5 Ways to Manage a Concentrated Stock Position

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

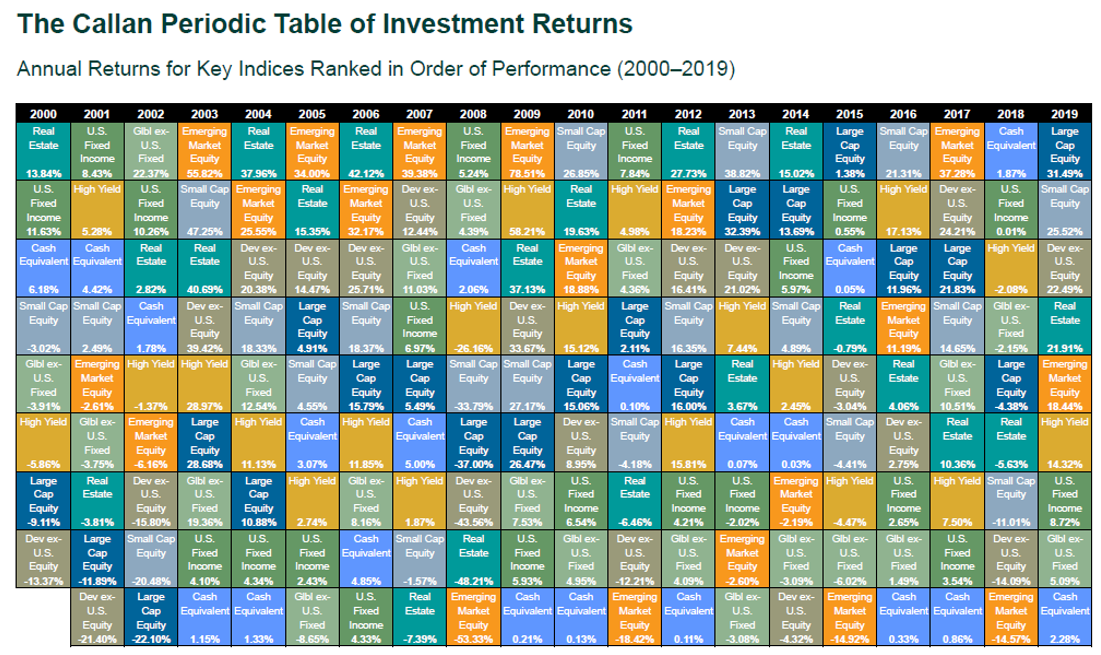

Diversification isn’t a magic bullet, but it is one of the best tools to protect your portfolio from unnecessary losses and volatility. The Darrow Wealth Insights blog covers diversification from several different angles: concentrated stock positions, asset classes, geography, company size, sectors, styles such as factors, and so on. As with anything in investing, consider your personal risk tolerance, time horizon, and circumstances.

Investors can wind up with a concentrated stock position in different ways. But it’s most often from an inheritance, founder, or employee with company stock.

The Instacart IPO is on hold…again. What should employees with stock options do when their employer’s IPO stalls? In truth, best practices around an IPO

The Federal Reserve is going to be raising interest rates (via the target Federal Funds rate). This is likely to happen next month. Rising interest

Rebalancing your portfolio is an important part of managing your money. Rebalancing means buying and selling positions in your portfolio to get back to your

What happens to stock options if a company goes public without an IPO? A Direct Public Offering (DPO) or direct listing is a way for

