Are You Holding Too Much Cash?

You may want to think twice before taking the old saying cash is king too literally. Even though interest rates have risen in the last few

Investing trends, topics, and money management strategies from professional money managers. The Darrow Wealth blog covers a wide range of topics, such as rebalancing your portfolio, setting your asset allocation, when to consider buying Treasuries, ways to diversify a concentrated stock position, and reasons to diversify globally.

You may want to think twice before taking the old saying cash is king too literally. Even though interest rates have risen in the last few

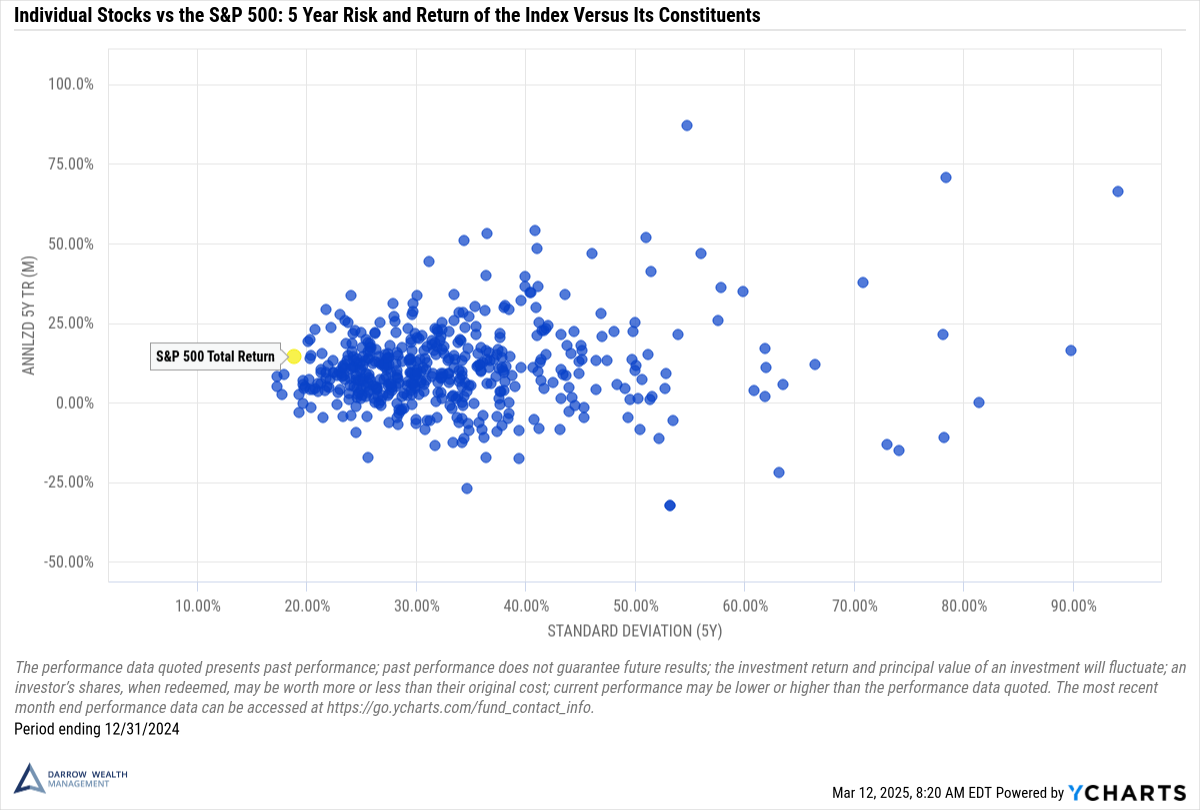

What is a concentrated stock position? If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified

