7 Ways to Use Extra Cash

- Fully fund your emergency cash account

- Invest excess cash using a brokerage account

- Max out your retirement accounts

- Pay tax on a Roth conversion or opt into a mega backdoor Roth

- Prepay your mortgage or refinance

- Pay off student loans or bad debt

- Put cash towards non-retirement goals

1. Fully fund emergency reserves

Do you really have extra cash? Before deciding what to do with excess cash, make sure you actually have it.

As a rule of thumb, you should generally keep between 3 to 6 months of fixed expenses in cash as an emergency fund. Two income households may be able to protect themselves with 3 months of savings.

Your personal situation will dictate how much cash you’ll need. If you’re concerned about losing your job, you may want to be more conservative. Business owners should also keep more cash on hand.

Consider keeping your emergency fund in a separate high-yield savings account. Switching banks can be a pain, but when interest rates are high, it’s probably worth it. Many high yield savings accounts are offering rates north of 4%. Compare that to a traditional bank that could yield 0% interest and switching is worth your time. Who doesn’t like free money?

Another option is buying Treasuries. When held to maturity, Treasuries provide a rare guaranteed rate of return.

2. Invest excess cash in a brokerage account

A brokerage account is a popular type of non-retirement investment account. With no income restrictions or funding limits, a taxable account provides the most options for investing extra money. Unlike retirement accounts, assets in a brokerage account can be used for any purpose at any time without early withdrawal penalties.

A brokerage account is funded with after-tax dollars, like savings in your bank account. The account is also subject to tax annually for dividends, interest, or capital gains distributions from mutual funds and ETFs received during the year, even if you did not sell an investment and reinvested the proceeds. When you sell a fund in your account, there will usually be a taxable capital gain or loss depending on your purchase price and cost basis which will be taxable in the current year.

A brokerage account offers many other benefits including tax planning opportunities in retirement, funding an early retirement, paying for college, and even leaving an inheritance with tax benefits.

To learn more about investing excess cash with a brokerage account and developing a unified asset allocation, please contact us today.

Here’s What Maxing Out Your 401(k) Could Get You In Retirement

3. Max out your 401(k), 403(b), or IRA

For the majority of investors, using extra cash to max out a retirement plan is a good idea. While you can’t fund a 401(k) from your savings account, you may be able to afford getting less take-home pay by increasing the amount deducted from your paycheck. Plan your contributions to help ensure you’re making the most of employer matching contributions, too. Here are the 2025 limits.

If you are under the income limits for contributions to a Roth IRA or tax-deductible IRA, the funding can come from your bank account. If your income is too high to make a pre-tax contribution to an IRA, you might be better off investing with a brokerage account instead of making a non-deductible IRA contribution as you run a high risk of paying tax twice.

Maxing out a 401(k) doesn’t make sense for all investors, though. For example, individuals with a pension, deferred compensation plan, or law firm partners responsible for contributing as the employer may benefit more from taxable investments opposed to more qualified pre-tax savings.

4. Pay tax on a Roth conversion or opt into a mega backdoor Roth

If you expect your tax rate will be higher in retirement than it is today, consider the benefits of a Roth conversion. When you convert an old 401(k) or a traditional IRA to a Roth, you’ll want to pay the tax with non-retirement savings.

A Roth conversion doesn’t benefit everyone equally. Roth IRAs often provide greater benefits to those with significant assets in retirement. Depending on your income needs, reducing your required minimum distributions may not matter. There are no income limits on Roth conversions. Anyone can convert to a Roth, even retirees.

If available in your 401(k) plan at work, you may also want to consider a mega backdoor Roth strategy. In this strategy, you can make after-tax contributions in excess of the regular IRS limit and then do a in-plan rollover to a Roth 401(k) or conversion to a Roth IRA. Since additional 401(k) contributions will reduce your take home pay, especially when funded after tax, you can use the extra cash you have on hand to supplement a smaller paycheck.

