The Federal Reserve plans to raise interest rates more quickly than the market expected a couple of months ago. This is sending shock waves into equity markets as assets are repriced. Here are some drivers of recent market volatility and summary of what interest rates mean for the economic outlook.

Markets brace for interest rate hikes

Due to inflationary pressures and low unemployment figures, the Federal Reserve announced they would accelerate the pace of tapering monthly asset purchases, paving the way to raise interest rates (the Federal Funds target rate) earlier than expected. Originally planned to complete tapering by June 2022, officials were now eyeing March with a significant potential for a simultaneous rate hike.

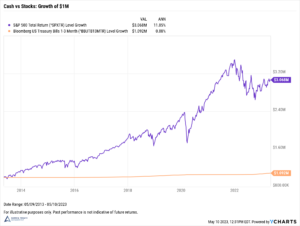

The super-easy pandemic monetary policy gave strong support to asset prices. The prices of bonds in the secondary markets increased as new bonds could be issued at lower rates (and thus lower current yields – see example). Historically low bond yields and massive fiscal stimulus drove investors into riskier assets including stocks, which was a major contributor of the outperformance of the S&P 500 in 2020 and 2021.

But now the Federal Reserve is planning to raise rates to turn off pandemic policies but also to cool down the hot economy. In January, the financial markets began pricing in a higher probability of multiple rate hikes in 2022.

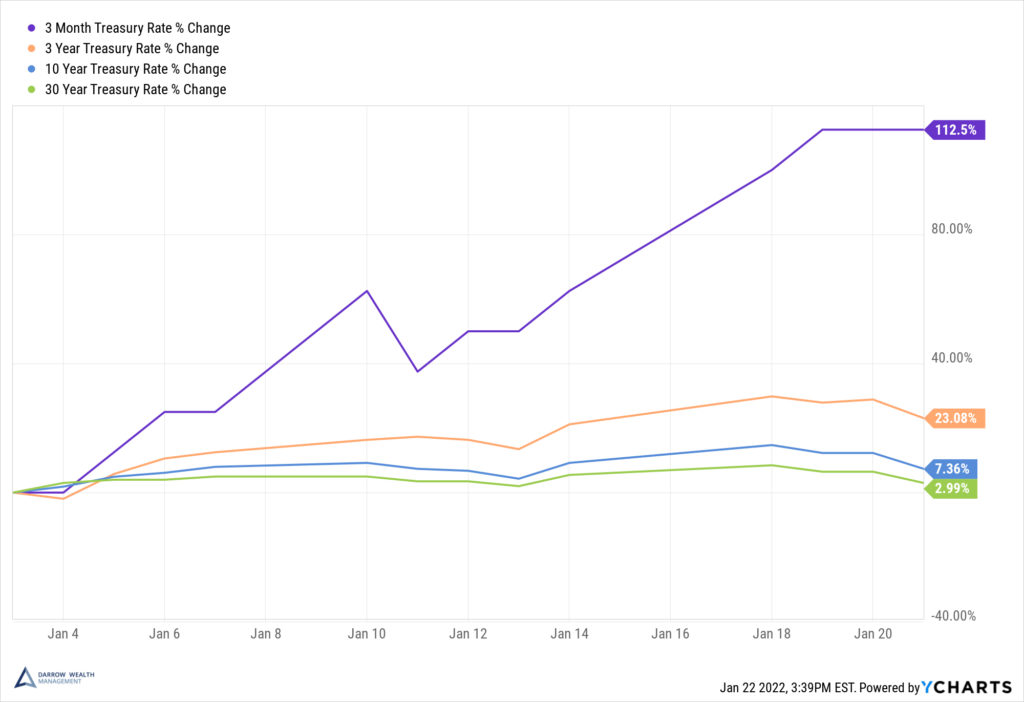

Year to Date Percent Change in Treasury Rates

When there’s an alternative to equities for yield again, investors recalculate the equity risk premium. High-flying equity valuations are getting a haircut.

For bonds, expectations of increasing interest rates mean investors in the primary market earn higher coupons on new issues. This puts pressure on prices of outstanding bonds in the secondary market which are paying less. This is one reason why bond yields are rising.

Given the prolonged period of super accommodative monetary policy, the Federal Reserve has a challenging task. It needs to raise rates to cool the economy, tackle inflation, and return to normative monetary policy. But some economists argue if it does so too quickly or sharply, the overreaction could trigger a recession.

