“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

– Peter Lynch

Talking heads in the media and permabears love doomsday scenarios. They sky is always about to fall. Sometimes they’re right, most times they’re wrong. After all, even a broken clock can tell time twice a day. Before discussing ways to prepare for a recession or market downturn, it’s imperative to clarify an important point. Trying to anticipate and subsequently prepare for the next market correction/recession/etc. is a fool’s game. Taking steps to help ensure you’re reasonably prepared for any type of economic uncertainty or recession, personal financial crisis (loss of a job, divorce, medical expenses, etc.), or downturn in the financial markets that could occur at any time is just common sense.

Taking steps to help protect your finances from a market correction or recession

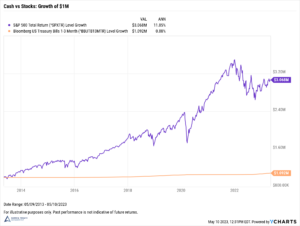

Keep enough cash, but not so much where it’s a drag

Having cash and investable liquid assets gives you flexibility for the unknown. If there’s a large, unexpected expense, you may not need to take out a loan. If you’re out of work for a year, you may not need to sell your home.

Going overboard on your cash savings can hurt you too, so be careful not to sideline too much money in a cash account. In general, dual income households should have between 3 – 6 months of cash in an emergency fund while single individuals or couples with one breadwinner may want to have 6 – 9 months. If you’re self-employed or have other unique circumstances, adjust accordingly.

Controlling your expenses gives you flexibility during periods of financial stress

Flexibility helps individuals adapt to changing circumstances and can minimize the disruption on your life. In general, high fixed expenses relative to your overall income limits your ability to adapt as your investments, goals, or finances change. And during periods of high inflation or market volatility, the negative effects of over-spending are magnified.

A strong savings rate relative to your income can help you build reserves before retirement—and during retirement, the focus should be maintaining a reasonable and flexible withdrawal rate relative to your investable assets.

Make a plan and stress test it for volatile or bear markets

Markets don’t just go up. If you’re assuming a static investment return every year, you haven’t accounted for market volatility. While modeling can’t fully insulate an investor from the impact of short-term events (nothing can), a detailed analysis can help investors understand the probability of outcomes by stress testing a financial plan to better assess the likelihood of success over the long-term. This can provide flexibility to deal with unexpected changes in market conditions or to your financial situation.

Plans that don’t bend, break. Adding conservative assumptions to a financial plan helps provide cushion against unknowns. By its very definition, unknowns can’t be meticulously planned for. But if you give yourself enough of a margin for the uncontrollable, with other adjustments, you can work to control the impact the economy has on your retirement plans.

Don’t wait for volatility to get your investments in order!

So many things to say here. The key to weathering the storm is having a diversified asset allocation that’s truly aligned with your risk tolerance and appetite before there’s a personal financial problem or other negative event.

