Should I Invest When the Market is High? Dispelling the Buy Low, Sell High Myth

Most investors realize trying to time the market by always buying low and selling high isn’t a realistic endeavor. Yet even with that knowledge, if

Risk management is a key component of any investment strategy. It helps investors protect their assets by aiming to reduce market risk though diversification, allocation between stocks and bonds, and other financial planning measures. By managing risks effectively, investors can help protect their portfolio against diversifiable risks and increase the likelihood of achieving long-term goals.

The risk of loss is inherent in investing: market volatility, changes in economic conditions, and geopolitical events are always there. It’s not possible to protect against all types of investment risk, but proper risk management seeks to mitigate risks than can be managed, such as company-specific risk.

Diversification of investments across different asset classes, sectors, and geographies, portfolio rebalancing, and an ongoing discussion about investment risk profile are some ways we seek to minimize investment risk.

Most investors realize trying to time the market by always buying low and selling high isn’t a realistic endeavor. Yet even with that knowledge, if

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

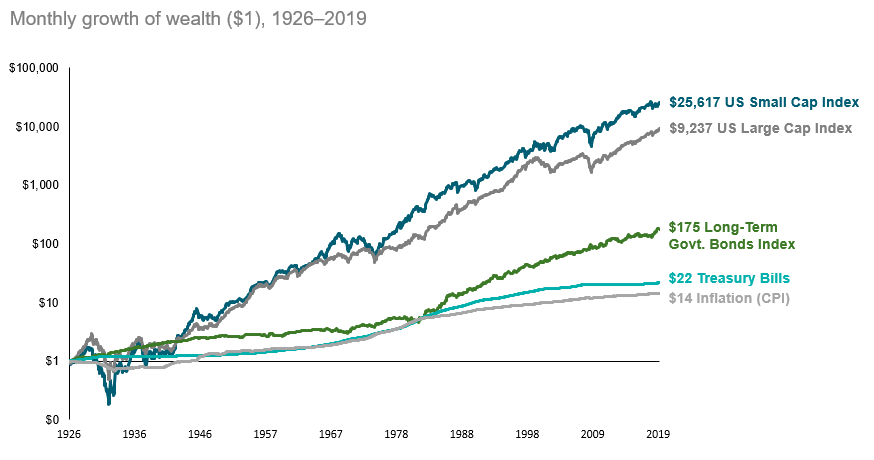

Stocks and bonds differ in many aspects, including the risk and return investors can expect. Because of these differences, stocks and bonds accomplish different things

Can you own too much of your employer’s stock? Undoubtedly, yes. Does holding a lot of company stock create the potential for a large windfall?

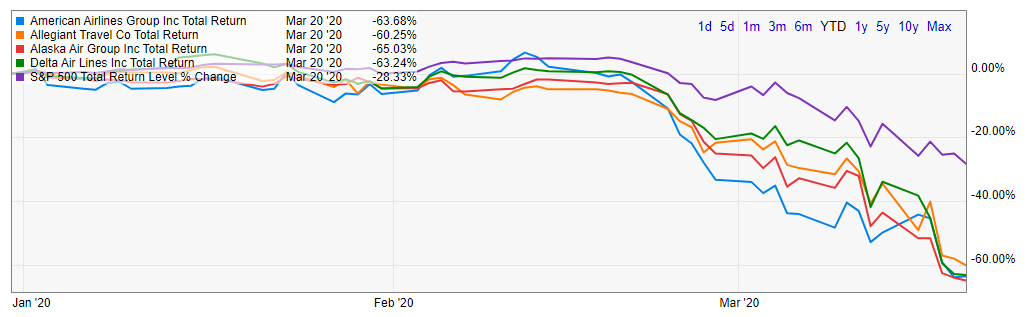

Could you have planned for this? Investors of all ages are thinking it: could I have done anything to protect my investments from the swift

What happens if…? That’s the million-dollar question. Stress testing a financial plan and retirement projections can help investors feel more confident in the likelihood they

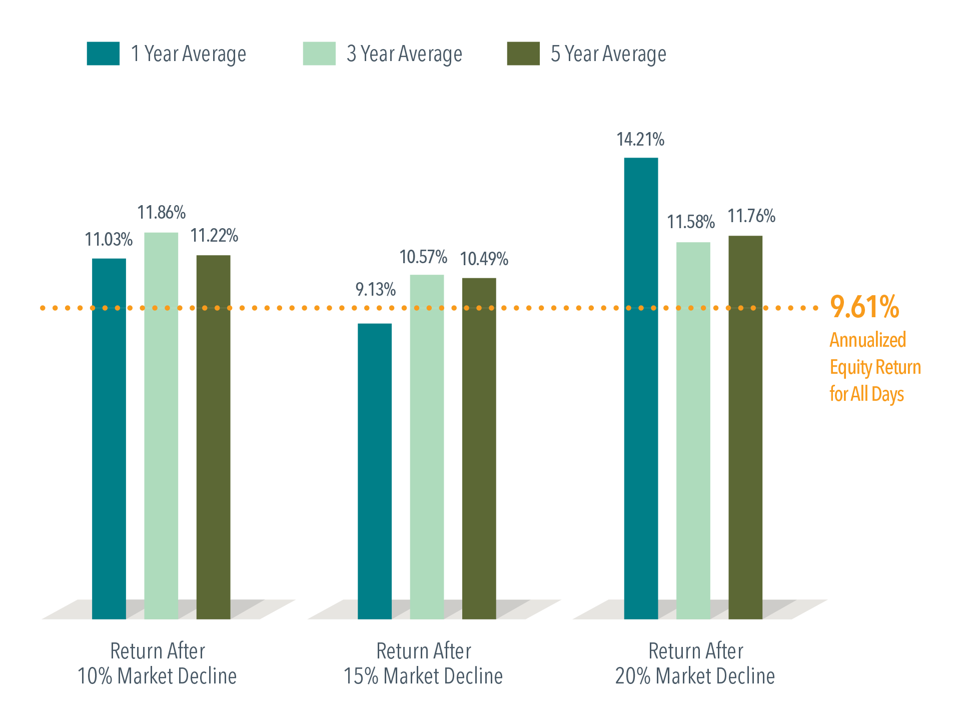

One of the most pressing questions for investors right now is where does the stock market go from here? A recovery following the global downturn

Whether the market is setting new highs or in the midst of a downturn, investors need to think a few steps ahead to ensure they’re

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

There’s a lot we know about the current state of the stock market, but we can only make an educated guess as to where the