83(b) Election: Tax Strategies for Unvested Company Stock

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

Tax planning and wealth building strategies from Kristin McKenna, CFP®. Tax-conscious wealth planning is critical for any high-income taxpayer: asset location and tax-efficient investing, stock option and equity compensation exercise and sale strategies, qualified small business stock, retirement income tax planning and bucketing strategies, deferred compensation, employer plans for business owners, charitable tax planning and donor-advised funds, reducing taxable income, changes in tax law.

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re

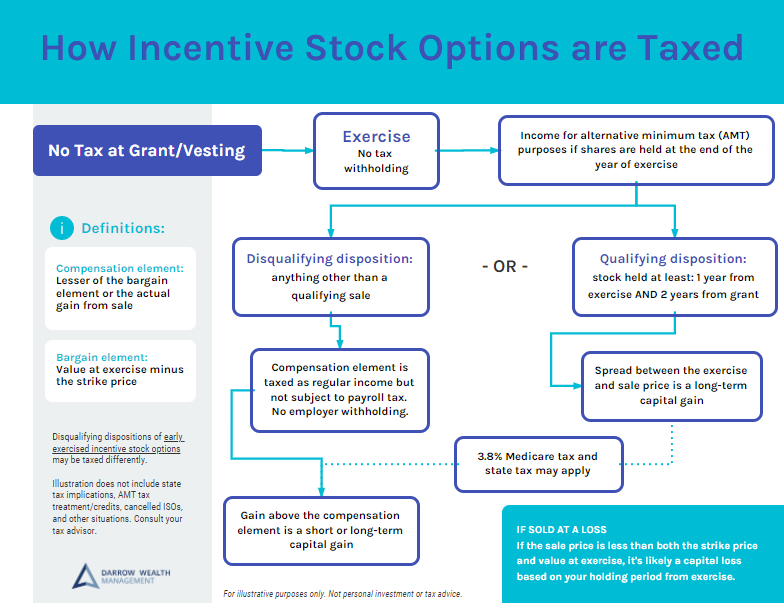

If you have incentive stock options, you’ve probably heard of the alternative minimum tax (AMT). Essentially, the alternative minimum tax is a prepayment of taxes.

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to

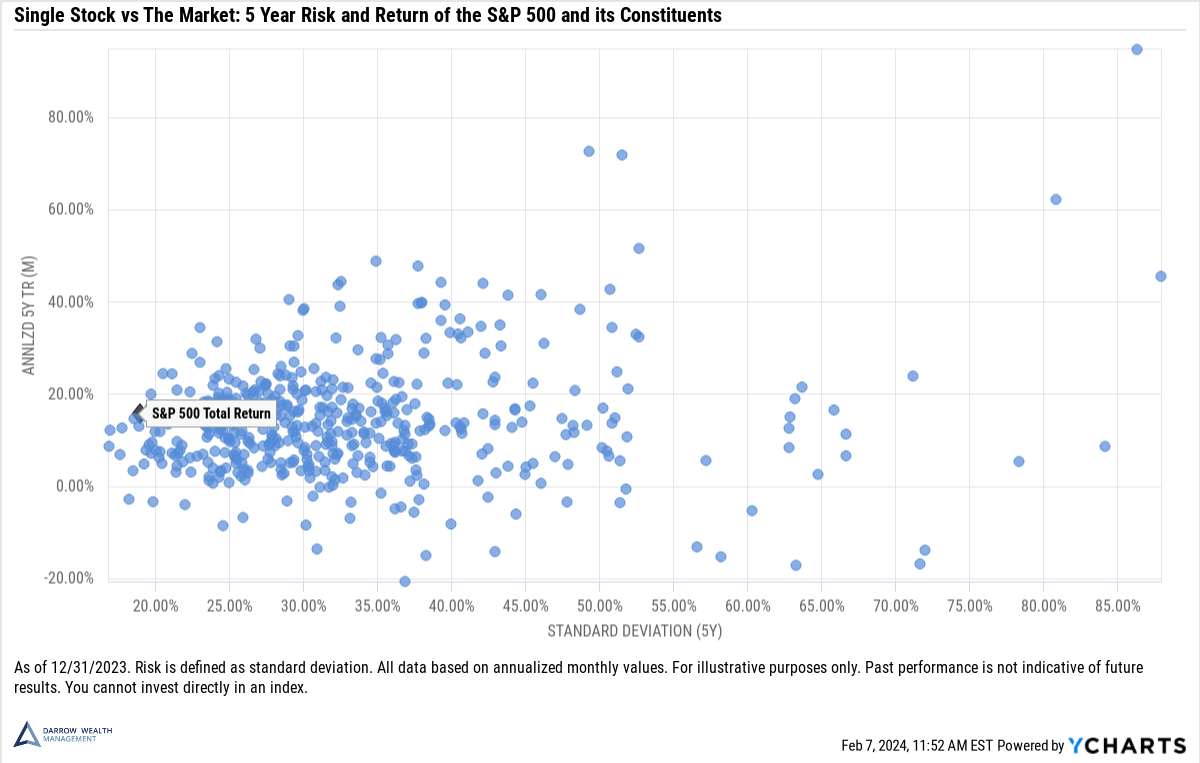

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments. Also, the 2024 income tax brackets and long-term capital gains

Working for a startup can pay off big financially, but a lot must go right along the way. If you are considering taking a job

The Secure Act 2.0 was signed into law December 29th, 2022, bringing more major changes to tax law. Among the most notable changes include a

Taxachusetts is back. In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on

Updated for 2023. Planning can help optimize annual required minimum distributions depending on your goals and cash flow needs. After the passing of Secure Act

If you invested in a startup or small business (founders, employee exercise of stock options, business owner), you need to know about qualified small business