5 Ways to Manage a Concentrated Stock Position

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

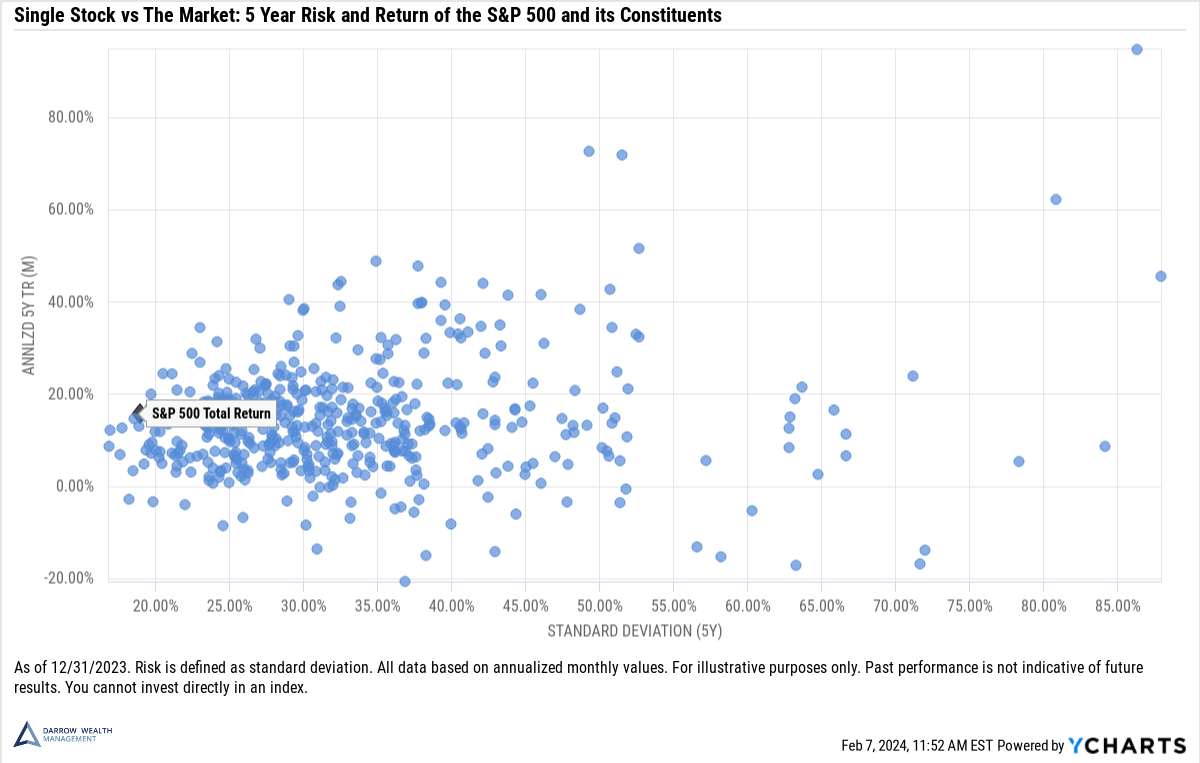

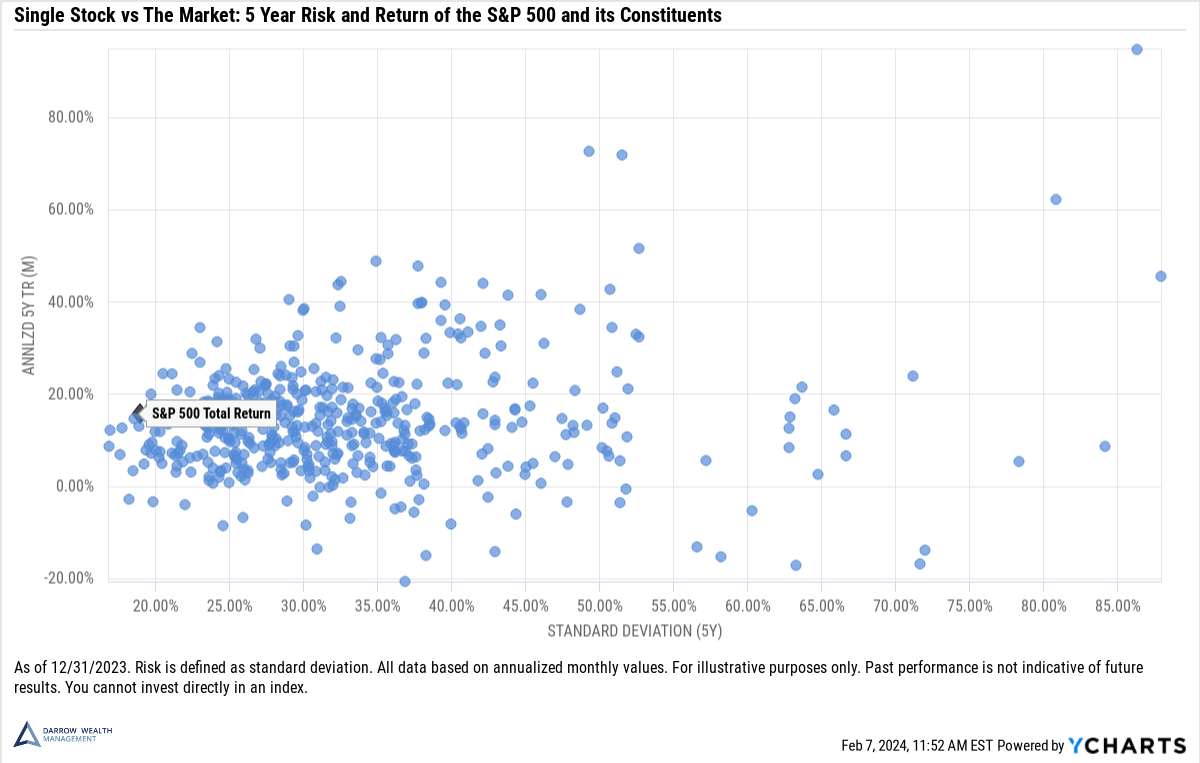

Risk management is a key component of any investment strategy. It helps investors protect their assets by aiming to reduce market risk though diversification, allocation between stocks and bonds, and other financial planning measures. By managing risks effectively, investors can help protect their portfolio against diversifiable risks and increase the likelihood of achieving long-term goals.

