How should married couples save for retirement with only one income? Saving for two when one spouse is the primary breadwinner or a stay-at-home parent can be challenging depending on your income. Fortunately, with proper planning, an eye on expenses, and enough time, couples can still save for retirement when one spouse stays home.

Retirement planning for couples with a stay-at-home spouse

There are several ways to save money when one partner stays home. Often, the best approach incorporates multiple strategies simultaneously. The details of your income and financial situation are essential to determine what makes sense for your family. As with everything in investing and financial planning, there’s no one-size-fits-all approach. Here are several ways couples can save for retirement on one income.

Maximize contributions to the working spouse’s retirement accounts

For couples with a primary breadwinner, it’s usually key for the working spouse to max out contributions to their 401(k). If the company offers matching or profit-sharing contributions, that’s even better. In 2020 and 2021, workers can save $19,500 in a 401(k) or 403(b) plus an additional $6,500 if age 50 or older.

The working spouse can also consider making contributions to their IRA on top of 401(k) savings. IRA contributions may be tax-deductible depending on your income. Assuming you have a 401(k) or retirement plan at work, IRA contributions can be fully deductible if your modified adjusted gross income is $198,000 or less in 2021. Partial deductions are permitted until MAGI above $208,000.

You can contribute up to $6,000 in a traditional IRA, plus $1,000 if age 50 or older. If you earn too much to get a tax deduction, you can make a non-deductible IRA contribution instead.

Spousal IRA

There’s no such thing as a joint retirement account. But couples filing taxes jointly can open an IRA for the non-working spouse, a spousal IRA. As long as the working spouse has taxable earned income greater than total IRA contributions, the non-working spouse can contribute to an IRA in their own name. The annual additions limit is the same as described above for the working spouse.

Similar to the working spouse’s IRA calculation, savings in a spousal IRA may be tax-deductible depending on your income. Assuming one spouse has a retirement plan at work, spousal IRA contributions can be fully deductible if your modified adjusted gross income is $198,000 or less. High earners can make a non-deductible spousal IRA contribution.

Taxable brokerage account

A brokerage account is a non-retirement investment account. Essentially, a brokerage account is the opposite of a retirement account in nearly every way. Major differences include no income limits, funding restrictions, or tax benefits. Taxable accounts provide the most flexible option for investing extra money.

Unlike retirement accounts, there are no rules about when you can take money from a brokerage account or requirements forcing you to do so. Another difference from retirement accounts is ownership. A brokerage account can be owned individually, jointly by both spouses, or in an individual or joint revocable living trust.

Retirement plans for solopreneurs or spouses with a side hustle

If either spouse is running a business as a solopreneur, it’s an opportunity to save for retirement with a solo 401(k) or SEP IRA. Any business owner can start a SEP IRA, but only self-employed business owners with no employees (other than a spouse) can use a Solo 401(k).

Depending on your income from the business, it’s possible to save up to $58,000 per year, per person, in either plan in 2021. Solo 401(k)s offer an additional $6,500 catch-up contribution for individuals 50 and older. Employing a (formerly) non-working spouse in the business can really pay off due to the retirement contribution limits.

How much do you need to save for retirement?

Forecasting expenses in retirement is difficult, and some investors over-estimate how much they’ll need to support them and their spouse when they stop working. Ultimately, how much you’ll need to save depends on your lifestyle expenses and retirement age. All else equal, you’ll need to save more to retire at 60 vs 65.

But for couples living on one income, the challenge is usually having enough extra money to save for retirement. It’s important to pay yourself first by funding savings goals before other non-essential expenses.

The best way to figure out how much you need to save for retirement, and how much you can spend during it, is by developing a financial plan. Planning is key in any financial situation. Retirement planning as a couple on one income is no different.

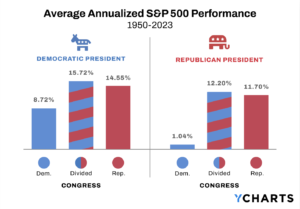

High-level guidance and rules of thumb are good starting points, but they don’t apply to everyone (or else they’d just be rules). For example, having a primary breadwinner may change your optimal Social Security strategy.

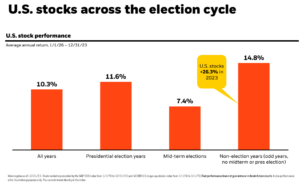

Further, basic online calculators don’t account for the variability in investment returns or the timing of down years. The only factor is a static average annual return. As a result, simple compounded return calculators only assume your investments grow. Stress testing retirement projections with the help of a financial advisor can help reduce the risk of running out of money in retirement.

This article was written by Darrow advisor Kristin McKenna, CFP® and originally appeared on Forbes.