The U.S. is in a Bear Market. There Could be a Recession. But This Isn’t 2008.

Are We Headed For Another Financial Crisis? It happened on March 11th: after 11 years, the S&P 500 once again entered a bear market. Defined

Risk management is a key component of any investment strategy. It helps investors protect their assets by aiming to reduce market risk though diversification, allocation between stocks and bonds, and other financial planning measures. By managing risks effectively, investors can help protect their portfolio against diversifiable risks and increase the likelihood of achieving long-term goals.

The risk of loss is inherent in investing: market volatility, changes in economic conditions, and geopolitical events are always there. It’s not possible to protect against all types of investment risk, but proper risk management seeks to mitigate risks than can be managed, such as company-specific risk.

Diversification of investments across different asset classes, sectors, and geographies, portfolio rebalancing, and an ongoing discussion about investment risk profile are some ways we seek to minimize investment risk.

Are We Headed For Another Financial Crisis? It happened on March 11th: after 11 years, the S&P 500 once again entered a bear market. Defined

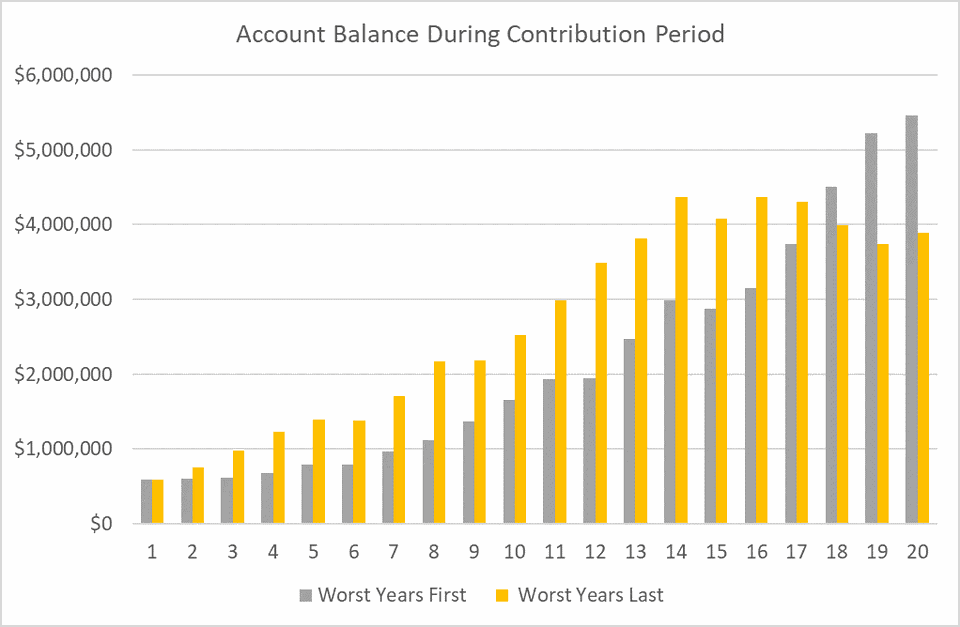

When the stock market is in turmoil, many investors are tempted to go to cash and wait for the dust to settle before getting back

