Are Financial Advisors Worth the Cost?

How much does it cost to work with a financial planner? And is it worth it? For some, not seeking advice from a CERTIFIED FINANCIAL PLANNER™ professional only because of the cost may be short-sighted. When considering whether financial advisors are worth the cost, consider the net cost of working with an advisor: the benefits and cost savings less advisory fees.

Not every investor needs a financial advisor, but many busy professionals don’t have the time to manage their financial life properly.

Managing your own finances isn’t free. DIY asset management and financial planning can potentially cost you in 2 key ways:

- Higher costs to access and trade mutual funds and ETFs

- The cost of missed opportunities or making the wrong decision with your money

Retail investors managing their own accounts or working with a broker might pay a lot more in fees compared to someone with access to institutional shares. Perhaps most importantly, consider the cost of making the wrong financial decision. Or missing the potential upside that an advisor could create for their clients through planning and investing strategies.

If you haven’t done something before, how do you know you’ll get the best outcome? There’s a lot on the line with major decisions and investing your life savings.

Should you do it yourself or hire a financial planner?

Do-it-yourself investors may not realize there’s a cost to investing. The expenses of underlying investment directly reduces your return, trading costs apply to buys and sells, and mutual funds may have different share classes with varying fee structures.

401(k) and 403(b) retirement plan participants will generally pay administration fees to the plan. Their investment choices are limited to the fund lineup available to them.

How fund expenses reduce your return:

Using FINRA’s fund analyzer, we selected a random mutual fund that had both Class A (up-front sales charge called a front-load) and Class I (institutional shares with no loads) and compared how the same $40,000 investment would look after 5 years assuming a 5% annual return.

Class A shares: The Class A shares we analyzed had a 4% up-front sales load and an expense ratio of 1.15%. After 5 years, the account was worth $46,271, a $6,271 gain on the initial investment. Over 5 years, the investor pays $4,027 in fees and expenses (the ending account balance reflects these costs).

Class I shares: The Class I shares we analyzed had no sales loads (neither front nor back-end) and an expense ratio of .83%. After 5 years, the account was worth $48,976, a $8,976 gain on the initial investment. Over 5 years, it costs $1,840 in fees and expenses (the ending account balance reflects these costs).

All else equal, the institutional shares cost the investor $2,705 less than the retail shares.

5 Common and Costly Mistakes Investors Make

The cheapest option today can become the most expensive in the long run

Also keep in mind that this overly-simple example only considers one fund in an investor’s portfolio and assumes the same fund was purchased in both scenarios. Even for institutional shares, the expense ratio in this example is high.

Independent financial advisors can access the entire universe of investment options. Since they’re not affiliated with a financial institution or wirehouse, they don’t have allegiances to fund families. If an independent wealth advisor determines a different investment is a better fit for your account, it could further reduce the cost of the institutional shares, especially when the same analysis is applied to the investor’s whole portfolio holdings.

Quantifying the value of financial advice can be hard

But that doesn’t mean it’s not there

Investors often only consider advisory fees when deciding whether it’s worth it to work with a professional or not. But have you considered the actual monetary gains (or reducing losses) that could result from professional advice?

For example, in a down market or a year with low taxable income, a Roth conversion could potentially save a significant amount in taxes down the line. Further, selectively harvesting losses can also be a way to reduce a tax bill; possibly generating big savings that won’t appear on an account statement.

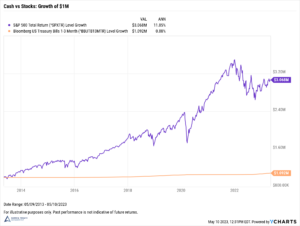

Other examples include maximizing tax benefits of charitable giving, boosting cash returns with Treasuries, or helping you avoid a costly trip to probate count by ensuring accounts are properly titled and funded. And these examples are just a few basic considerations.

In other situations, having access to an advisor with specific subject-matter expertise can be essential. In working with a new client coming from another advisor, we flagged shares as likely qualifying for a little-known section of the tax code before the post-IPO lockup was over. At one point, this was on track to save the clients seven-figures in taxes (though unfortunately the market soured before the client could fully exit the position). Obviously this is a rare and extreme example of the value an advisor could potentially add.

None of these examples would appear on an account statement or performance report. The value of working with a financial advisor will differ for every investor’s unique situation, but the takeaway is to consider this aspect of the relationship as part of your overall cost-benefit calculus.

How much does a financial advisor cost?

The cost to you depends what type of advisor you’re working with. But if you’re not paying your advisor, who is? An investor working with an “advisor” who is really a broker may not always realize when their “advisor” receives financial incentives to make certain recommendations.

Fee-based advisors can receive commissions for placing the trade, recommending one investment over another, or selling annuities or life insurance. The investor may also pay a fee as a percentage of the assets held at the financial institution.

You’d Hire a Pro for a Renovation, So Why DIY with Your Life Savings?

Cheaper doesn’t mean better when discussing your life savings

In contrast, fee-only financial advisors do not receive commissions or sell investment products. They’re only paid by their clients, typically as a percentage of the assets they manage for the client. Many fee-only advisors are also registered investment advisors. This is the only type of financial advisor with a fiduciary duty to always act in their clients best interest, the highest standard of care under the law.

Darrow Wealth Management is an independent, fee-only registered investment advisor and fiduciary.

Kristin McKenna for TheStreet: When is it Worth it to Work with a Financial Advisor

Are financial advisors worth the cost?

Consider the total spectrum of costs and potential savings:

- What’s at risk if I make a mistake managing my own investments?

- Do I have the time and expertise to manage my finances properly?

- Could an advisor help me grow my wealth by improving my current financial strategy?

- Could a financial advisor reduce the costs associated with my investments to help offset their fees?

- Do I have a strong handle on my entire financial life? Retirement planning, college, estate planning, spending and cash flows, asset allocation, and so forth?

- How often will I look at my accounts? When will I consider making a change in asset allocation, tax-loss harvesting, converting to a Roth, funding a trust, or modifying other aspects of my current plan?

Think big picture when evaluating the benefits of a money manager

Building wealth takes time and commitment. It doesn’t necessarily make sense for every investor to work with a financial advisor. But many busy professionals just don’t have the time required to manage their financial life properly.

Are financial planners worth the cost? Understand the costs you’re currently paying and compare that to what fees and savings could be achieved with a financial advisor. Given the downside risk of going it alone and benefits of comprehensive wealth management, the value justifies the expense for many executives.

Media appearances by Kristin McKenna CFP®, President, Darrow Wealth Management

Publications above reflect media organizations that have quoted and/or published articles authored by Kristin McKenna and should not be misconstrued as a current or past endorsement of Kristin McKenna, Darrow Wealth Management, or any of its advisors. Please refer to the media page for more information and links to published works.