The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments. Also, the 2024 income tax brackets and long-term capital gains tax rates.

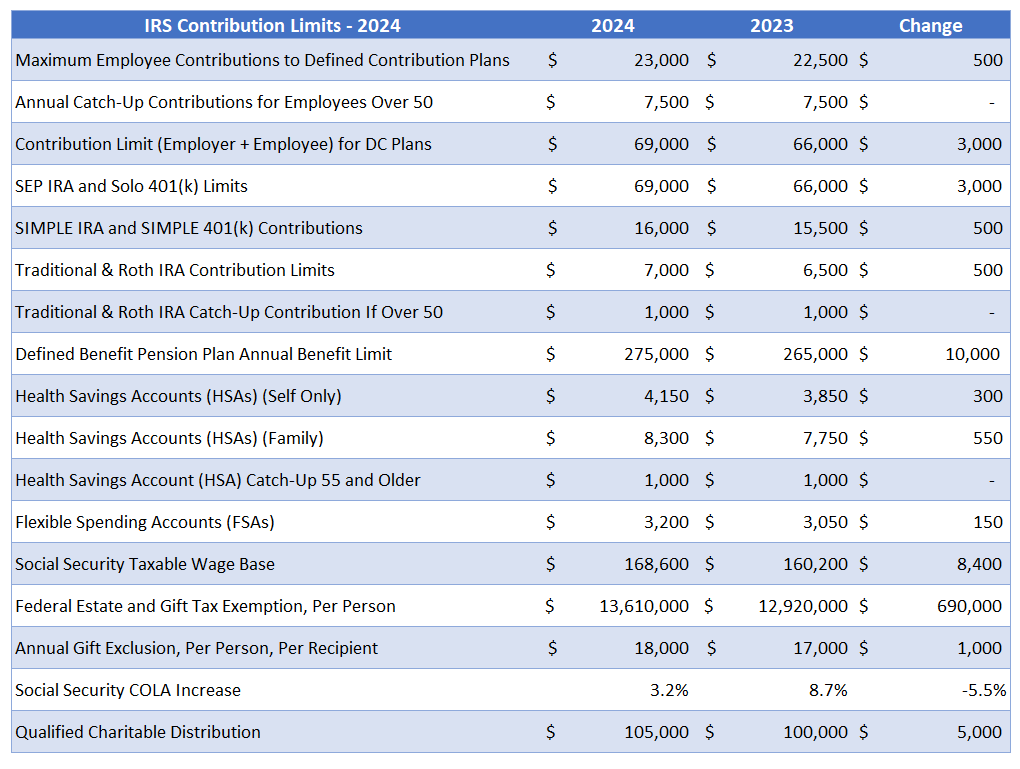

Contribution Limits for 401(k)s, IRAs and More in 2024

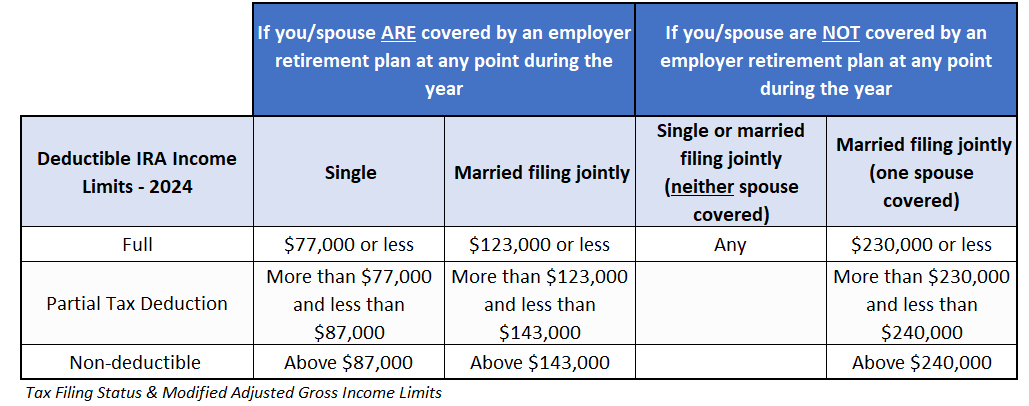

Income Limits for Tax-Deductible IRA Contributions

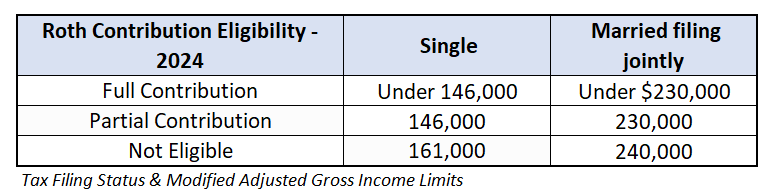

Roth IRA Contribution Eligibility

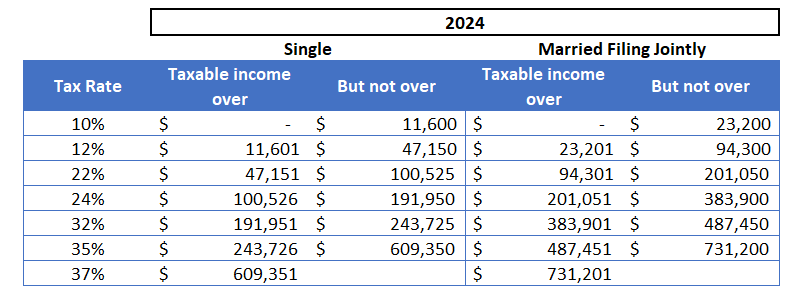

2024 Income Tax Brackets

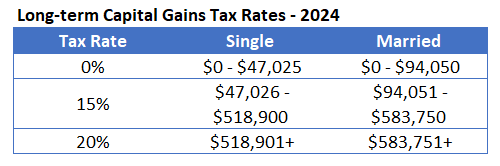

2024 Long-Term Capital Gains Tax Rates

Standard Exemptions

- Married filing jointly: $29,200 (+ $1,550 age 65+ or blind)

- Single: $14,600 (+ $1,950 age 65+ or blind)

AMT Exemptions

- Married filing jointly: $133,300

- Single: $85,700

Exemption amounts phase out beginning with alternative minimum taxable income over $1,218,700 (married/filing jointly) and $609,350 (single filers).

AMT ordinary income rate increases from 26% to 28% for alternative minimum taxable income over $232,600 (single and married/filing jointly).