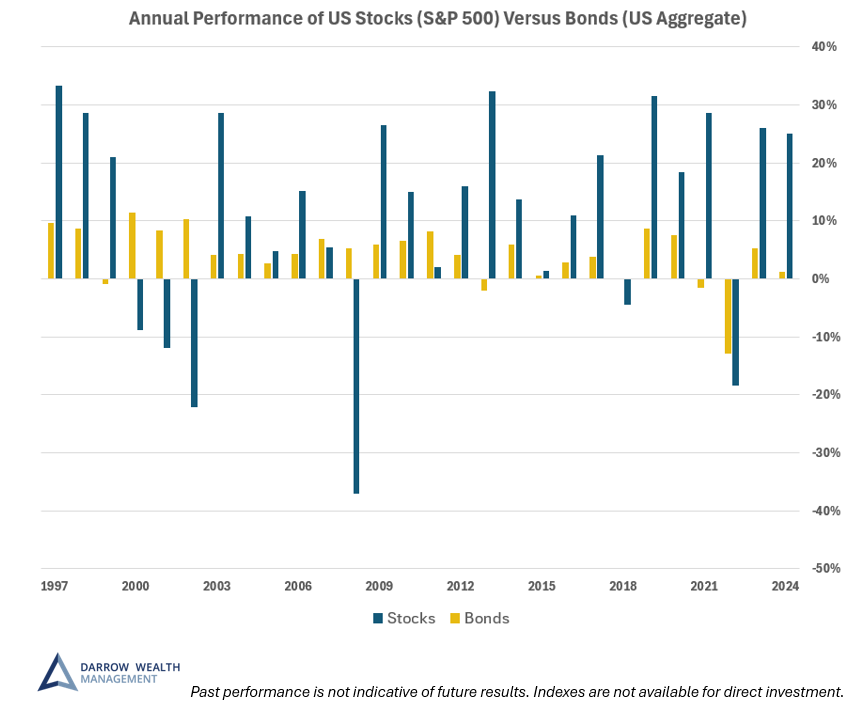

Stocks and bonds differ in many aspects, including the risk and return investors can expect. Because of these differences, stocks and bonds accomplish different things

