement planning and moves the RMD age to 73 then 75 in 2033.

Contribution Limits for 401(k)s, IRAs and More in 2023

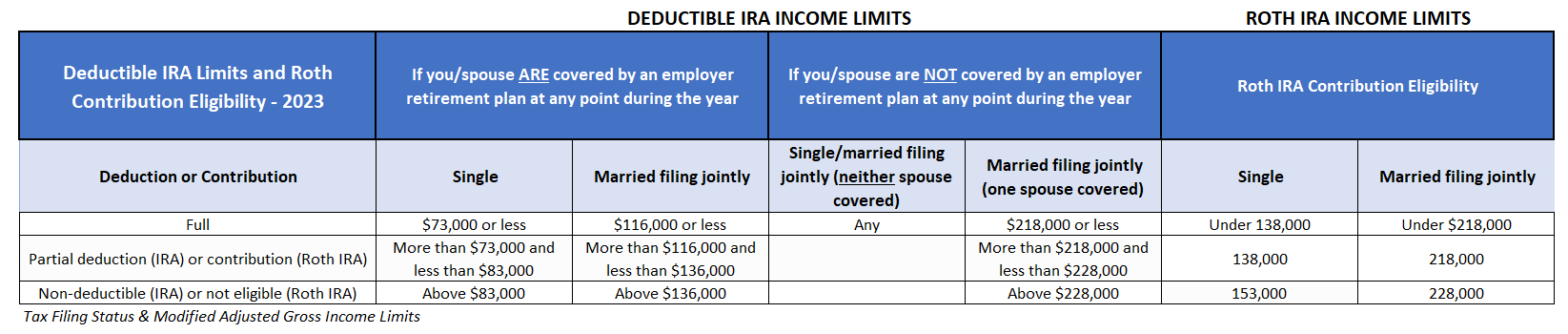

Income Limits for Tax-Deductible IRA Contributions & Roth IRA Contribution Eligibility

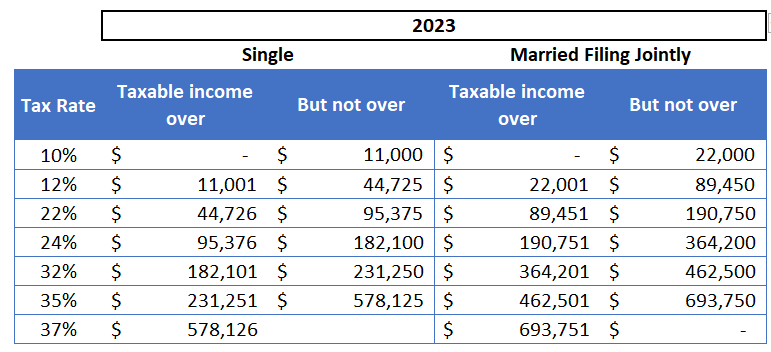

Income Tax Rates in 2023

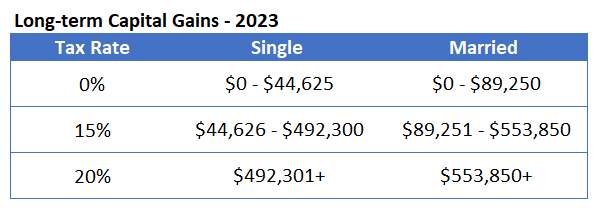

Long-Term Capital Gains Tax Rates