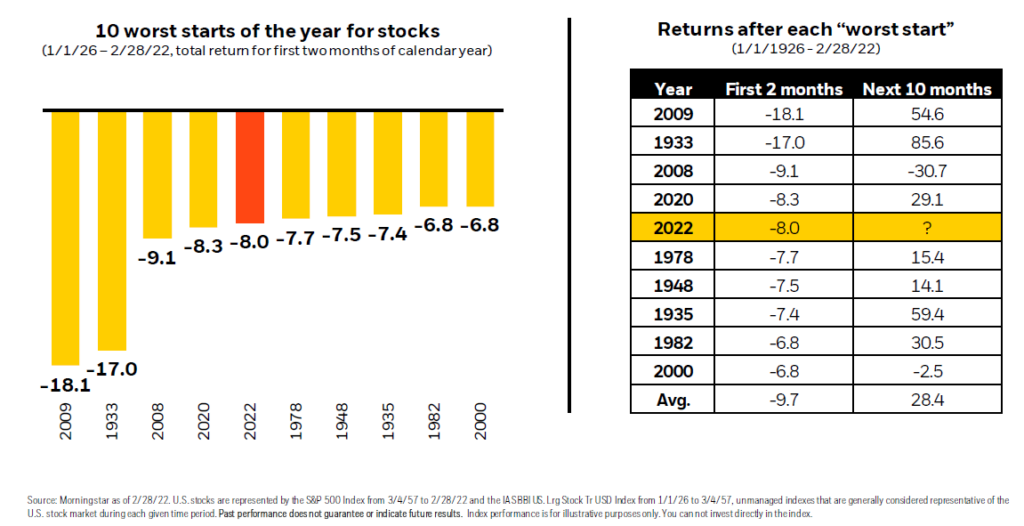

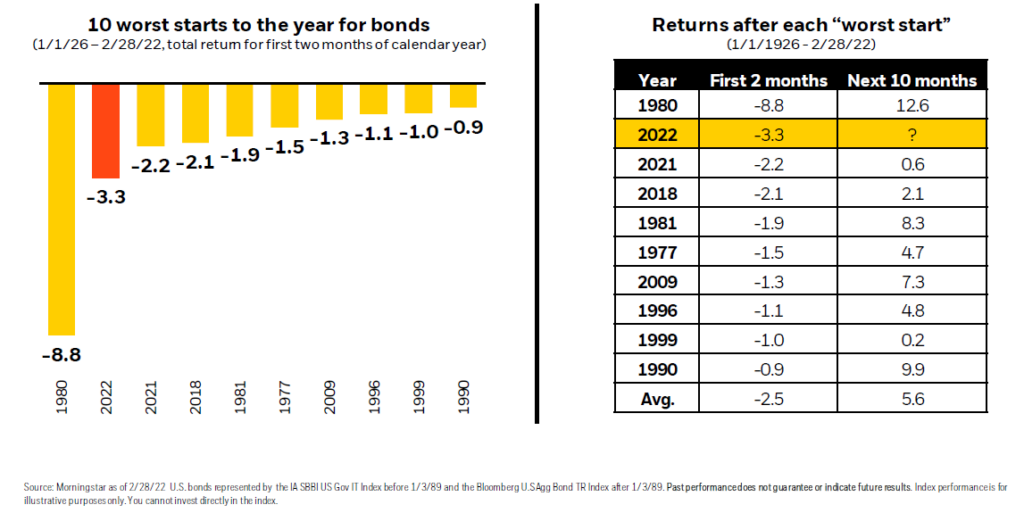

We all know 2022 hasn’t been kind to investors so far. But according to BlackRock, it’s been one of the worst two months to start a year on record. The S&P 500 had its fifth worst January – February in history and bonds wrapped the second worst ever start to a year. There has been considerable volatility between asset classes the last few years. The Covid crash of 2020 was the fourth worst start to a year for stocks while 2021 was the third worst start for bonds.

This year is particularly painful for investors as the benefits of diversification are muted at best. But investors should find some comfort knowing that past performance isn’t indicative of future results.

How stocks performed after the worst starts to a year

In the top worst starts to a year in history, only twice were stocks down overall to end the year. Put another way, 78% of the worst starts for stocks ended with positive results. In many cases, even above-average returns. This is another reason why it’s important to stay invested and not try to time the market.

Source: BlackRock

How bonds performed after the worst starts to a year

Interestingly, the same is true for then US aggregate bond market: only 22% of the time were bonds in the red to end the calendar year after a historically bad January and February.

Why are stocks and bonds down to start the year?

At any time in the markets there are multiple narratives, and 2022 is no different. The year began with investor concerns about how the Federal Reserve raising interest rates may affect stocks and bonds. Inflation is at 40-year highs and given the prolonged period of super accommodative monetary policy, the Federal Reserve must raise rates to cool the economy and tackle inflation without overreacting, potentially triggering a recession.

