Moving and wondering whether you should sell or rent your house? It’s common for homeowners to wonder if they should rent or sell their home after buying a new house. Owning a rental property can be a great way to diversify your streams of income, particularly if you have a low mortgage balance. However, keeping a home as a rental property doesn’t make financial sense in all situations. And not everyone is able and willing to be a landlord. In many cases, the decision to keep the home as an investment property pays off with a long-term holding period.

Homeowners who underestimate the effort required to be a landlord or make an emotional decision to keep the property may want to sell after a few years – which can erode any potential profitability of keeping the home in the first place. Before deciding to keep your home as a rental property, consider how real estate fits into your investment strategy.

What’s your home worth?

What’s your home worth?

Although your home may be your largest asset, not everyone considers it an investment.

Value of the home is not measured in dollars. Some individuals don’t see their home as an investment because they never plan to stop using the house as their own. So profits from a sale or rental income may not be expected.

Other individuals don’t see their home as an investment if the decision to stay or move is not financial. Just because you may be able to sell for a large gain does not mean you would ever seriously consider relocating for that fact alone.

The house is an investment with the goal of price appreciation or rental income. When compared to renting, it is easy to see how many Americans come to the conclusion that buying a house is an investment. Calculating the true return on investment for your home can be difficult, and it is important to keep in mind that price appreciation doesn’t equal ROI.

Investors who take an overly-simplistic approach to quantifying their gains may end up with an equally inflated view of how profitable real estate is. This is really easy to do when the asset is your home. Professional real estate investors are dedicated to their models and making the numbers work – an exercise any new real estate investor or landlord should also consider practicing.

Should I sell or rent my house?

Many of the factors impacting return are out of your control. For example, changes to the tax benefits of owning real estate, interest rates, condition of the property, overall real estate market, etc. all matter. So consider your sell or rent decision in context with your bigger goals. When considering converting your home into a rental property, first take an objective look at your overall financial picture and crunch some numbers.

2 Big Myths About Being a Landlord

What the Tax Cuts and Jobs Act means for landlords

The tax reform legislation signed in 2017 has made dramatic changes to the benefits of holding real estate as a primary residence. Some of the major changes that will negatively impact homeowners are: state and local tax deductions (including property tax) are capped at $10,000 and interest paid on home equity debt may still be tax deductible, provided that the proceeds of the loan are used to “buy, build or substantially improve the taxpayer’s home that secures the loan.” Further, beginning in 2018, mortgage interest and qualified home equity debt interest is only tax deductible on new home loans up to $750,000.

Where homeowners may have lost out in the Tax Cuts and Jobs Act, real estate investors have remained mostly unscathed. Property taxes on a rental property can be deducted as an expense on Schedule E and not subject to the $10,000 limit. Mortgage interest is also itemized on Schedule E for a rental property. The cap on qualifying loans does not apply to rental properties.

The new tax bill also included a provision where landlords may be entitled to a tax deduction of up to 20% on their “pass through” income, which could benefit investors that own their properties as an individual, limited liability company (LLC), or partnership. Income limits and other rules do apply, so it’s important to work with a tax advisor to understand how the new tax laws may impact your individual situation.

While these changes could equal big savings for landlords, if you decide to rent out your home instead of selling it, consulting a CPA to prepare your tax returns is advisable.

Is Real Estate a Better Investment than Stocks?

When to consider renting your house instead of selling

Renting your house may make sense if you agree with all of the following

The cash flows work

Generally, you want your expected rental income to cover your regular expenses (e.g. mortgage, property taxes, ongoing maintenance, HOA dues), and allow you to add to your reserves for unexpected repairs. Consider working with a CPA to run the numbers for you on an after-tax basis. This should include depreciation and other potentially tax-deductible expenses.

Good margins

If your cash flow model reveals a slim projected after-tax profit from renting your home, it may not be a good investment, especially on a risk-adjusted basis. Consider your objectives for the investment property. If your primary goal is NOT additional monthly income, then it may still be worth considering. Perhaps a major employer is relocating to your area and you expect the cash flows to materially change in the near term or maybe you wish to hold into the property until the market improves before selling.