The risk of loss is inherent in investing: market volatility, changes in economic conditions, and geopolitical events are always there. It’s not possible to protect against all types of investment risk, but proper risk management seeks to mitigate risks than can be managed, such as company-specific risk.

Diversification of investments across different asset classes, sectors, and geographies, portfolio rebalancing, and an ongoing discussion about investment risk profile are some ways we seek to minimize investment risk.

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

More homeowners have been renovating their homes instead of buying due to housing prices. While continuing to build equity in your home can be advantageous

Declines in the financial markets are an uncomfortable part of investing. Taking steps to plan ahead of a market decline is best, though what you

Stocks are down this year, pretty much across the board. Unfortunately, there are some companies that won’t survive the downturn. Even for the ones that

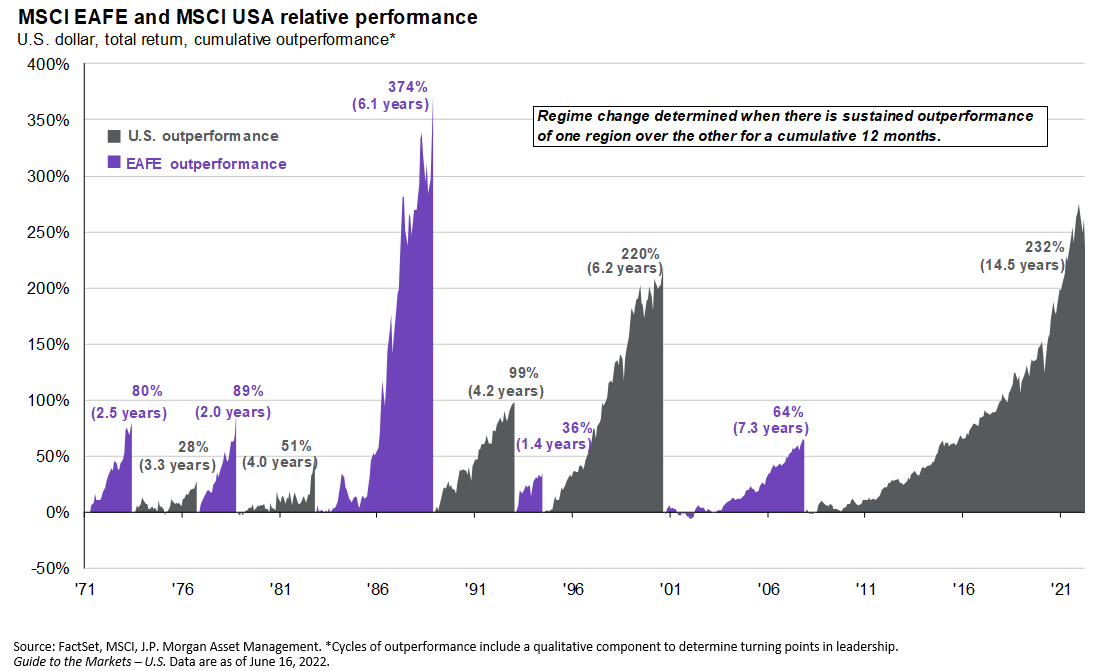

The United States currently represents 60% of the global equity market.¹ This means investors with an extreme home bias are ignoring 40% of the equity

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” – Peter

Investing through market volatility can be challenging. Should you go to cash? What investments perform the best during a market selloff? Is it a good

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

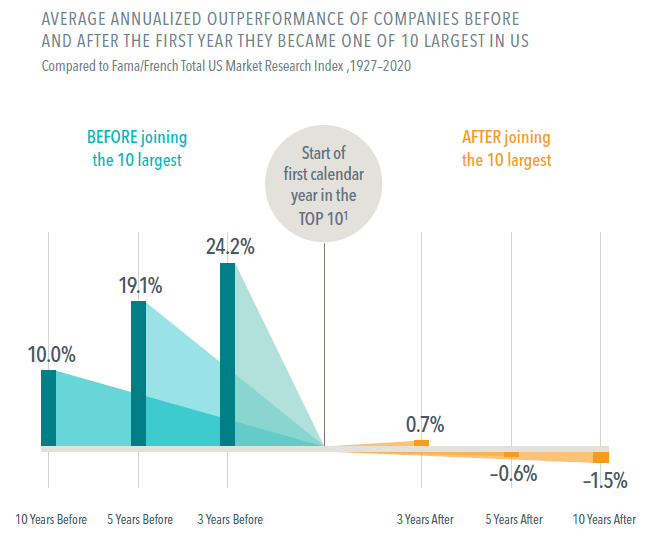

With the dominance of the largest U.S. stocks often occupying headlines, it’s worth remembering that the biggest companies don’t always produce the best returns. In

Tesla, GameStop, Hertz, Dogecoin: retail traders continue to dominate headlines in the financial news media. Some individuals may be wondering, how is trading different from