Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law before 2022. For investors, there’s a concern that tax hikes will hurt stocks, a reasonable conclusion. But historically, tax rates have mostly moved independently from stocks. Put another way, there’s little evidence to suggest that changes in the corporate, personal income, or capital gains tax rates will materially help or hurt stocks.

Impact of tax rates on stocks

In 1958, the top tax bracket for individual taxpayers was a stunning 91%. The highest long-term capital gains tax rate was 25%. The maximum corporate tax bracket was 52%. The S&P 500 returned over 38% (price).

The highest tax rates were the exact same the year before, but in 1957, the S&P 500 posted a loss of -14%. That’s a year-over-year swing of 52%. Clearly something other than tax rates was making the market move. This isn’t an anomaly, either.

In 2012, the top tax bracket for individual taxpayers and corporations was 35%, while the highest long-term capital gains tax rate was 15%. In 2013, the corporate rate stayed the same, but the highest individual tax rate increased to 39.6% and the long-term capital gains tax rate increased over 10% to 25.1%.

The S&P 500 notched a 13.5% price return in 2012, but returns more than doubled the next year even though tax rates went up. In 2013, the S&P posted gains of nearly 27%.

As illustrated in the chart above, there’s little evidence to support the notion that tax hikes hurt stocks. Similarly, tax reductions haven’t regularly supported stocks, either. Turns out, there’s little correlation between the performance of the S&P 500 and tax rates.

Relationship between tax rates and the stock market

The proposals out there would increase the individual, capital gains, and corporate tax rates. That’s only happened twice since 1954. Both times, the S&P 500 price returns were roughly 7% and positive the year before the tax hike. Whether Congress turns tax plans into tax law and in what form, remains to be seen, as does the market reaction.

Corporate taxes

At first glance, it seems logical to assume that raising the personal, corporate, or capital gains tax rates would hurt equities. After all, the owners of stocks are primarily wealthier individuals who may be disproportionally affected by tax rate increases. So how might raising taxes on corporations to pay for social programs or tax cuts for middle class affect the stock market?

First, less affluent individuals tend to spend more of their income. According to a 2019 Consumer Expenditure Survey, the top 10% of households (defined as families with income above $135,000) spent 64% of their after-tax income while the bottom 90% spent 99% of their take home pay.

Setting aside the inflationary implications, additional consumer spending helps businesses. This includes small private businesses and publicly traded companies – and their shareholders. While higher corporate tax rates can hurt the bottom line, there’s an argument that it’s partially offset by additional revenue from spending.

Further, some businesses will seek to offset the negative implications by slowing the wage growth of their employees, effectively passing it along to individual taxpayers.

Individuals

For individuals facing higher income or capital gains taxes, there are ways to reduce tax, though strategies may be incremental improvements. While some may be inclined to explore estate planning strategies to get an asset out of their taxable estate or speed up plans to sell a business or other asset, historically, tax hikes haven’t really hurt stocks.

In another words, if tax rates go up, are you going to dump your brokerage account or ask for a pay cut? Unlikely.

Selling assets to realize the gain before tax rates increase makes sense in some situations. But unless you stay in cash, any subsequent reinvestment will also be subject to capital gains taxes. Unless, of course, you don’t have a gain at all, which is hardly the goal.

State of the economy and broad-based market conditions

A primary reason there isn’t a strong correlation between tax rates and equities is because the market is focusing on the overall investing climate. There are a lot of factors that drive returns in the financial markets. What are interest rates? Inflation? Government spending? Opportunities in the U.S. for growth relative to conditions overseas? Unemployment rate? Lending standards? Geopolitical tensions? Where are bond yields?

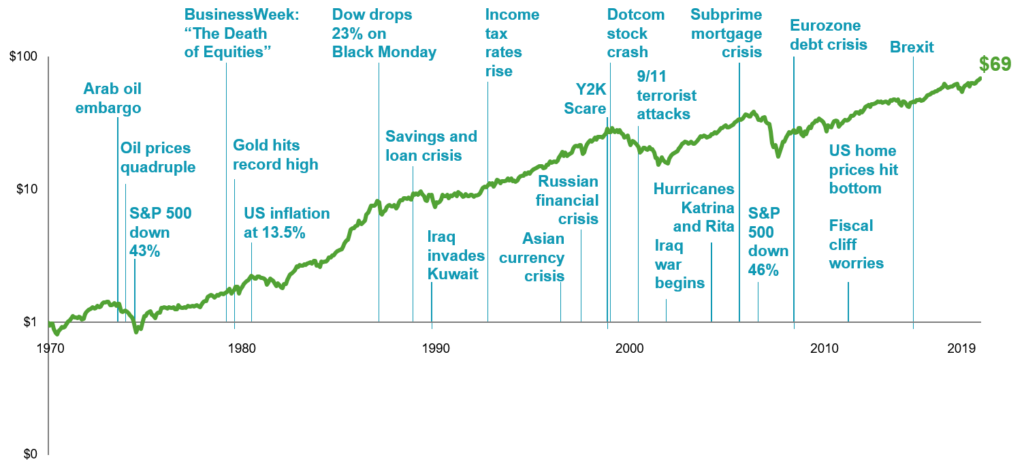

History has shown that there are many different events that can influence how markets move.

MSCI World Index – Growth of $1

Source: Dimensional Fund Advisors. Past performance not indicative of future results. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

When weighing the impact of tax increases, the market also considers the possible longevity of higher tax rates. Even if one party has control of Congress, simply waiting two or four years can change that.

Don’t let the tax man make your financial decisions

No one likes paying more in taxes. While the possibility of a tax hike may be concerning, it’s important to focus on what you can control. Tax planning strategies shift over time as policy changes. But it’s never wise to let tax law be the main driver of personal financial decisions. Tax implications are a key consideration but making decisions purely for tax reasons is often short sighted.

Past performance not indicative of future results. All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Article is for general information only and not to be misconstrued as personal tax, financial, or investment advice.