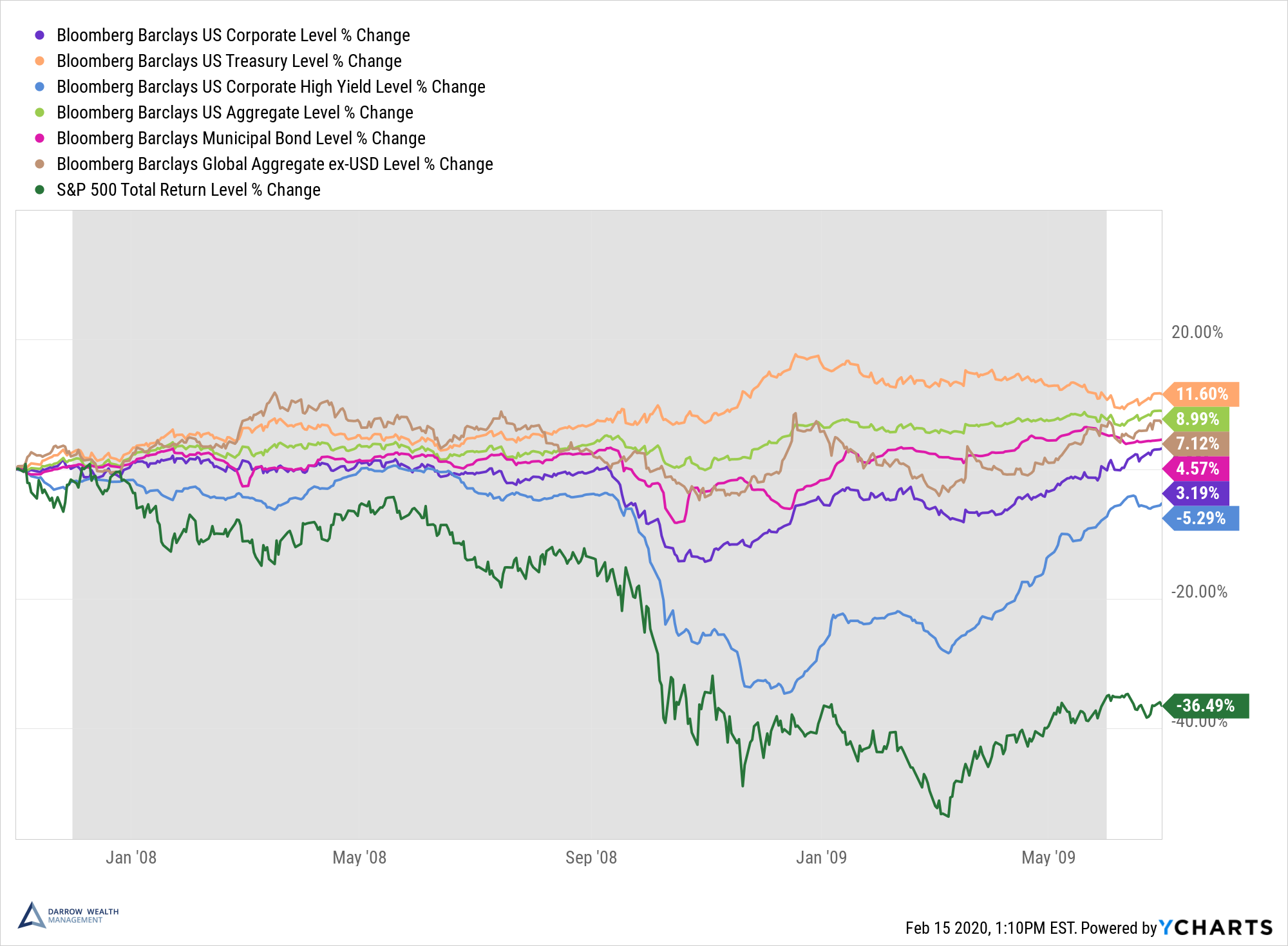

How do bonds work and why buy them in your investment accounts? There are several benefits of investing in bonds. Most notably, bonds provide investors

