Like many things in life, managing your own investments becomes more complex as you get older. For young professionals just starting out, it makes sense to learn the basics of how to manage your investments and do it yourself. Later in your career, there is more wealth to protect and greater income opportunities, leading to planning complexities. Properly managing your investment portfolio and entire financial life can be time-consuming at any age. Before deciding to manage your own investments, learn more about the components of a successful investment management strategy.

6 Components of a Successful Investment Management Strategy

1. Asset management 101: investment concepts and terminology

Before you set an asset allocation in your investment account, you will need to do some research on securities and types of investment accounts. How do mutual funds differ from ETFs? What is a target-date fund and an expense ratio? Understanding more basic investment concepts and terminology is critical at this stage.

How you manage your investments will also depend on what type of account you’re investing with. Broadly, there are two main types of investment accounts: retirement and non-retirement.

Retirement accounts include 401(k) plans, IRAs, and other tax-deferred accounts. Non-retirement accounts, such as a brokerage account, is an individual investment account. There aren’t any tax advantages but it’s the most flexible way to invest.

Once you’re comfortable with the broad strokes of asset management you’ll be better equipped to make informed decisions regarding how your money is managed.

2. Outline your goals and risk tolerance

Everyone has lifestyle goals, but not everyone can articulate (or agree on) them. Write down your goals including funding details in today’s dollars in 3 buckets: short-term (less than 5 years), mid-term (5-10 years), and long-term (10+ years).

The goal is to align your investment mix with your investment risk comfort level.

Consider keeping funds for any short-term goals in cash to avoid the fluctuations in the stock market. Mid and long term goals can be bucketed and invested according to your overall risk tolerance. Most of us are long-term investors. Even when you retire, you’ll still have 20, 30 years or more to keep investing in the stock market.

Special note on risk tolerance: many new investors are tempted to purchase single stocks. Holding only the stock of a handful of companies is quite risky, particularly when the decision to do so is based on the buyer’s preference for a company, product, or service and not necessarily on current market conditions or in-depth research on the firm’s financials.

Individual stocks inherently carry a much higher risk than a diversified broad-based fund or ETF. Unless the account is simply a “play” account where the funds are not ultimately needed, investment risk management should be a critical component to your asset allocation strategy.

3. Asset allocation strategy

To set your asset allocation for your portfolio, you will need to consider your risk tolerance to arrive at an appropriate mix of asset classes to build a diversified portfolio. There are plenty of “rules of thumb” which may suggest a 70/30 split between equity and fixed income for pre-retirees. It may not be right for you, but consider it a starting point.

Using your risk profile, you will need to decide what percentage of your portfolio to allocate towards the main asset classes: equity (stocks), fixed income (bonds), cash, and real estate. Generally, the more conservative you are the higher the allocation to fixed income and cash…up to a point.

Once you have your basic allocations (as an example: 70% equity, 22% bonds, 7% real estate, 1% cash), the next step is to define your allocation within these asset classes. For example, with equity, consider various market capitalizations (small, mid, large), and regions, like international vs domestic equity.

Creating a diversified portfolio of multiple asset classes and sectors is a time-intensive process but essential as it is the building blocks for your financial strategy.

4. Fund selection

Managing your own investments doesn’t end after you set your asset allocation. Now you’ll need to research and select the ETFs, mutual funds, or individual securities to buy. Given the expansive universe of products, this can be quite time-consuming, so be patient.

Morningstar offers research the various components of a security: overall rating, tenure, performance, expenses, composition, objective, and so on. There are many factors to consider so you will need to determine what criteria you would like to prioritize. Morningstar’s data can be a very helpful tool in fund selection, but you should not pick your investments based on their rating alone.

The fund selection process is both art and science. It requires trade-offs and careful attention to various facets of a security or fund. As you are evaluating the different funds available to fit the asset classes and sectors identified in step 3, also consider whether you wish to use active or passively managed funds.

As you are choosing which funds to consider, there are two key points to keep in mind:

- First, when you open an account with a broker-dealer like Vanguard, Fidelity, Schwab, etc., you may be encouraged to use their proprietary products. Why? That’s a major source of revenue for them. Incentives like free trades or a reduced fee may be offered on their securities. This doesn’t mean you should automatically stay away from their fund family, just another factor to consider when you aren’t working with a fee-only financial advisor.

- The second key point for do-it-yourself investors to remember is that you won’t have access to all investments. Some securities or fund families may require an institutional relationship from an approved advisor. You might also end up paying more for funds as a retail investor.

Kristin McKenna, CFP®, Managing Director at Darrow Wealth Management, for TheStreet:

When Is It ‘Worth It’ to Work With a Financial Advisor?