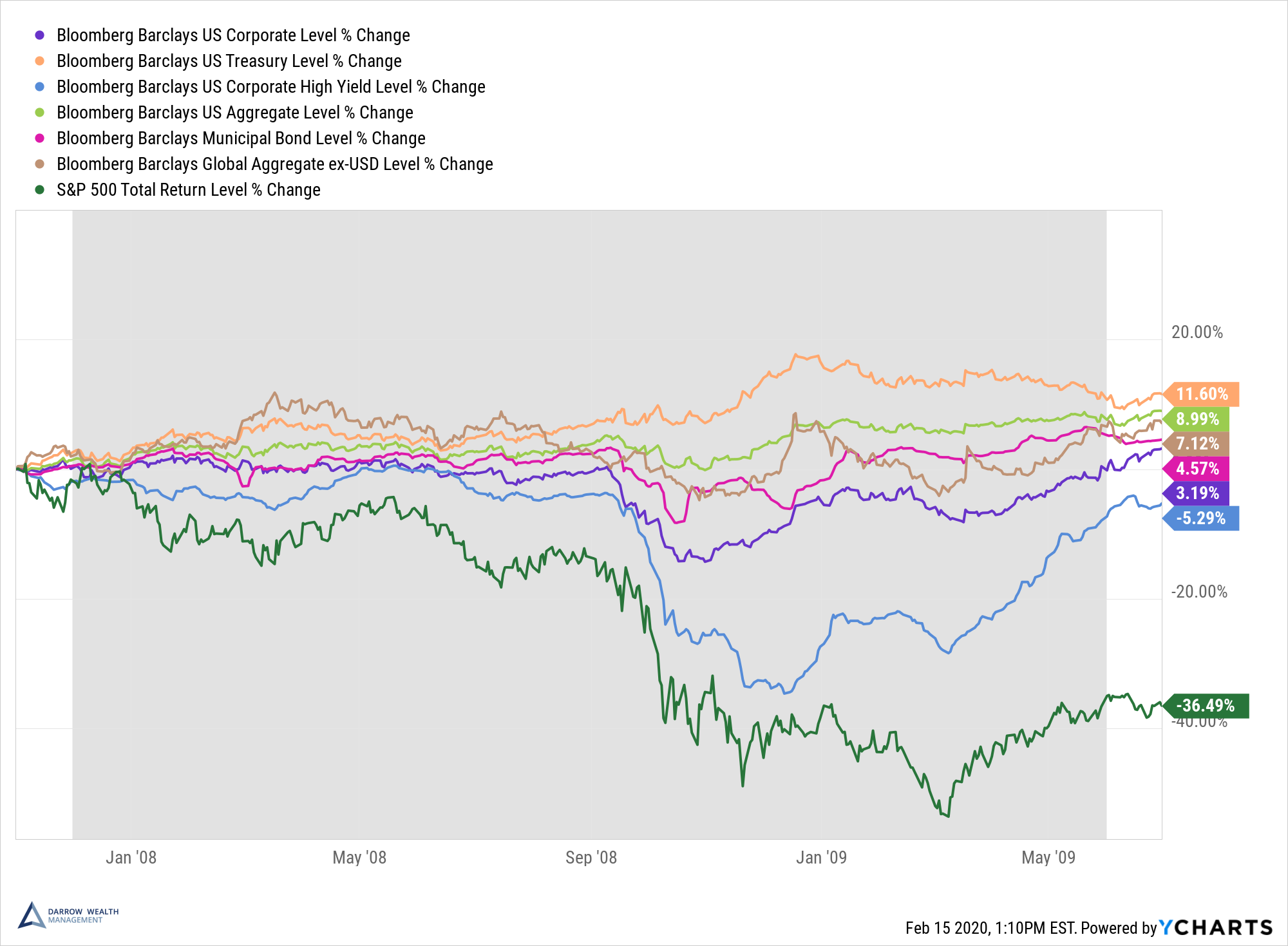

Although past performance is not indicative of future results, history can be a helpful lens to view bond performance during past recessions and bouts of

Don’t stress out about every headline, stress test your retirement plan instead. Markets move every day and the news cycle is 24-7. Unfortunately, headlines often leave

The idea of living off dividends in retirement sounds nice, but investors often don’t realize how much money they’ll need invested to generate enough income

Rebalancing your 401(k) and investment portfolio is an important part of a successful investment strategy. Your asset allocation is the percentage of your portfolio that

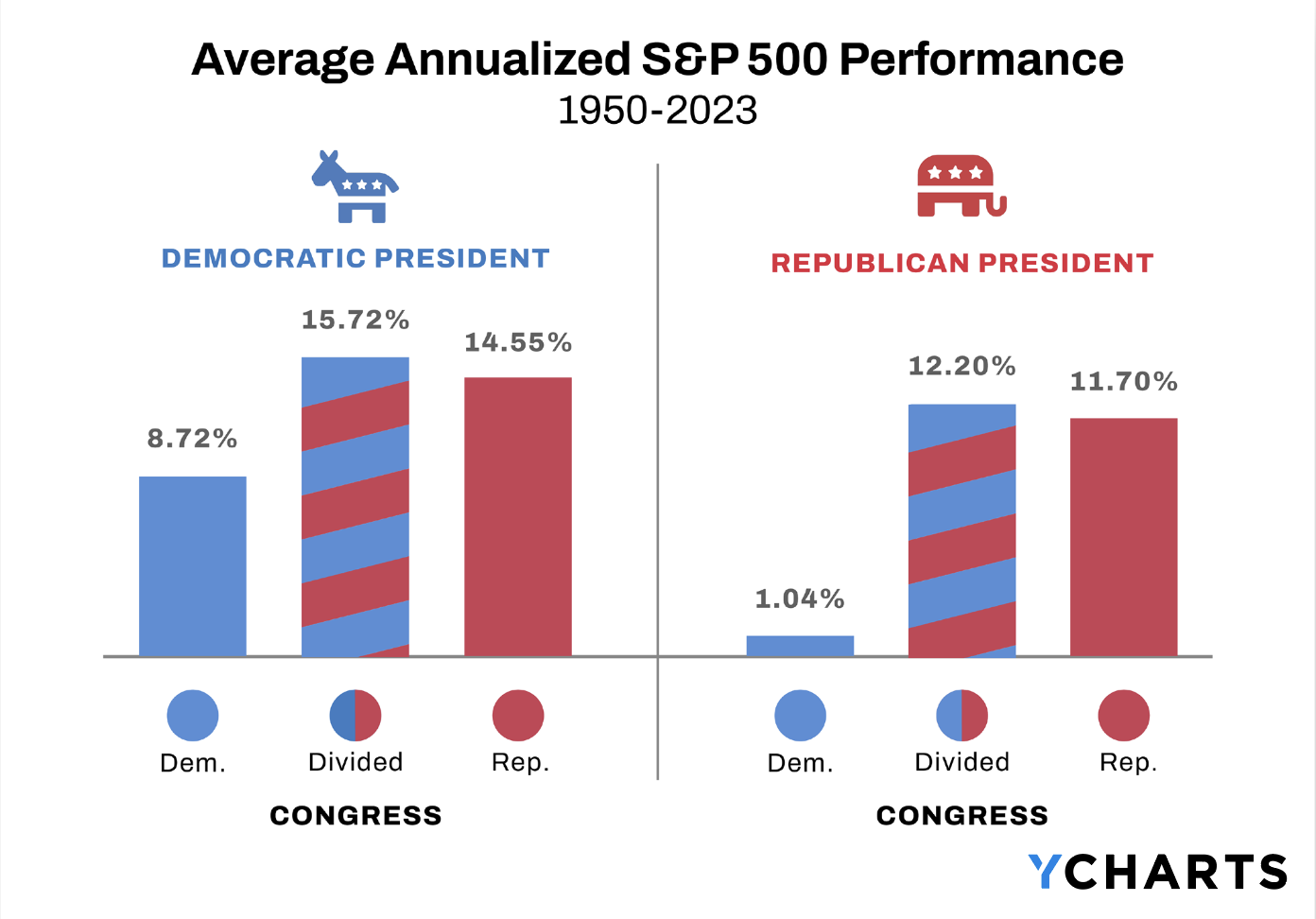

How does the stock market perform when Republicans or Democrats have control of Congress vs when it’s mixed? Although volatility is often heightened during an