You have strong cash reserves and regular income from outside sources: What is your capacity to make unexpected repairs or handle vacancies without impacting your other goals or regular financial obligations? Real estate is a notoriously illiquid and cash-intensive asset. Having strong cash reserves in addition to a regular emergency fund is necessary. Of course, holding too much cash will eat into your returns over time, so the opportunity cost is something to consider in your modeling.

Being a landlord is OK with you

First-time landlords often fall victim of the ‘passive-income‘ myth. Unless you have multiple rental properties, hiring a property manager may not fit into your cash flow model. This presents a significant challenge for landlords that do not live near the property or don’t have the ability to quickly react when a repair is needed or a problem arises with the tenants.

Financially, you don’t really need to sell

Perhaps you plan on renting yourself or have other sources of cash for a down payment on another home. Even if you don’t foresee any immediate cash needs, make sure you are on track to meet your other goals. For example, make sur your retirement or college savings are on track before opting to keep the house as an investment. Holding real estate can be a great way to diversify your investments, as long as it doesn’t become too big of a part of your overall net worth.

When it’s best to sell your house instead of renting it

Here’s when it may be best to sell your home

Cash flow reasons

Although there are ways to come up with a down payment and buy another home before selling the old one, it doesn’t work in all situations. Even if the down payment isn’t an issue, the after-tax cash flows may not work. Or perhaps the money isn’t worth the hassle/risk of keeping the property.

Fund other goals

If you can avoid plowing all of the proceeds from the sale of your home into your next property, the windfall could make a meaningful impact on your other goals. Consider getting caught up on your retirement savings by putting the proceeds in a brokerage account or funding the kids’ 529 college savings plans.

Cut your losses

Homebuyers who have been underwater in their house may be eager to jump at the chance to break even. Another reason could be the condition of the property. Cars aren’t the only thing that can turn out to be a lemon. If the property was a money pit while you were living there, it may only get worse when rented. Maybe you’re willing to shower at the gym while you wait for a new hot water heater, but your tenant probably won’t.

Avoid paying tax on the gain from the sale of your home

Almost cut in the Tax Cuts and Jobs Act, the primary residence gain exclusion didn’t change in the final bill. If you own the home and have lived in it as your primary residence for at least two of the last five years, you may be able to exclude all – or a portion of – the gains from capital gains tax.

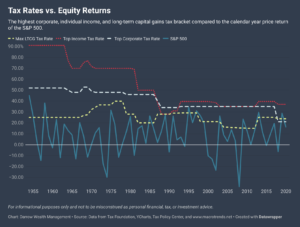

Single filers may exclude gains up to $250,000 ($500,000 if married filing jointly) from their taxable income. Depending on your tax rate and projected gains/rental income, it could take decades to recoup the lost tax-free profits. Keep in mind, the tax code can change at any time.

If the success of your strategy hinges on the continuation of current tax code provisions, proceed with caution.

Increasing expenses and other impacts to profitability

Do your projected cash flows look strong in the next year but you’re not sure it will last? Factors outside your control can impact profitability over the long term. Consider increasing property taxes, homeowners dues, special assessments, and repairs on an aging property.

Keep monthly costs low

Consider how keeping the property may impact your monthly mortgage payment on the new home. If you need to put less than 20% down, it will impact the interest rate lenders offer. It could trigger private mortgage insurance (PMI), which could stay with you for the life of the loan. The new tax bill also reduced the limit on mortgage interest deduction to $750,000 of debt for new loans. There is no longer an interest deduction for home equity loans.

Your home is already the bulk of your net worth

Your home may already be a large part of your net worth. If so, it may not be wise to increase your real estate holdings by keeping the house. Selling the home can allow you to use some of the proceeds to diversify your investments.

Final renting vs selling considerations

On the fence about whether to rent or sell your home? If you want to see how it goes as a landlord, remember the primary residence home sale exclusion. If you’ve owned the home as your primary residence at least two of the last five years, you may be able to exclude up to $500,000 in gains.

But if you rent the home for over three years, you lose the ability to do so. With the top capital gains rates at 20%, the lost savings are significant. This is the primary reason renting your home does not make sense as a short-term strategy.

Depending on your situation, a financial model may be advisable to analyze the trade-offs and cash flows to help determine the best financial outcome for you. Contact us to learn more about the benefits of a financial plan.

What’s your home worth?

What’s your home worth?