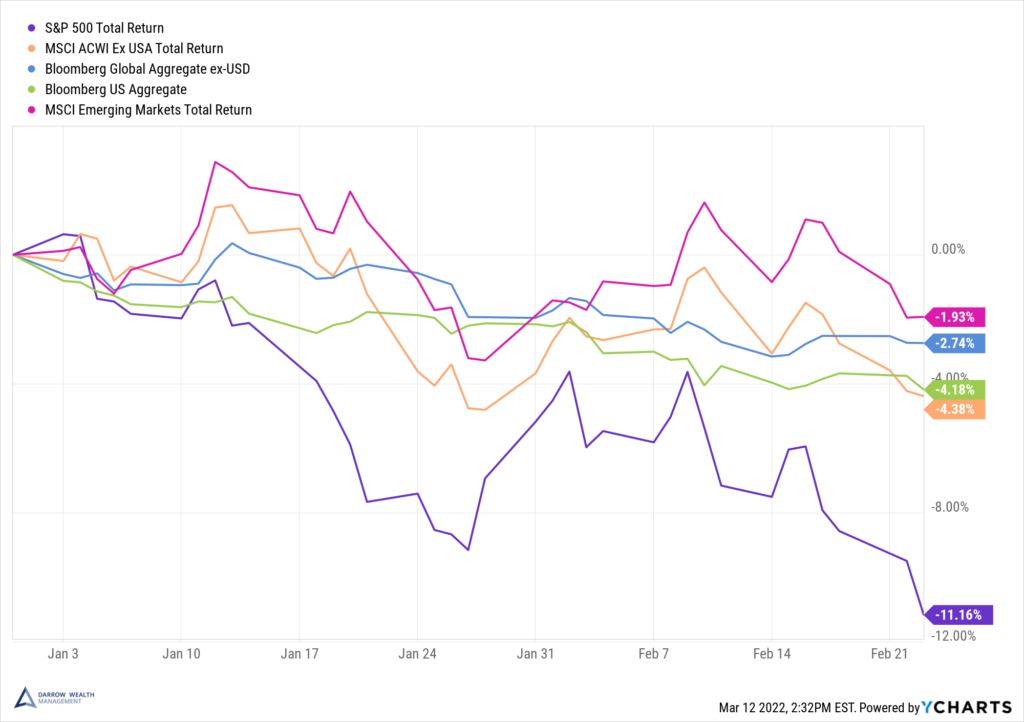

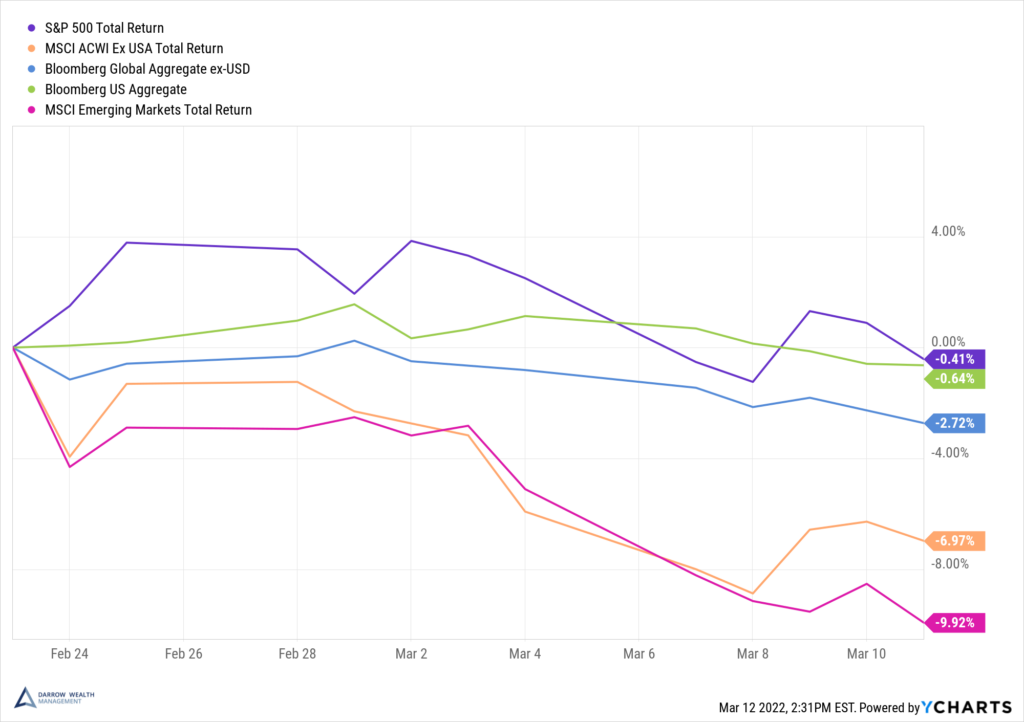

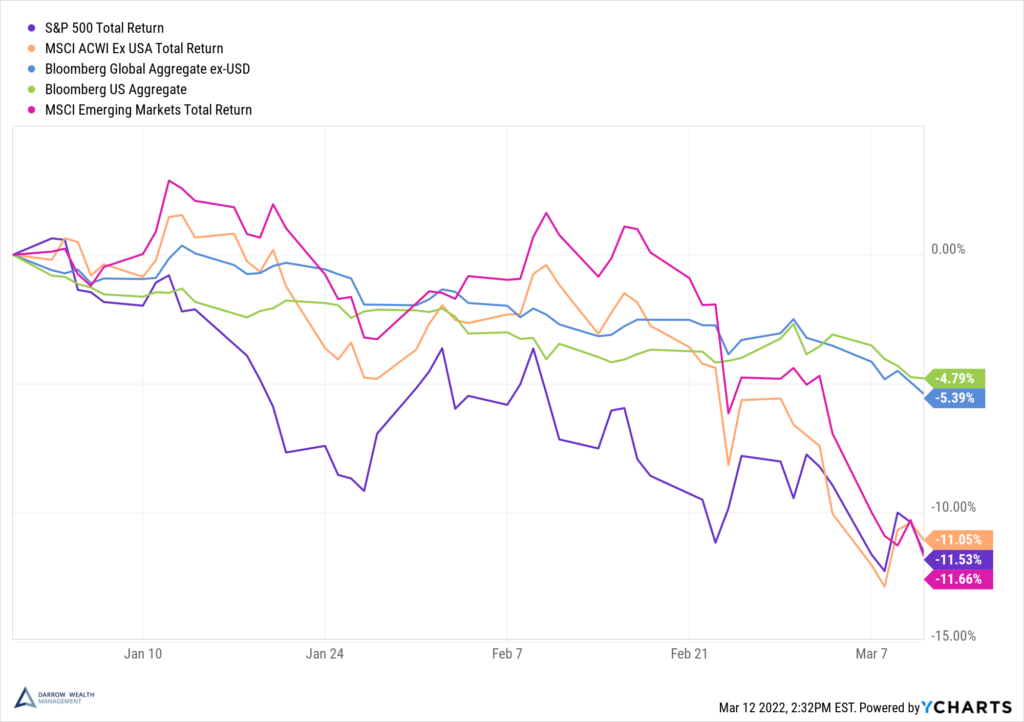

As geopolitical tensions mounted and Russia invaded Ukraine, international ex-U.S. equities and fixed income, which had been outperforming their U.S. counterparts year-to-date (although still negative), quickly reversed. The benefits of diversification became much harder to see year-to-date as global asset classes have suffered very similar losses.

Asset class returns prior to the Russian invasion of Ukraine

Asset class returns since the invasion of Ukraine on February 24th

2022 YTD returns (through March 11th)

Diversification isn’t a magic bullet: there isn’t always somewhere to hide when the markets are down. Further, during periods of volatility, correlation between asset classes tends to increase. But there’s no telling when that will change and by how much, so for the long-term investor, it’s important to stay invested.

Where will we end this year?

This is undoubtedly a challenging time in the markets, make no mistake about it. Although there’s no way to know where we will end this year, the three facts about the markets below may provide some solace that despite short-term volatility, markets have historically gone up over the medium and long-term.

- According to J.P. Morgan, since 1980, the average intra-year decline for the S&P 500 was 14% (excluding dividends). During this period, the average year-end price return was 9.4%. For reference, as of last close (March 11, 2022), the S&P 500 was ‘only’ down 11.8%.

- Since 1980, the S&P 500 produced positive annual returns roughly 75% of the time.

- For fixed income, negative annual returns for bonds are rare. Since 1981, the Bloomberg U.S. Aggregate Bond Index only ended a year with a negative return four times (less than 10% of the time). And consecutive years of negative returns has only ever happened twice, both in the 1950s. In 2021, the Bloomberg U.S. Aggregate Bond Index returned -1.5% on the year.

Investors should brace for more volatility in the weeks, perhaps months, to come. While it’s never fun to see your portfolio lose value, it’s a necessary reminder that stocks don’t only go up. Thankfully, over the long-term, the good years have far outweighed the bad ones.

This article was written by Darrow Wealth advisor Kristin McKenna, CFP® and originally appeared in Forbes.

Disclosures

Examples in this article are generic, hypothetical and for illustration purposes only. Both past performance and yields are not reliable indicators of current and future results. This is a general communication for informational and educational purposes only and not to be misinterpreted as personalized advice or a recommendation for any specific investment product, strategy, or financial decision. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. If you have questions about your personal financial situation, consider speaking with a financial advisor.

All indexes are unmanaged and an individual cannot invest directly in an index. Index returns do not include fees or expenses. Past performance is not indicative of future results.