Putting extra cash towards your mortgage doesn’t lower your payment

If you have extra cash and are considering putting it towards paying down your mortgage early, you should be aware that it won’t automatically reduce your payment. Putting extra cash towards your mortgage doesn’t change your payment unless you ask the lender to recast your mortgage. Unless you recast your mortgage, the extra principal payment will reduce your interest expense over the life of the loan, but it won’t put extra cash in your pocket every month. Before putting a lump sum towards your mortgage, understand your options.

What is mortgage recasting?

Mortgage recasting is when a lender re-amortizes the loan after the homeowner makes a large lump sum payment. In order for your payment to change, the loan must be re-amortized to reflect the lower principal balance.

Here’s an example:

Assume you buy a home and take out a 30-year $500,000 loan at 3% interest. Your monthly payment is about $2,100. In five years, you have extra cash and decide to put $100,000 towards your mortgage.

Without recasting your mortgage, your payment stays the same as the amortization schedule is still based on the original $500,000 mortgage, but the lump sum payment allows you to pay off the loan much faster: in about 22 ½ years instead of 30.

If you recast your mortgage, the lender will use your adjusted principal balance after the payment, approximately $345,000, and create a new amortization schedule over the remaining 25 years on the mortgage. Your new monthly payment would be roughly $1,635, a savings of $465 per month.

Recasting your mortgage might not be an option

Before making a big one-off payment on your loan, ask your lender if they’re willing to recast your mortgage. The lender is not required to do this, and some loans aren’t eligible, so it might not be an option. You’ll want to understand the process and whether this is possible before making any extra payments on your loan.

Consider your alternatives for the cash

Refinancing your mortgage

Mortgage rates are currently very low. The average rate on a 30-year fixed mortgage is 3.06% as of the writing of this article. Depending on the interest rate on your existing mortgage, it may make more sense to refinance your loan instead of recasting it. This could allow you to save on interest expense over the life of the loan and reduce your monthly payment while using the cash for other investments. Alternatively, you could consider paying down the principal and refinancing the loan.

Investing the cash instead

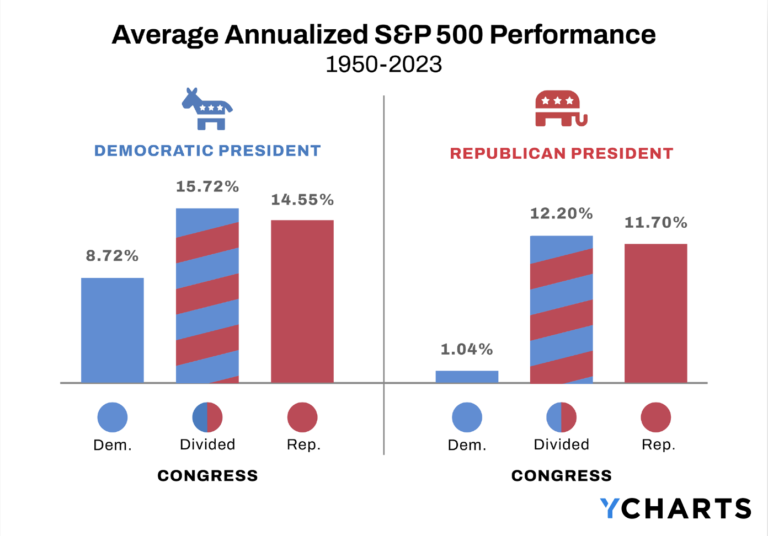

If you have excess cash burning a hole in your pocket, consider the opportunity cost of paying down your mortgage early instead of using the funds to invest elsewhere. While you will save on a portion of the interest expense, you may be better off investing the money instead, especially if your interest rate is low.

Consider your interest expense relative to your long-term return expectations. If a homebuyer can get a 30-year fixed mortgage for 2.85% and their long-term assumption for investment returns is 6%, they’re using leverage to achieve a better financial outcome. After all, you won’t enjoy the benefits of paying down your mortgage early until you’re living debt-free, but the average buyer only lives in the house for 10 years.

Flexibility is valuable

Considering whether to pay down a mortgage early is quite common. Perhaps you’ve inherited money, saved diligently, or created a windfall by selling stock options. Homeowners who buy a new house before selling their old home might also consider using the proceeds from the sale to pay down the new mortgage. Again, unless your lender agrees to recast your mortgage, it won’t change your payment.

While it’s a good exercise to run the numbers, make sure you consider the value of flexibility in your decision. If you use the money to pay down your loan, it’s not readily available if you need it for other goals and you haven’t improved your cash flows each month without a mortgage recast.

Building equity in your home is good, but you’re already doing so with each mortgage payment. Owning your home outright and being mortgage-free is desirable. But make sure you’re making the most of the opportunity the cash can provide you.

This article was written by Darrow Advisor Kristin McKenna, CFP® and originally appeared on Forbes.