5. Investing, rebalancing, and taxes

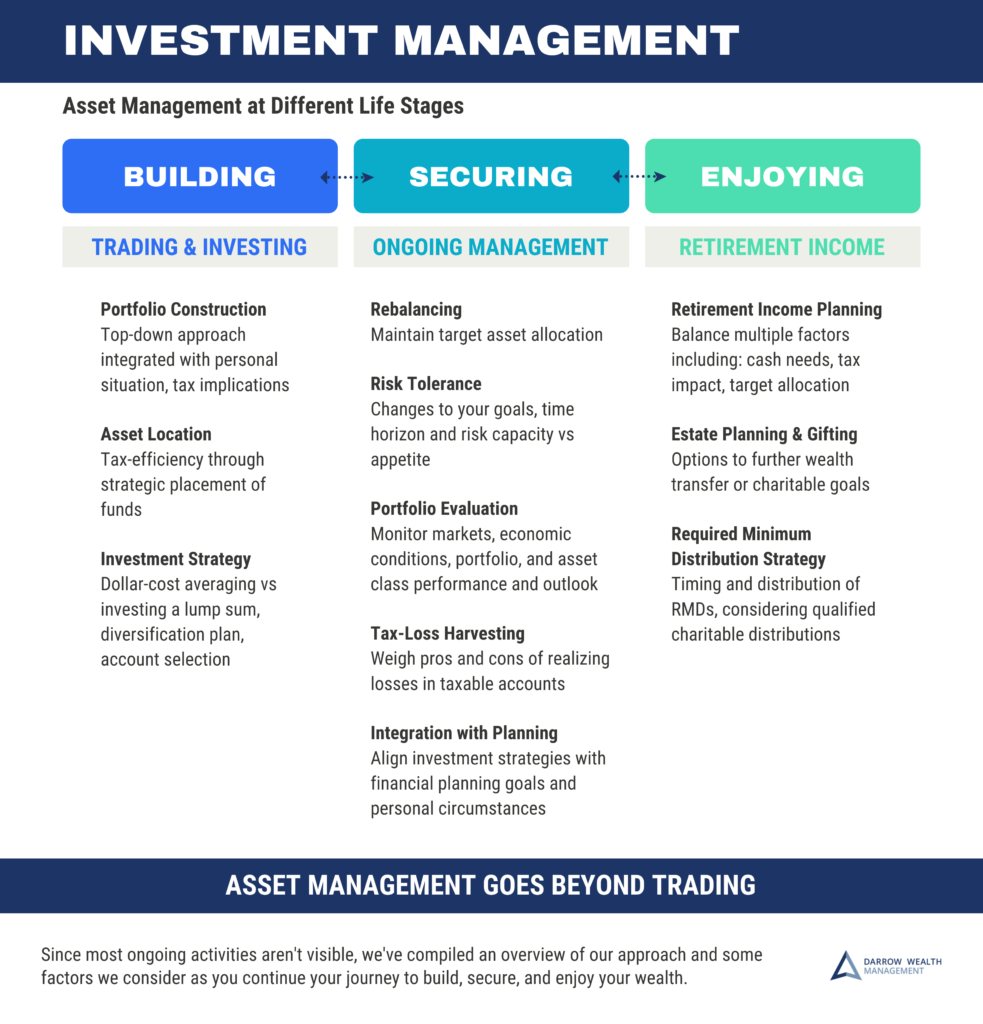

Ongoing investment management is often forgotten with busy professionals. Set it and forget it sounds nice, but in practice, your life savings needs more attention.

If you are investing cash in the market, you can place your trades. However, if you are shifting the investment strategy on an existing portfolio, there may be tax consequences if the assets are held in a taxable brokerage account. You may want to shift the asset allocation over two tax years if the account has big gains.

Other factors to consider when implementing an investment strategy: asset location and portfolio-level vs account-based asset allocation.

On an ongoing basis, you will need to periodically rebalance your account or portfolio. Rebalancing is necessary because over time, as your assets gain or lose value in the market, your intended portfolio composition will shift over time and you may be invested much differently than you intended. Since stocks tend to fluctuate more rapidly than bonds, a 70/30 portfolio could become 90/10 if left unbalanced over time, which exposes you to much more risk and far less diversification.

At a high level, rebalancing is the process of selling a portion of securities in an asset class or sector that has experienced greater gains, and reinvest the proceeds in the other asset classes of your portfolio that may not have performed that well. It may seem counter intuitive, but rebalancing your portfolio is how to maintain your intended asset allocation over time. Rebalancing may have tax consequences in a brokerage account, although you may have losses to offset a portion of your gains.

6. Putting it all together in one financial strategy

Learning how to manage your investments is only one piece of the puzzle. Sticking with the strategy over the long run, especially during market downturns, is hard.

One of the reasons to work with a wealth advisor is to get help developing a financial plan to tie together your whole financial life. These issues may include college planning, strategies for stock options and RSUs, tax efficient retirement income strategies, insurance coverage, estate planning and trusts, real estate, charitable giving, and so on.

Although it’s possible for individuals to manage these things on their own, there’s a high cost if something is overlooked. Many of our clients are so busy at work and home that they simply don’t have the time or desire to devote to managing this aspect of their life.

If you’re having doubts about managing your own investments, learn more about our wealth management program and how we may be able to help. Darrow Wealth Management is a Fee-Only Wealth Management firm with offices in the Boston, MA area and working with individuals and families across the country.