The Federal Reserve is going to be raising interest rates (via the target Federal Funds rate). This is likely to happen next month. Rising interest

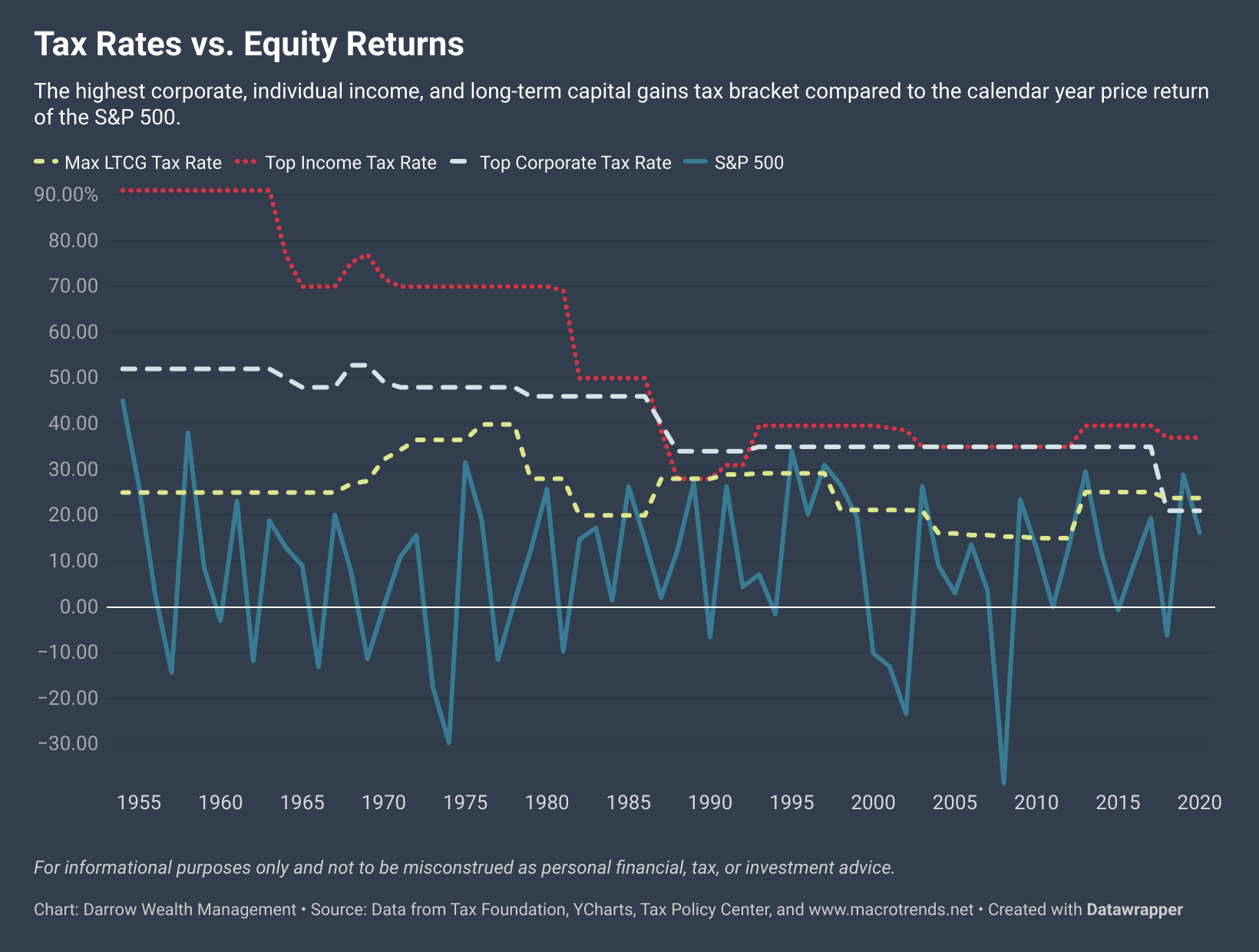

Between the Biden tax plans and other bills already before Congress, it’s likely that some level of tax legislation will make its way into law