When the stock market is in turmoil, many investors are tempted to go to cash and wait for the dust to settle before getting back in. One of the issues here is how to time your exit and entry—unlike a flash flood or significant weather event, investors aren’t going to get an emergency alert on their phone when it’s time to take cover, run for the hills, or once it’s safe to return.

Aside from the fact that in the financial markets, we only know this information in hindsight, the notion of going to cash until the market recovers also ignores another very real but less visible danger: missing out on the recovery.

Stick it out or sell to cash?

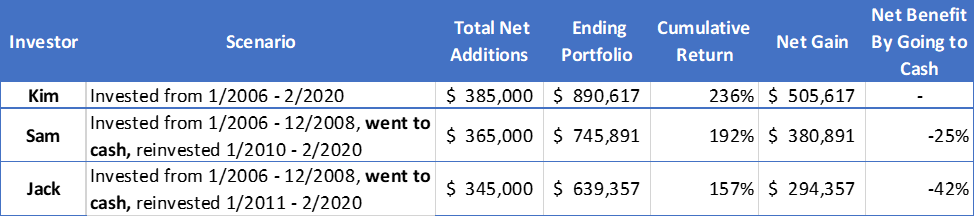

By way of example, here are three long-term investors who started to invest in 2006. For simplicity, this example doesn’t include the impact of taxes, inflation, and rebalancing. Dividends and capital gains assumed to be reinvested.

Kim

Kim invested $100,000 in March 2006 in an account that was allocated to 85% stock (SPDR¨ S&P 500 ETF) and 15% bonds (iShares Core US Aggregate Bond ETF)1. She invested $5,000 per quarter until the end of February 2020. Over this 14+ year period, Kim’s net investment was $385,000 and by the end of last month, her portfolio was worth over $890,000.

Despite having gone through the financial crisis, Kim’s portfolio has increased 236% over this period.

Sam

Now let’s look at another investor, Sam, who had the same account as Kim but decided to sell and go to cash at the end of 2008. Was he better off?

If Sam cashed out at the end of December 2008, his account would be worth about $129,000 despite investing $160,000. Even though he lost principal, Sam managed to bail before the bottom of the crisis, which was March 2009.

Fast forward to January 2010–the market rebound is seven months old and Sam feels comfortable getting back in. He takes his proceeds from the 2008 liquidation and reinvests with the same 85/15 investment mix as before. Sam resumes dollar-cost averaging $5,000 per quarter.

By the end of February 2020, Sam’s portfolio would be worth roughly $746,000. Kim’s portfolio is ahead by nearly $150,000.

Jack

In the last scenario, let’s look at Jack, who’s strategy was just like Sam’s, but Jack waited until January 2011 to get back in with the same investment and contribution strategy as before. By the end of February 2020, Jack’s account would be worth $639,000Éover $250,000 less than Kim’s account and more than $105,000 less than Sam’s!

Past performance not indicative of future results.

When it hurts to look, maybe you shouldn’t

No one likes losing money. Wild swings in the stock market can make even the most level-headed investor second-guess their strategy. Although self-isolation is easier than ever these days, it’s not realistic to avoid the news completely. However, that doesn’t mean you should check your portfolio every day or even every week.

We all know that our accounts go up and down each day. Other times, like now, the market swings are much more volatile than usual. Checking your account can create unnecessary stress and perhaps worse, may end up pushing you to act when you shouldn’t.

Your home is an asset too, likely one of your largest assets. But chances are you’re not checking Redfin or Zillow every day to see how the value has changed because you’re not planning on selling any time soon. You know the housing market goes up and down.

If you are about to put your home on the market, then perhaps the current real estate market is more of a daily concern for you, as conditions in the short-term will impact the sale. However, it’s important to remember that this isn’t the same as individuals who recently retired. Unlike the sale of a home when you take your proceeds and just walk away, in all likelihood, new retirees are still investing for the next 20, 30 years or more.

How to Prepare Your Finances for a Recession or Prolonged Market Downturn

The role of planning and portfolio construction

Unfortunately, when the market is up and everyone is growing their assets, planning and portfolio construction can take a backseat for many investors. Portfolios that are thoughtfully constructed and diversified are built to withstand a variety of market conditions over the long term. That is not to say things can’t go wrong or diversification will insulate you from losses—because it won’t.

But investors have much better odds of success when they rely on tested investment principles, data-driven methodologies, and the support of an advisor who will help them navigate choppy waters. While panicking and going to cash isn’t typically advisable, that doesn’t mean investors shouldn’t make any adjustments during periods of market volatility.

