Putting recent volatility into perspective

The COVID-19 virus has roiled the global financial markets in recent days, dominating the headlines. Although the virus does present real risks, it’s important to put the recent volatility into perspective.

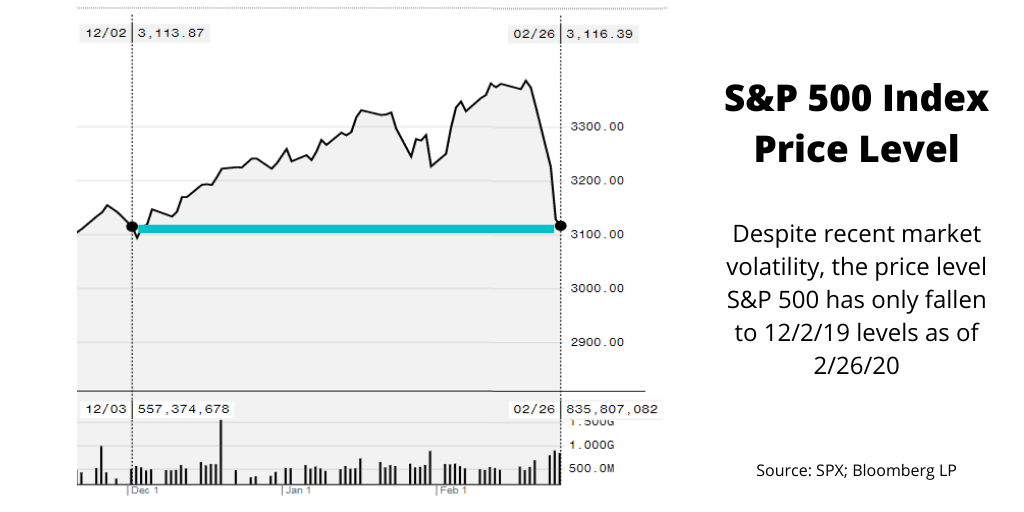

As of February 26th, the S&P 500 was down 3.54% on the year. From a price perspective, this only brings the index back to levels last seen in early December 2019.

After a 10% decline in the S&P 500, the index has experienced forward-looking average annual returns of 11.3%, 10.2%, and 9.6% on a 1, 3, and 5-year basis. Past performance is not indicative of future results, especially given our position in the 11-year-long bull market, but this highlights the importance of staying the course as the markets can turn on a dime.

What is driving the recent selloff?

There are a number of contributing factors to the recent market selloff.

- Impact on global economic growth: China is the world’s second-largest economy, so the virus will certainly impact the economic conditions in the country as people are forced to stay home. Transportation and energy sectors have been some of the hardest hit. China is also a major producer of the world’s goods, which has already impacted supply chains worldwide. Many U.S. companies have subsequently revised earnings estimates. As with most sudden selloffs, the market is reacting more to future fears rather than recent events. The possibility that the virus may continue to spread is top of mind.

- The presidential election: Election years are notoriously volatile for the financial markets, which hate uncertainty. The recent surge in popularity of self-proclaimed Democratic-Socialist Bernie Sanders has also spooked investors. Expect politically-driven market volatility to continue. Regardless of your political beliefs, we’re still a long way from a potential Bernie Sanders nomination, nevermind a presidency — let alone the implementation of any policies that could fundamentally impact the market.

- No safe spaces: Given the global nature of the financial markets, major events like the coronavirus are felt across asset classes. In the U.S., already low bond yields are being driven down further as investors flee equity investments. As investors pour into bonds, prices rise, which causes yields to fall.

- Institutional fund managers have been trading: Recent market moves have been driven in large part by active institutional asset managers of mutual funds and ETFs. Unlike individual investors, like you, many of these managers are concerned about short-term performance and self-preservation. The vast majority of individual investors must remain focused on their long-term investment horizon. Even for retirees, this can be 30 years or more. It is especially in times of uncertainty that patience and discipline are required.

Should investors worry?

It’s never a good feeling when the markets are nervous, but that doesn’t mean it’s time to act. Perhaps the best way to manage risk is to maintain a well-diversified portfolio so the impact of one sector or region or even asset class doesn’t have an outsized impact on your portfolio.

In the news media and even in this message, there’s a big focus on the S&P 500. While the S&P does have a major impact on the U.S. stock market, it doesn’t represent its entirety. The index is so often used as a barometer for the markets because everyone understands it, so it’s a helpful basis for comparison.

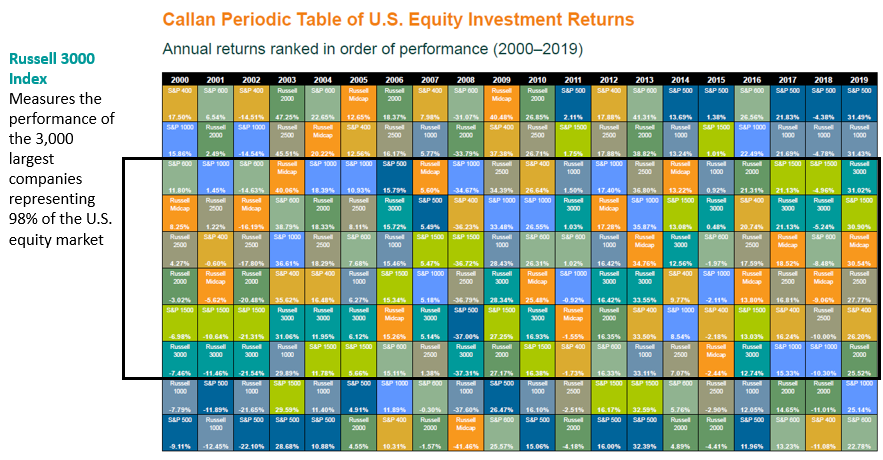

By way of example, consider the table below. The black box represents the ranked returns of the Russell 3000 between 2000 – 2019. The Russell 3000 represents the largest 3,000 U.S. companies. Now look for the S&P 500 on the chart, represented in blue. The volatility of the S&P 500 relative to the Russell 3000, which includes small and mid-cap stocks in addition to large-caps, is evident.

And this is just the U.S. equity market: after considering global equity and fixed income diversification, it’s clear that the portfolios of most well-diversified investors look quite different than the S&P 500.

Over time, the only way for investors to keep pace with inflation and grow and maintain a portfolio capable of producing the income required in retirement is equity exposure. However, as the investment period in retirement shortens, it may make sense for some investors to increase bond holdings relative to equity. This remains the case in any type of market environment.

If you have questions about your investment strategy and would like to discuss your personal situation with a wealth advisor, please contact us to schedule a phone consultation.