Owning real estate can certainly pay off, but to say it’s unequivocally a better investment than putting money in the financial markets is short-sighted. Over the years I’ve spoken with numerous investors who ended up renting their home when they moved instead of selling, buying an income property just because that’s what their parents did, or bought a rental unit because they weren’t sure what else to do with their money and the income property narrative made sense.

Real estate is a very emotional for many investors, which can create issues when investors aren’t able to objectively analyze the merits of a purchasing decision. Due to the specific risks associated with real estate investing, it doesn’t make sense for every investor. Even when it is appropriate, it’s important to consider diversifying outside of real property.

It’s impossible to adequately compare the returns of privately held individual real estate investments to the broad-based stock market. Even when some data is available, geography, taxation, cash flow, purchase price, expenses, and other factors all weigh heavily. From a purely price-appreciation standpoint, the Zillow Home Value Index is a helpful resource.

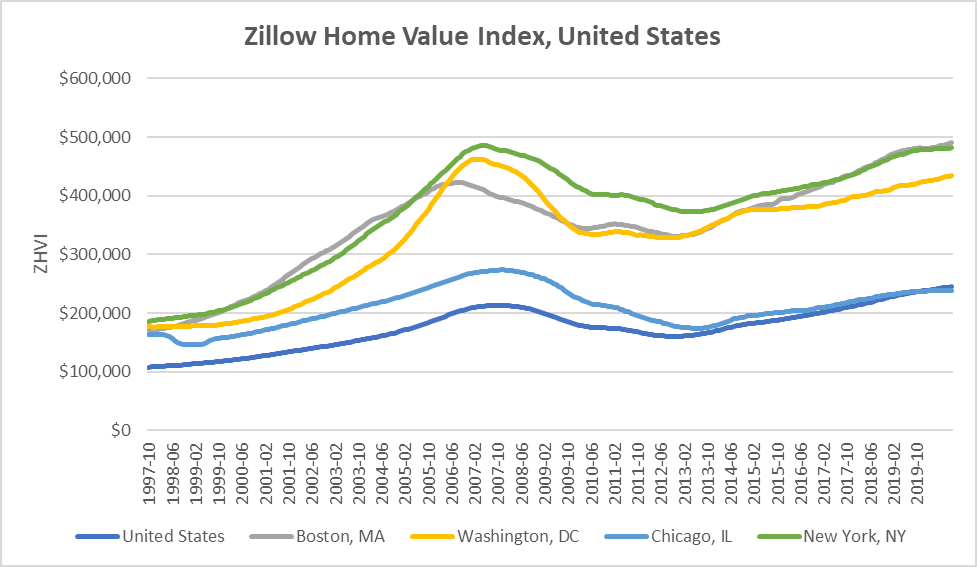

The chart below shows the Zillow Home Value Index (ZHVI) from 1997 to 2019 for all home types, which includes single family residences and condos.

Source: Zillow

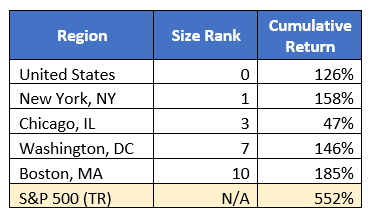

Using four of the top ten geographic markets by size, it’s clear there’s a lot of variability from the U.S. as a whole and the regions themselves. Over the 23-year period, Chicago’s cumulative return was by far the worst, at 47% while prices in the Boston market appreciated the most at 185%.

Comparatively, the S&P 500 achieved a total return of 552% during this same period, which includes dividend reinvestment.

Of course there are limitations on the comparison between Zillow’s data on home price appreciation and the actual returns investors can achieve with an investment property. Most notably, it doesn’t account for the potential of ongoing cash flow from an income property or how a mortgage can provide leverage to boost investment returns. On the flip side, the data also doesn’t account for any cash investment in the property, expenses, selling costs, and so on.

Investing in real estate without owning real property

Individuals don’t always realize they can gain exposure to the benefits of owning real estate without the biggest risks of being a landlord. Real estate investment trusts (REITs) offer just that. Like other publicly traded ETFs and mutual funds, REITs come in many Ôflavors’ depending on your investment goal. You can purchase a rental property REIT that invests in specific geographic areas or a broad-based fund that invests in commercial property around the U.S. or around the world.

Using the S&P United States REIT Index as a comparison, over the last 10 years (ending 2/20/20) the index returned over 12.50% on an annualized basis while the S&P 500 was up over 14% (annualized) during the same time (for comparative purposes, S&P Dow Jones Indices bases data for both indices at 100). Though real estate is generally a more volatile asset class due to the sensitivity to interest rates, the returns are at least suitable for comparison.

The stock market has several advantages over real estate from an investment standpoint: little capital required to participate, losses are limited to your original investment, readily available data to compare investments and assess risk, liquidity of financial markets provides an easy out when you need to cash out and the value of your asset is constantly updated so you always know where you stand (at least for today).

Owning a rental property can provide ongoing income and help protect against inflation, but it’s also cash-intensive and highly illiquid. Aside from the upfront capital needed to buy the property, you’ll need to keep enough cash to pay for any emergency repairs that arise, special assessments in a condo building, or cover the mortgage and maintenance if you have a vacancy. Over time you’ll need to make improvements to the property to command higher rental income or prepare for a sale, which generally costs 5% – 6% of the sale price in commissions. The opportunity cost of sidelining all that cash is quantifiable and should be estimated in cash flow projections when analyzing a possible investment.

Much like the stock market, there are many factors outside of your control when you’re a landlord. Perhaps the area’s largest employer moves their headquarters, or an influx of new luxury rental units flood the market, driving rental prices down.

A different kind of time-weighted return

As a landlord, you must be responsive to tenants as problems arise—even when it’s inconvenient. Paying a property manager can alleviate much of your workload, but unless you have a large profit margin or sizable real estate portfolio, the cost of doing so could leave you in the red. Your physical location to the property may require you to pay on-site managers.

Investing in publicly traded mutual funds and ETFs, on the other hand, can be done from anywhere. Unlike real estate, where hiring a property manager is really just a cost center, a financial advisor may be able to save you time and improve your bottom line through planning opportunities and a risk-adjusted investment strategy.

Aside from property upkeep, owning a rental property also requires you to find and vet tenants, navigate state housing laws in the event of property damage or tenant issues, and resolve problems that may arise with neighbors or homeowners’ associations.

Time is money, especially for busy professionals. As you’re running the numbers and quantifying the opportunity cost, make sure the expected cash flows are enough to justify your time-weighted return.

As with any investment, diversification is one of the best ways to manage your risk. Real estate can be a great part of an investment portfolio for the right investor who knows what they’re signing up for when becoming a landlord. Before getting wooed by the idea of becoming a land baron, talk to someone who owns a rental property and run the numbers. For busy professionals, it can be difficult to find a property with enough upside and ongoing cash flow to justify the time and hassle of being a landlord.

This article was written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes.

Related:

2 Big Myths About Being a Landlord

Converting Your Home Into a Rental Property

What’s the ROI on Your Home?