There’s no better time than the present to get your finances ready for a new year. Unfortunately, for many busy professionals, there just isn’t enough time in the day to tackle seemingly non-urgent matters. As a CERTIFIED FINANCIAL PLANNER™ professional, I’ve seen how unintentional oversights and a lack of planning can cause big issues down the road. This January, it’s time to finally tackle your financial to-do list.

Give your 401(k) an annual check-up

Not compulsively checking your invest accounts is a good thing; ignoring it altogether is not. The start of a new year is a great time to review your account. Here are a few areas to focus on:

- Contributions. The IRS maximum annual addition is $19,500 in 2021, same as 2020. Individuals age 50+ have an additional $6,500 in catch-up contributions. Check your current selection and consider increasing your savings if you’re not currently at the annual limits. Ideally, try and spread your additions throughout the year versus front-loading, as dollar-cost averaging means investors buy fewer shares when valuations are high and more when the market is cheaper. Funding your 401(k) too soon may also mean taking a lower employer match.

- Investment selection. While the options in your 401(k) plan will generally be limited to a defined “menu” of available funds, consider whether you should make any adjustments, such as to your allocation between stocks and bonds or to lower-cost investment options.

- Beneficiary designations. Are the beneficiary designations in your 401(k) still accurate? If you’ve recently gotten married, divorced, started a family, or set up a trust, your elections may no longer be accurate.

Get your estate planning documents in order

Almost every adult needs a basic estate planning package. Without exception, if you are raising a child you need to have an updated will. Even if you have estate planning documents, if you move to another state, you need a new plan because states have different laws.

It’s not just about the kids either: unmarried individuals or couples without children should also work with an estate planning attorney to draft wills, power of attorney, health care proxy, and possibly set up a trust as well. Married individuals sometimes incorrectly assume that if their spouse dies, assets automatically pass onto the surviving spouse. Depending on a number of factors, such as the type of asset, ownership, etc., assets may not pass as planned or could be subject to probate.

Give your old retirement plans some love

Consolidating old retirement plans into one account can be beneficial. It simplifies and streamlines the investment management process and you’ll get a better grasp on where you stand financially. Many investors don’t understand the drawbacks of keeping old retirement plans or what the alternatives are.

Especially for individuals in fields with frequent job transitions, such as biotech and pharma, it doesn’t take long before the number of 401(k) plans becomes out of control. Aside from the practical matters, rolling an old 401(k) over to an IRA can provide cost savings, as you’ll have access to more low-cost investment options.

Combat lifestyle inflation

Many professionals are fortunate enough to receive pay increases each year. But without a conscious effort to increase your savings rate, extra income will likely be spent instead. This is known as lifestyle inflation.

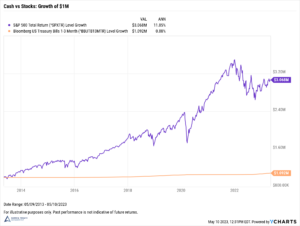

As the most basic level, the more expensive your lifestyle, the more income you’ll require in retirement to maintain it. Especially for high-earners, saving outside of a 401(k) is likely necessary to maintain the same standard of living in retirement. A brokerage account is typically the best type of investment account in this situation, as there are no limits on how much you can contribute.

Fortunately, the best way to combat lifestyle inflation is usually the easiest. Automating your savings to systematically sweep extra cash into an investment account or high-yielding savings account is a great way to set it and forget it. Even though funds in a brokerage account can be liquidated at any time without a penalty (though subject to capital gains taxes), the extra steps required to obtain the cash helps prevent investors from making large impulse purchases.

Also consider holding emergency savings or goal-based funds at a separate institution from your regular cash accounts. It’s tempting to spend what you see, so excluding those funds from daily visibility can help keep you on track.

Seek professional help

The best time to engage a professional advisor is actually before there is a need for one. Waiting until tax issues arise to call a CPA or contacting a financial advisor after you’ve retired limits your options. In many cases, it isn’t possible to rewind time, and depending on the situation, planning opportunities may be scarce.

Whether you truly need a financial advisor or accountant will depend on your situation. Not all investors will require the support of a professional. For individuals who would benefit from working with an advisor, delaying the decision may mean missing opportunities. The benefits of making good decisions can compound over time through investment returns or increased savings. But so too can the impact of making poor financial choices.