Can you own too much of your employer’s stock? Undoubtedly, yes. Does holding a lot of company stock create the potential for a large windfall? Also, yes. For employees, it can be difficult to know how much company stock is too much. But identifying a concentrated position is often just the tipping point. When should you sell and diversify? What are the tax implications? What’s the best way to invest the proceeds? Though some of these questions will take time to analyze, if you’re over-invested in your company’s stock, now is a good time to consider diversifying.

How much company stock is too much?

Generally, if the stock of one company makes up more than 10% of your investments, it may be too much. The COVID-19 pandemic is the latest example illustrating how a concentrated stock position can swiftly decimate on-paper wealth. Diversifying your holdings typically means reducing your investment risk and locking in gains.

A simple math exercise shows how holding too much company stock can impact your financial situation.

Assume you have $1M in invested across two buckets: 90% is invested in a diversified asset allocation and 10% is in your employer’s stock. If your diversified portfolio returns 10%, and the company stock loses -30%, your portfolio’s entire return is 6%.

Now assume the same $1M is allocated with 30% in company stock and 70% in a diversified mix. Using the same return numbers, your portfolio return drops to -2%.

If -30% seems excessive, consider how these companies have fared in 2020 vs 2019:

| 1 Year Total Returns (2019 vs 2020) | ||||||||

| Year | S&P 500 | American Airlines Group Inc | Marriott International Inc | Exxon Mobil Corp | Simon Property Group | United Airlines Holdings | Wells Fargo & Co | Norwegian Cruise Line Holdings Ltd |

| 2020 | 18% | -45% | -13% | -36% | -39% | -51% | -42% | -56% |

| 2019 | 31% | -10% | 42% | 7% | -7% | 5% | 21% | 38% |

Big losses are difficult to recover from. A -30% loss takes nearly a 43% gain just to get back to your original account value.

Over-investing in one stock has always been risky

There are numerous risks of owning too much stock in one company, even outside of the current pandemic. Risks generally fit into one of the following categories:

Legislative: legal action against a company, fines, or legislative restrictions that can impact core operations. Uber and Lyft have been in a prolonged battle over the status of their driver as independent contractors. The ridesharing companies could end up closing operations in California over it.

Regulatory: regulatory shifts may place new restrictions on an industry or impact their ability to operate. The pharmaceutical industry remains vulnerable to new regulations restricting their ability to price drugs.

Company risk: unforeseen risks specific to a company tied to their products/services, competitors, financials, etc. When Lumber Liquidators flooring was said to cause elevated risk of cancer, causing stock prices to plummet.

Industry: industry risk is a type of risk that will affect all participants in an industry through a shared exposure to external factors. The hospitality industry and airline industry have been particularly hard-hit by the pandemic. The decline of traditional print media and newspapers in favor of digital and free content is another example.

These risks are prevalent when you invest in any one company, but your exposure is heightened when you also work there as your salary and benefits are already tied to the well-being of the organization.

When is the best time to sell and diversify large stock holdings?

If, like most investors, your investments suffered from the March selloff you might be hesitant to make any changes, even if your account recovered. Recency bias is when we give more weighting to events that just happened. When the market is up, making changes or investing new cash doesn’t seem as risky as doing so after a correction or worse.