How Do Stocks Perform When Interest Rates Rise?

What do interest rates mean for the economic outlook?

Despite many positive byproducts of a low-rate environment, it’s an indicator of a weak economy. The Federal Reserve lowered interest rates to avoid economic and financial disaster from Covid-19. During periods of strong economic growth, officials may increase interest rates to get back to normal target levels or so the economy doesn’t overheat.

Interest rates are largely an expectation of economic conditions in the future. The expectations and sentiment of market participants drives outcomes even absent of an actual event. For example, if an investor is concerned about regulations that would break up big tech, they might sell shares of Google (Alphabet) in advance. The potential event hasn’t occurred, and may never happen, but if this concern is widespread, it would likely affect the stock price.

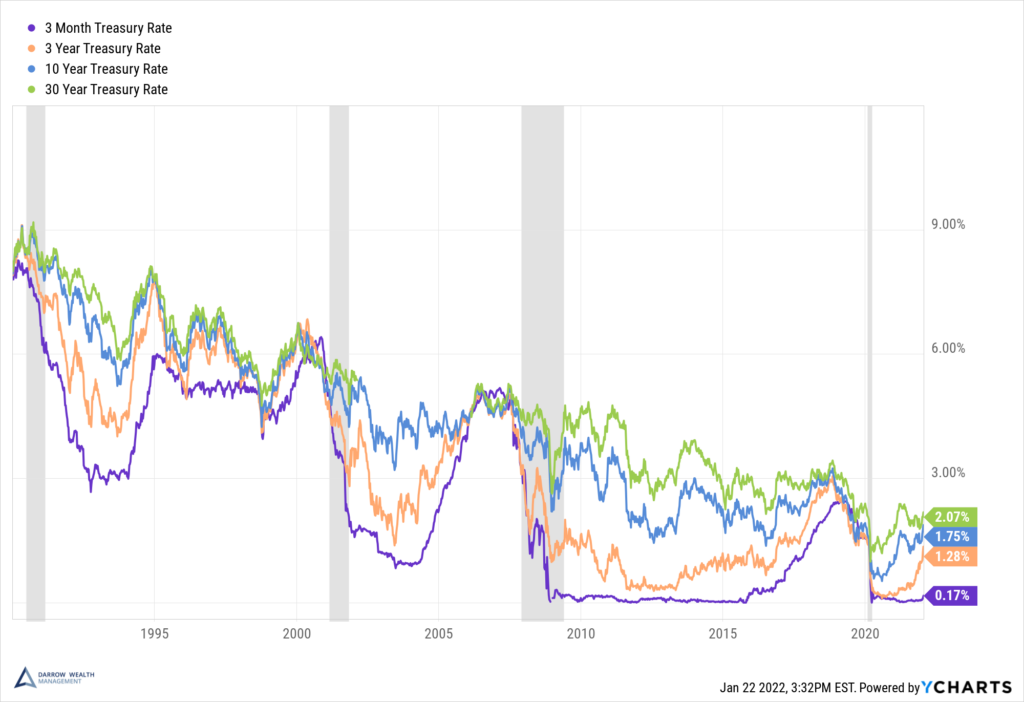

The yield curve works the same way. It’s based on expectations of future interest rates relative to the very near future. In a normal, healthy market, the yield curve is upward sloping. Rates on short-term treasuries (considered risk-free assets) are low relative to bonds with longer-dated maturities. When expectations for future economic growth are positive, the further out you go on the yield curve, the higher the rate will be relative to shorter maturities.

Historical Yield Curve

When the yield curve inverts, short-term rates are higher than long-term rates. This is a key recessionary warning signal (gray bars above indicate a U.S. recession). Right now, the yield curve is flattening, which is when short-term rates rise faster than the rest of the curve. Short-term rates are going up in anticipation of the Federal Reserve raising rates while longer-dated rates aren’t moving nearly as much because the assumption is that higher interest rates will slow economic growth (which is what the Fed wants).

Given the prolonged period of super accommodative monetary policy, the Federal Reserve has a challenging task. It needs to raise rates to cool the economy, tackle inflation, and return to normative monetary policy. But some economists argue if it does so too quickly or sharply, the overreaction could trigger a recession.

Both past performance and yields are not reliable indicators of current and future results.