5. Using excess cash to refinance or prepay your mortgage

Mortgage rates are currently in the orbit of 7%, so most homeowners won’t benefit from refinancing. As a result, many investors are wondering if they should pay off their mortgage or pay it down more rapidly.

Prepay your mortgage or pay it off

If you have a low interest rate, paying off your mortgage early may not be the best use of extra cash. And remember, if you make a lump sum payment towards your existing mortgage, it won’t change your monthly payment unless the lender agrees to recast the loan.

However, if you bought a home recently and have a higher interest rate, perhaps north of 6%, it may make sense to pay down the loan more quickly. This is a big decision, so you’ll want to consider all the factors before moving ahead. For example, consider:

- Will the lender recast the loan?

- Will you live in the home long enough to live mortgage-free?

- What else could you do with the money? What is the opportunity cost? Do you have higher cost debt or an expectation that you could earn a greater return if investing the case elsewhere?

- How much quicker will you be able to pay off your loan? How much interest would it save you?

Refinance

But if rates get more attractive and you have cash on hand, you may be wondering if refinancing is a good use of that money. When you refinance, you get a new loan and use the proceeds to pay off your existing mortgage. The principal is typically your current outstanding mortgage balance and the loan will be re-amortized over a new period, perhaps 30 years.

Refinancing your mortgage can be a great way to increase your monthly cash flow and pay less in interest over the lifetime of the loan. But there’s a cost. Lenders estimate that closing costs are generally between .75% and 1% of the loan.

Although you can arrange for a zero-cost refinancing by paying a higher interest rate or rolling it into the principal, it will cost you more over the life of the loan. Further, the additional debt isn’t tax-deductible as it exceeds the existing loan balance. To calculate how long it’ll take to recoup closing costs, divide the closing costs by the monthly savings from refinancing. Before moving forward, speak with your lender and financial advisor to discuss how much you could save by refinancing your mortgage.

6. Pay off or refinance student loans or bad debt

Student loans

According to a NerdWallet household debt study, dentists and doctors have some of the highest student loan debt balances. If you have student loans with high interest rates, you may want to consider using extra cash to pay off loans or refinance.

Prepay or refinance student loans? Depending on your financial situation, the best strategy may be a blend of refinancing and prepaying loans. While prepaying existing loans won’t change your interest rate, it will help you save on interest over the years.

Since refinancing usually means changing your monthly payment, prepaying instead of refinancing offers flexibility. Depending on the size of your loans and extra savings, you may not be able to pay them off completely.

Before refinancing your loans, make sure to consider your eligibility for student loan forgiveness.

Bad debt

Not all debt is bad debt. A mortgage can offer tax benefits and low interest loans offer investors leverage if they can earn a greater return elsewhere. Credit cards and high-cost debt offers little value though, particularly if you’re sitting on a pile of extra cash.

7. Put excess cash towards non-retirement goals

For many investors, there’s a lot of life to live between now and retirement. We’re also typically saving for more than our golden years. Whether you’re trying to pay for college, buy a second home, boat, or take a major vacation, consider putting extra savings towards a few of your other goals.

Depending on your financial situation and how much excess cash you have, consider working with a fiduciary wealth advisor and to develop a financial plan. A financial model can quantify what-if scenarios and find the best way to utilize your cash.

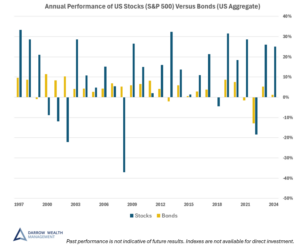

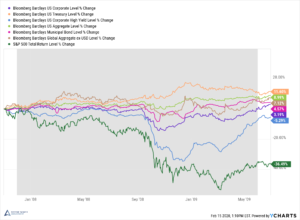

Help putting excess cash to work

Having extra money to work with is a good problem. Unfortunately, investors often let cash pile up before acting. Imagine, hundreds of thousands of dollars in a savings account, earning nothing! Try not to get caught up with current market conditions when wondering whether it’s a good time to invest. Instead, focus on time in the market, not timing the market.

Infographic: What To Do With Excess Cash

[Last reviewed March 2025]