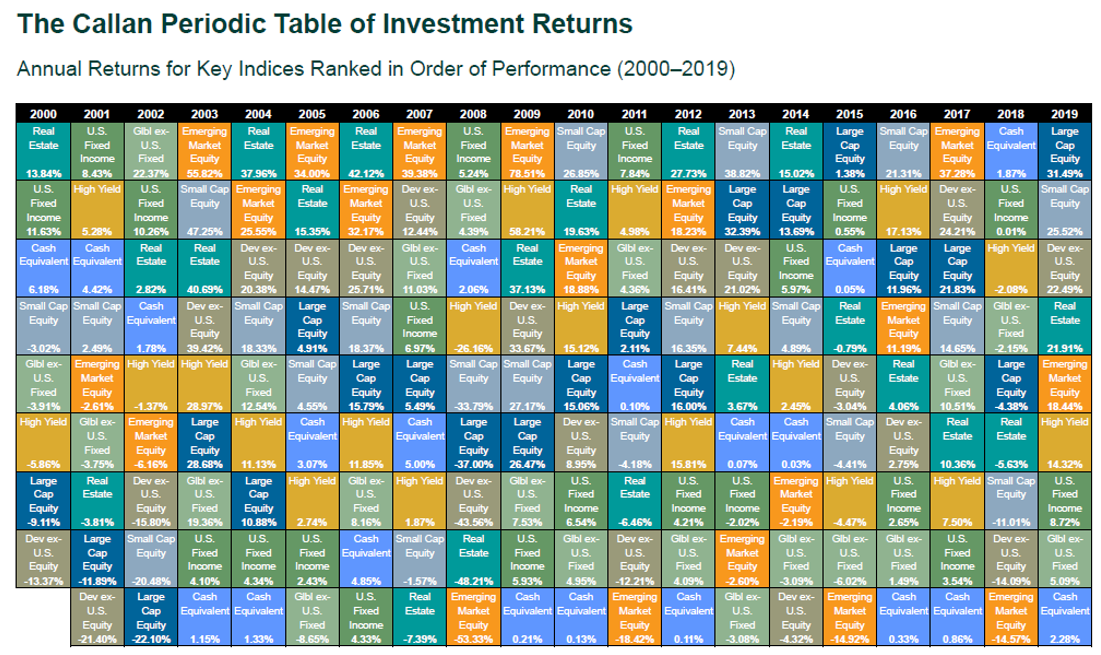

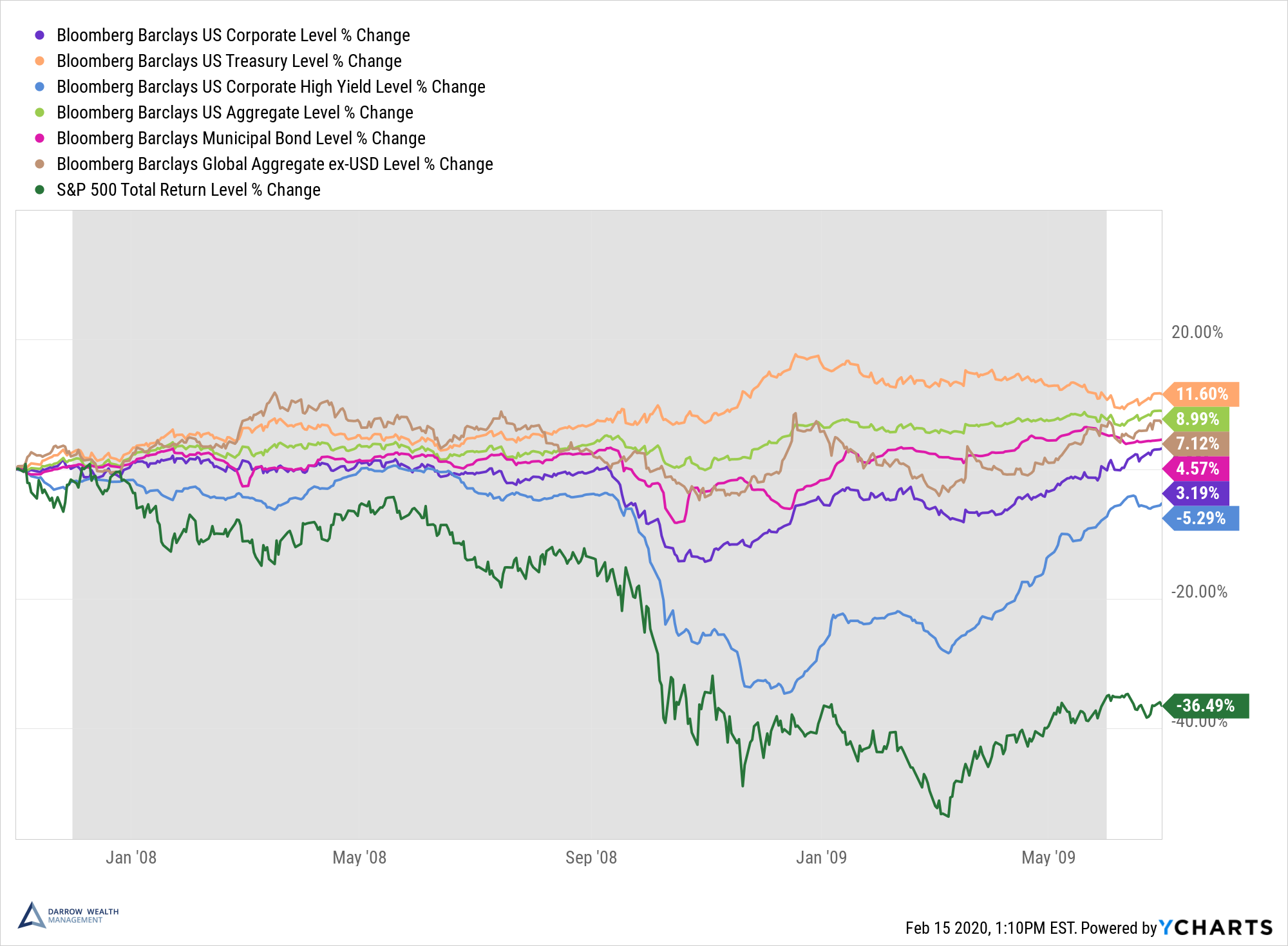

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful

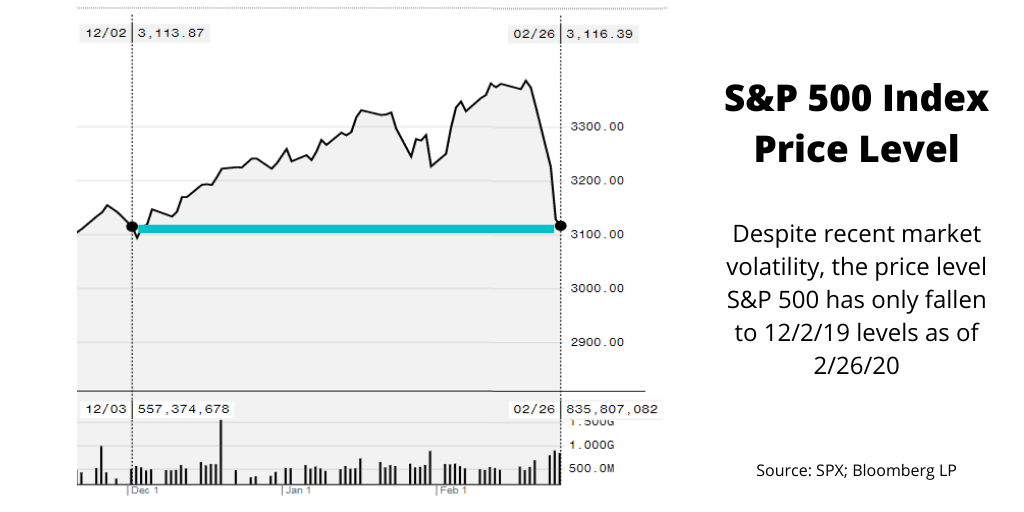

Putting recent volatility into perspective The COVID-19 virus has roiled the global financial markets in recent days, dominating the headlines. Although the virus does present

Updated as of December 31, 2020. The S&P 500 is often used as a measure of the entire US stock market, and for good reason,

Setting your asset allocation is like drafting architectural plans when building a home; it provides a map to guide the construction of your investment portfolio.

There’s plenty for investors to worry about when their financial livelihood is on the line. When planning for major financial decisions such as retirement, individuals

If you’ve ever heard excerpts from the latest Apple earnings report, you may have thought, ‘so what?’ Well, for many investors, Apple’s relative performance could

Why is it important to diversify your investments? The answer is simple: to manage risk. Diversifying your investments is about more than holding different stocks