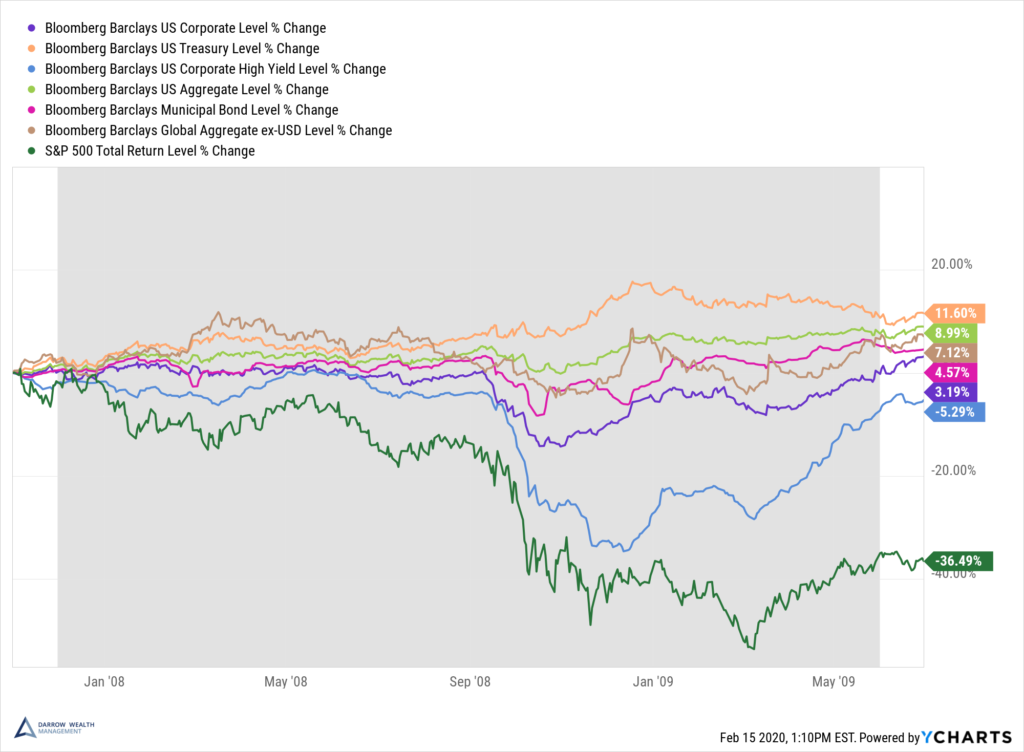

Asset allocation

Diversification isn’t a magic bullet, but it’s typically the best defense in volatile markets. Bonds are the ballast in many portfolios and exposure to fixed income is often essential during market downturns.

Consider how bonds performed around the 2008 financial crisis:

Diversification should run throughout your portfolio, across and within asset classes. Consider U.S. value versus growth year-to-date. As of market close March 18th, 2022, the Russell 1000 Growth index was down over 11% (total return) after being down nearly 20% to start the WEEK. By comparison, the Russell 1000 Value index was down roughly 1.5% on the year (total return), with a YTD low around 6%. Go out farther periods, and growth has outperformed, at times significantly. It shouldn’t be either-or: holding both in relatively equal weighting can reduce the overall volatility on your portfolio.

Make an action – or inaction – plan before a recession, market correction, or other negative event

Having a diversified portfolio can increase the odds of staying the course. Wild swings in a portfolio can scare some investors into selling and going to cash, which is often a huge mistake. But that doesn’t mean that you can’t or shouldn’t do anything at all.

After prolonged periods of losses, a portfolio can become unbalanced as the relative value of one asset class or fund exceeds or lags another. Extreme caution is advisable before rebalancing during extreme periods of market volatility. For example: during the Covid crash, the S&P 500 posted a 9.5% loss on March 12, 2020 only to close with a 9.3% gain the next day. If you had rebalanced after the big down day, you could be off target the very next day.

During a recession, correction, or bear market, there may be an opportunity to harvest losses in a taxable portfolio. Tax-loss harvesting can create tax assets by selling positions to realize a loss for tax purposes. Though this strategy can be worthwhile, there are several challenges. Taxpayers must refrain from buying the fund (or something similar) for 30 days to avoid a wash sale. But the market can move significantly in this timeframe.

A month after the March 2020 lows, the S&P 500 was up about 27%. Staying in cash could mean missing out on the recovery. So a replacement fund should mostly fit into your asset allocation for longer periods or you may need to realize a gain to buy the old fund back, potentially after it’s already increased significantly in price.

If you have extra cash to invest, consider the pros and cons of dollar-cost averaging versus investing a lump sum. Despite the buying opportunity, can be unnerving to put money in the market when it’s falling. By spreading out your investments over a predetermined amount of time, investors can avoid the temptation to stay in cash or try to time the bottom.

Final thoughts on preparing your finances from a market correction or recession

Even the best laid plans can go awry; especially when grappling with short-term volatility or sudden major changes to your financial situation or the economy. There’s no way to fully insulate your finances from a sudden shock to the markets. But there’s no doubt that diversification and prior planning can help prepare you to manage the change.