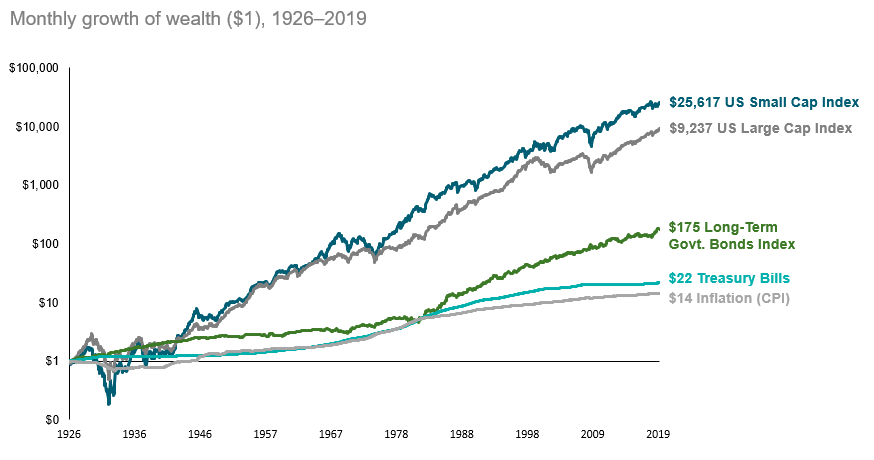

Stocks and bonds differ in many aspects, including the risk and return investors can expect. Because of these differences, stocks and bonds accomplish different things

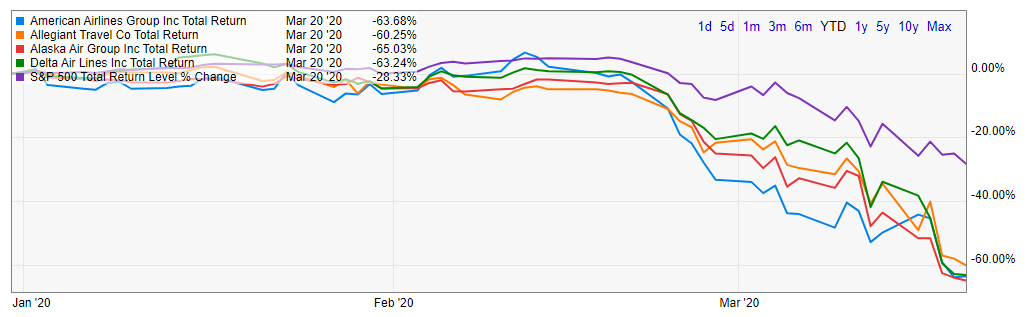

What can happen if you own too much of your company’s stock? The coronavirus outbreak is yet another example of the dangers of having too