Perhaps retirees should consider taking less from their portfolio if they’re worried about running out of money. Perhaps pre-retirees should consider investing extra cash while valuations are cheaper than they were at the beginning of the year. Could it get worse from here? Sure. But if you’re a long-term investor, you have to zoom out.

Analysis: How Cash Flows Impact Your Account

Financial planning and modeling is perhaps the best way to sleep at night during periods of extreme market volatility. In working with clients, we can run a Monte Carlo simulation to account for the inevitable ups and downs in the market, cash in, cash out, and the timing of these factors, to help investors grow comfortable with what their portfolio may be able to withstand over time.

The time to make adjustments to your portfolio generally isn’t after volatility occurs. And while past performance is not indicative of future results, we can use data to help inform us about where the market might go in the future.

Markets can turn on a dime

It’s likely that we’re not out of the woods yet. People are still getting sick and it’s important not to lose sight of the human element behind recent stock activity.

From a purely financial standpoint, if your goal is to wait until you’re 100% sure we’ve already passed the bottom before investing or reinvesting, you’ve already missed out on some of the recovery.

Should You Keep Investing During a Recession?

And that really matters—between January 2000 and December 2019, if you missed the S&P 500’s best 10 days your average annualized total return would be 2.44% compared to 6.06% had you stayed fully invested. Missed the best 20 days? You’re essentially flat.

Again, these swings happen really fast—during this period 60% of the best 10 days fell within two weeks of the worst 10 days.

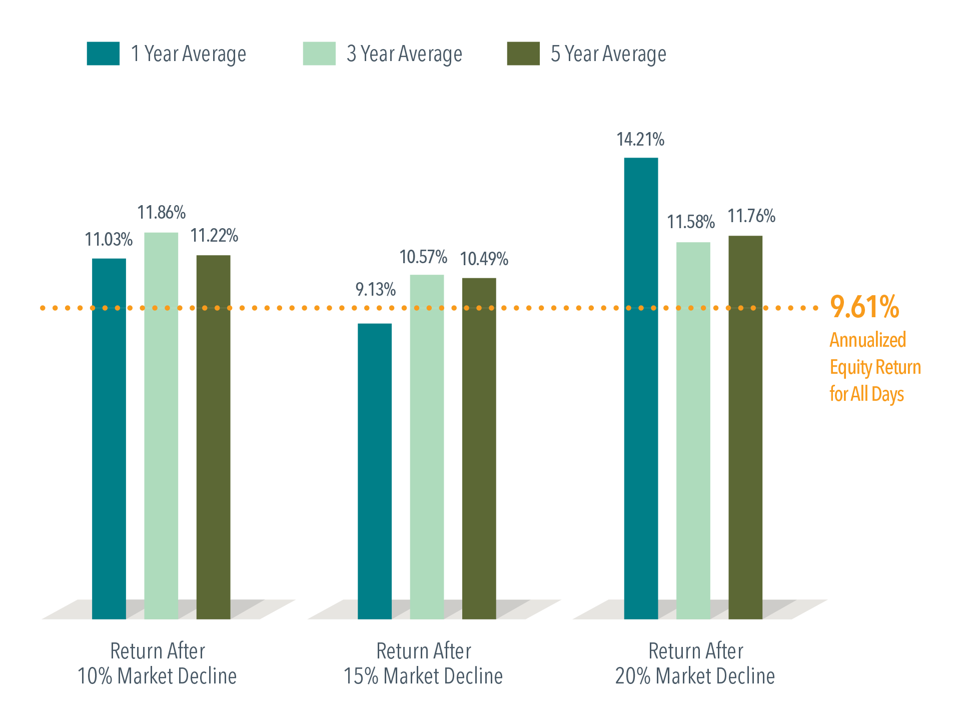

Average returns after a correction or worse

According to Dimensional, in the years following a 10% correction or worse, the stock market has still been up on average (and significantly so) in the one, three, and five years to follow. Will this time be different? We don’t know yet—but long-term investors should probably just ride it out.

Fama/French Total US Market Research Index Returns

July 1926 – December 2019

Will this time be different?

We don’t know yet—but long-term investors should probably just ride it out.

1 Note: these ETFs were selected because they been around for a long time and track two popular indexes known to many investors (the S&P 500 and the Bloomberg Barclays Aggregate Bond Index). For simplicity, only two ETFs were chosen for this analysis, but this is not intended to represent a well-diversified asset allocation. In practice, investors should generally consider a well-diversified portfolio that includes other asset classes and geographical regions.

Past performance is not indicative of future results. Indices are not available for direct investment.

This article was written by Darrow advisor Kristin McKenna, CFP® and first appeared on Forbes.