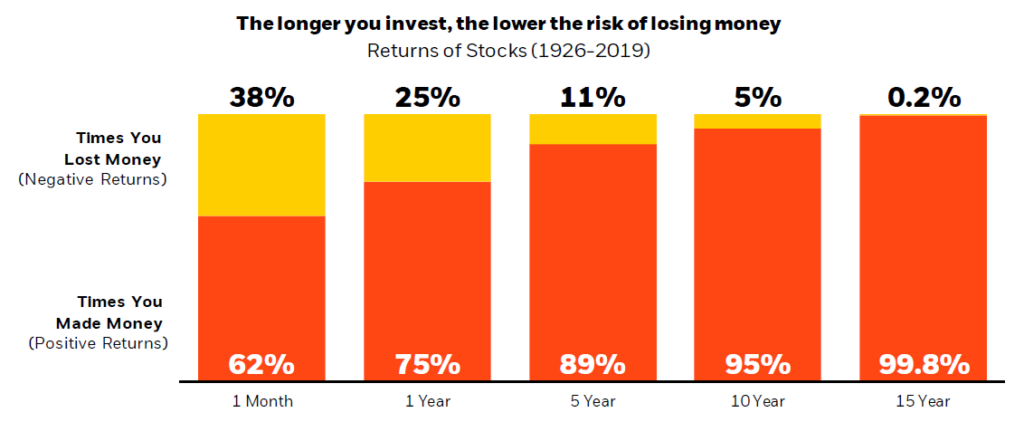

Historically, taken together, stocks tend to go up more often than they go down.

Even after hitting new highs or suffering losses after a correction or worse, historically, average annualized returns for the S&P 500 have been between 10% to 14% in the one, three, and five-year periods to follow. But keep in mind, the S&P 500 has 504 more stocks in it than a single-stock portfolio, which is likely to be much more volatile.

When you have a large amount of money to invest, you don’t have to put it in the market all at once. Dollar-cost averaging over a few months can help reduce the risk of investing during volatile markets.

There’s a lot to consider when deciding to diversify company stock. But if you decide that spreading out your investment risk is a good idea, try not to get too caught up on getting back to a previous high-water mark. It might happen quickly—or not at all—but while you’re waiting, you’ve got more on the line than you’re comfortable risking.

What to do if you have too much company stock

Figuring out what to do about a concentrated stock position can seem daunting. After all, every aspect is intertwined: tax treatment, trade-offs with holding periods, evaluating the best options for the proceeds, and developing a diversified asset allocation for all of your investments. It’s really important to get the strategy right, especially if company stock is a big part of your investable assets. If you’re not already working with a financial advisor, it might be a good time to consider it.

In working with clients in this situation, we typically start by taking an inventory of their entire financial situation, goals, and how they’re tracking towards them now. These decisions cannot be made in a vacuum, so it’s important to review their whole investment allocation, contribution and savings strategy, details of the stock holdings, stock options or awards, future stock grants, cash flows, etc. It usually makes sense to develop a comprehensive financial plan to bring it all together.

A financial plan can help

A comprehensive model is the only way to account for how changes to one aspect of your finances can trickle down to other areas of your situation. For example, a financial plan could help illustrate the trade-offs between paying short-term capital gains tax but locking in profits and waiting for more favorable tax rates but continuing to shoulder the risk. The highly detailed analysis can account for varied cost basis of the stock and different holding periods.

Since many investors are saving for multiple goals, a plan can also help analyze the best ways to use the proceeds, including how much to save towards each goal, when, and in what type of account (allocating towards retirement versus taxable accounts). It may be tempting to pay down your mortgage, but it’s likely not the best way to maximize your windfall.

Running what-if scenarios can also help you explore what’s possible financially by strategically diversifying company stock. Perhaps you want to consider retiring early or retirement income at different ages.

A Monte Carlo simulation helps ensure the strategy aligns with your long-term goals and is likely to withstand various market conditions. Simple static return calculators don’t account for the variations in market performance. The S&P 500 average return is about 9% between 1980-2019, but the index only returned 9% once during this period.

Stress-testing a financial plan helps avoid underestimating risk by incorporating the volatility of returns and looking at the probability of outcomes over the long-term.

What would you do if it were any other stock?

Employees and executives can’t always control when and how they can diversify their stock holdings. Insiders have restrictions about when they can sell and some companies match 401(k) contributions in company stock. But most investors can control many aspects of their exposure. Developing a plan to diversify your holdings doesn’t mean selling all your shares, either.

It’s important to remain neutral when deciding whether to start selling your shares. Working with a financial advisor can help you remain objective about the company. Always ask yourself, if it were any other company, would you do anything different?

This article was written by Darrow advisor Kristin McKenna, CFP® and originally appeared on Forbes.