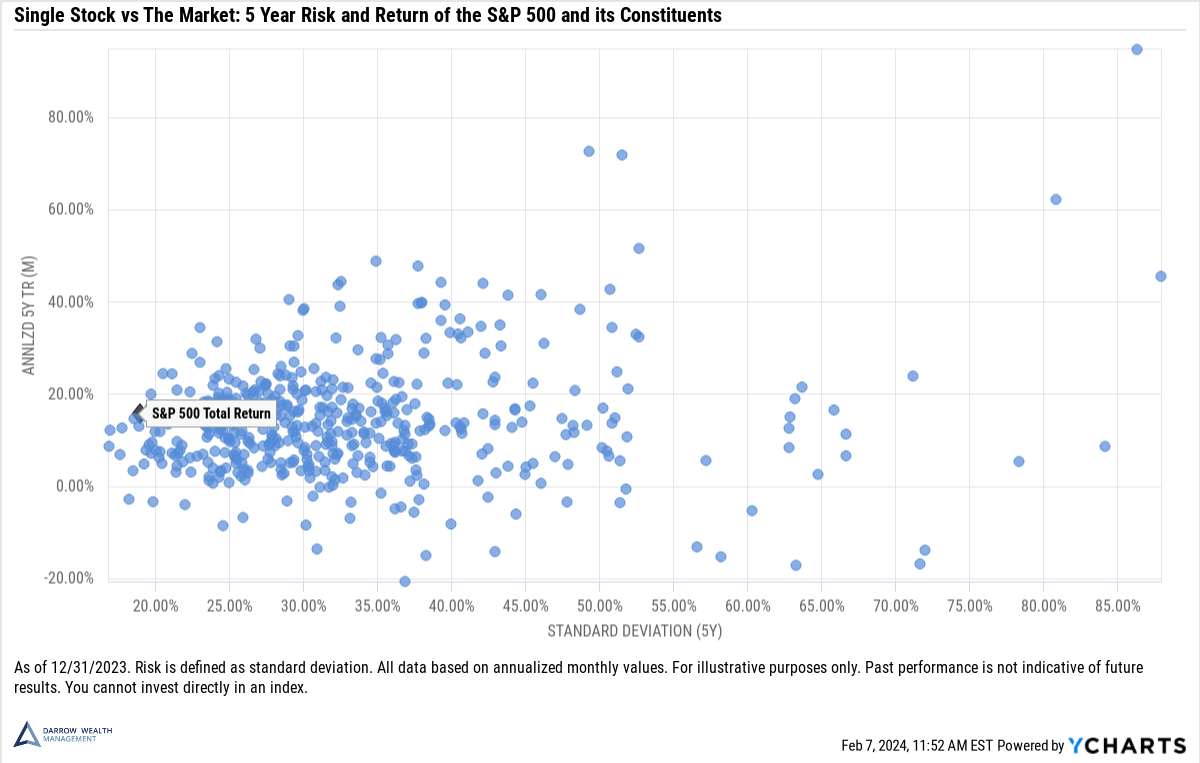

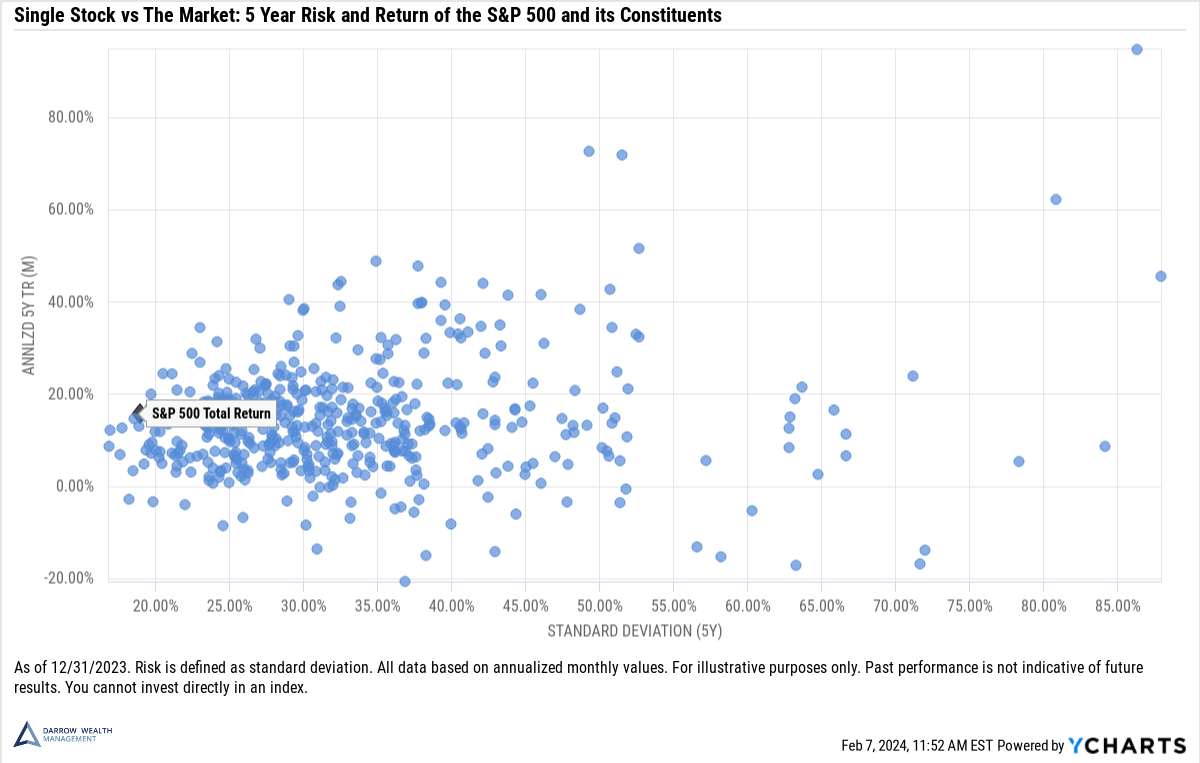

Amidst the vast uncertainty in the markets right now, it’s more important than ever for investors to understand the benefits—and limitations—of diversification. Having the right

The globalized nature of the world economy makes diversification a tall task. Although past performance is not indicative of future results, history is a helpful