When to Use Pre-Tax vs Roth 401(k) Contributions

Should you make after-tax Roth or pre-tax contributions to your 401(k)? Roth accounts can be powerful wealth-building tools. But paying tax early doesn’t always make

Should you make after-tax Roth or pre-tax contributions to your 401(k)? Roth accounts can be powerful wealth-building tools. But paying tax early doesn’t always make

While there likely isn’t a magic bullet to wipe out your tax bill, there are ways to layer tax-efficiency into your plan. If you’re concerned

The 4% rule is one of the most well-known rules of thumb in personal finance. The premise is simple: retirees can withdraw 4% of their

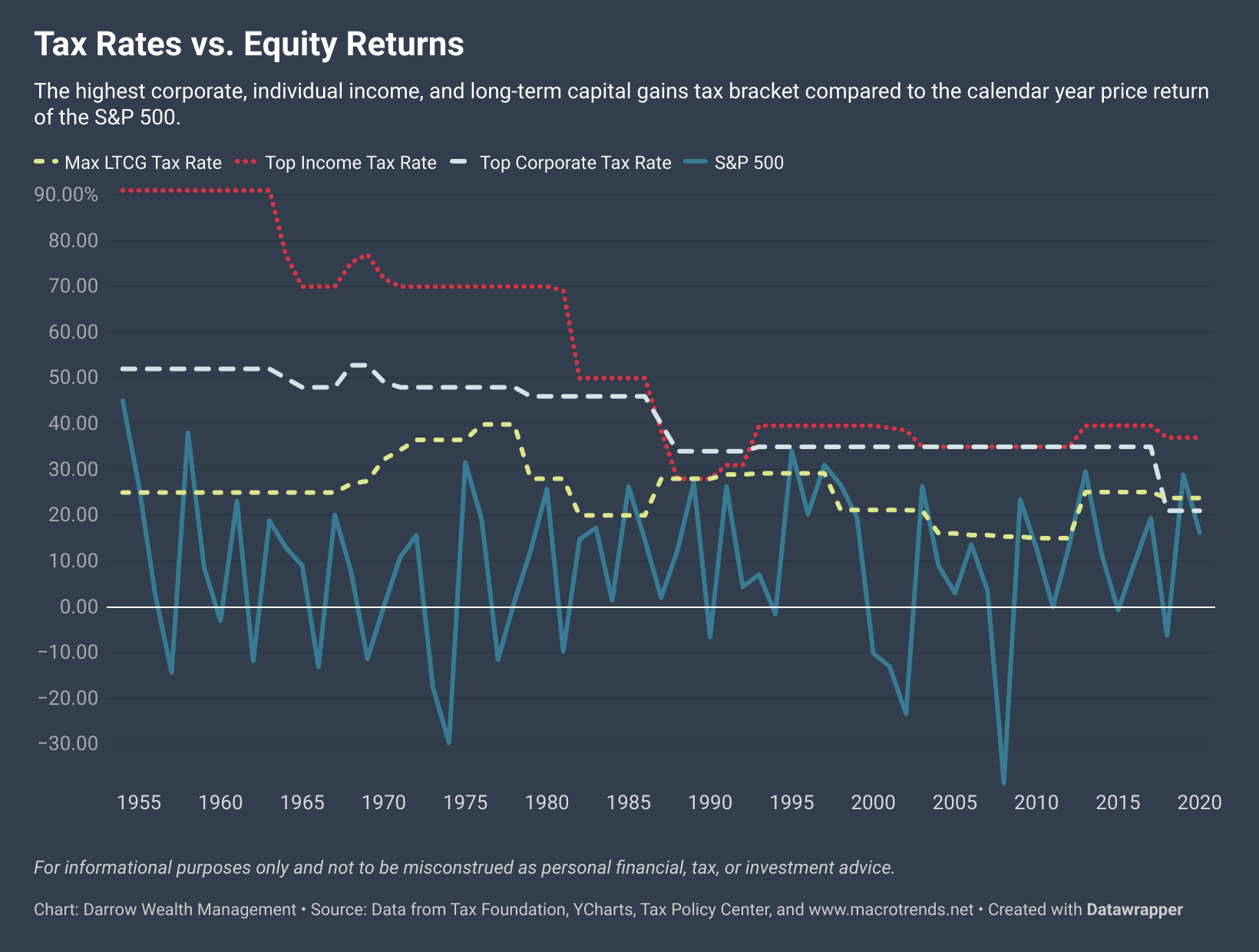

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law

There’s no better time than the present to get your finances ready for a new year. Unfortunately, for many busy professionals, there just isn’t enough

How should married couples save for retirement with only one income? Saving for two when one spouse is the primary breadwinner or a stay-at-home parent

Which is better, a Roth or traditional 401(k)? The central difference between a Roth 401(k) and traditional 401(k) is the tax treatment of your contributions.

With 30-year fixed mortgage rates currently averaging below 3%, it might make sense for homeowners to consider refinancing. Depending on several factors, such as your

How much can refinancing your mortgage save you? Mortgage rates are currently very low – the average 30-year mortgage is now below 3%. It might

Should You Take a Pension or a Lump Sum? Deciding between a lump sum or receiving pension benefits monthly requires careful planning and consideration. Though