Rebalancing your 401(k) and investment portfolio is an important part of a successful investment strategy. Your asset allocation is the percentage of your portfolio that you distribute between different asset classes, like stocks and bonds. Without periodic rebalancing, your investment mix will change as the market fluctuates, falling out of alignment with your target investment mix.

To rebalance your portfolio, you’ll buy and sell certain investments to realign to your accounts with your desired asset allocation. This is critical because without rebalancing, you may be taking on more risk than necessary to meet your goals.

Why do you need to rebalance your portfolio?

There are a couple main reasons to rebalance your investment portfolio. First, your investment goals or risk tolerance might change, requiring your asset allocation to be updated. As you approach retirement, managing risk is even more important. Adding more bonds to your portfolio could be appropriate.

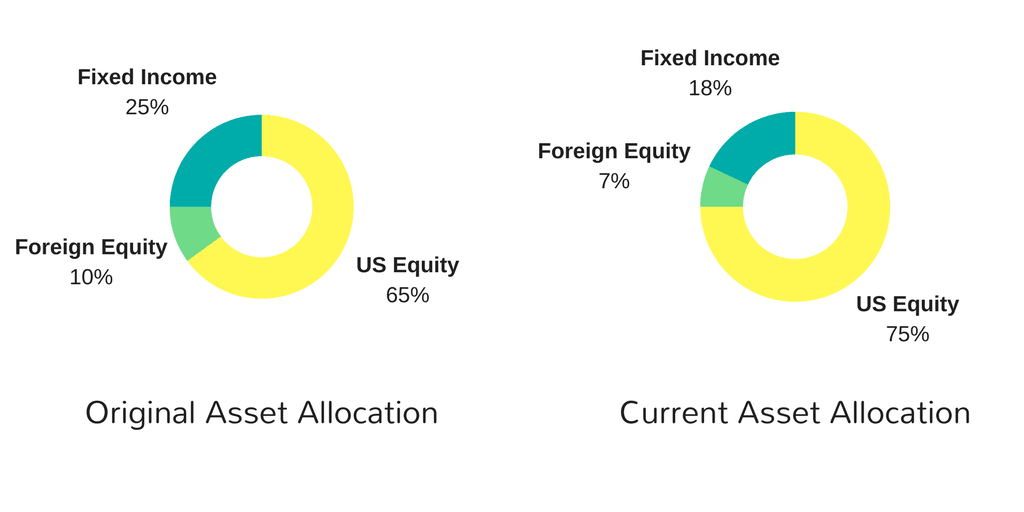

Another reason to rebalance is because the investment performance of your portfolio has caused the current asset allocation to shift.

Consider the following:

The equity portion of the portfolio has grown at a much higher rate than the bonds, creating an investment mix that is more heavily weighted in stocks than planned. Why does this matter? Because past performance doesn’t mean future results.

If the stock market were to suffer a decline, the unbalanced portfolio would be exposed to much more risk than intended. Put simply, rebalancing is one way to manage risk in your portfolio.

To correct this, portfolios are rebalanced periodically. In the sample closing balance portfolio above, an asset manager would determine which equities should be sold, and which bond funds to buy, to restore the original target allocation.

How often should I rebalance my 401(k)? Here’s when to rebalance

Rebalancing your portfolio is not something you need to do with extreme frequency. Unless you’re working with a financial advisor, you’ll need to determine when and how to rebalance your investments.

If you have a target-date retirement fund in your 401(k), it will automatically rebalance. While that can certainly make life easier, an age-based investment isn’t always the best choice. Typically, target-date funds are most useful for small 401(k) accounts, perhaps if you just changed jobs. But depending on the investment options in the retirement plan, as the balance grows, it may be advantageous to customize your asset allocation.

Time-based rebalancing

The timing of a rebalance can vary. One way is to schedule a periodic review of your portfolio, perhaps quarterly. At this point, you would check to see whether your asset allocation has changed and can adjust your 401(k) and other accounts if necessary.

Even if you’re due for an adjustment, when the stock market is volatile, rebalancing is challenging. So depending on market conditions, carefully weigh the pros and cons before proceeding.

Drift-based portfolio rebalancing

Another option is to set maximum thresholds for changes above a certain threshold (or below it). If an asset class in your portfolio drifts from target by more than your acceptable band threshold, then you rebalance.

In an overly simplified example, if you have a 5% threshold for drift and a target allocation of 50% for stocks, you will rebalance whenever stocks make up more than 55% of your total portfolio or less than 45% of your total portfolio. This is an example of an absolute threshold band.

In some cases, fund-specific allocations are smaller and therefore a relative band may be used before rebalancing. For example, if you have a 5% target in a particular bond fund, an absolute band of 5% wouldn’t be appropriate (the investment could double or drift to zero without triggering a rebalance). A relative band would be more suitable.

Putting it all together (literally)

Because there are so many aspects to consider, there’s no hard rule on how often you should rebalance your portfolio. And for various reasons, you may also want to consider using a time and drift-based rebalancing as well as considering both absolute and relative deviations from target when making investment decisions.

Finally, when rebalancing your 401(k), don’t forget about your other accounts! In another words, when considering fluctuations versus original targets, how does that change look if you combine your 401(k) and other accounts into one portfolio allocation?

Other situations that may warrant rebalancing your portfolio

There are also various circumstances which may trigger the need to rebalance or pose an opportunity to reallocate your investments:

- A large withdrawal or contribution to one of your accounts

- A shift in your original investment plan that changes how much risk you wish to take

- A change in your investment options, perhaps as a result of a 401(k) rollover or change in your retirement plan fund lineup

- After inheriting an IRA or brokerage account

If you’re questioning the appropriateness of your original percentages, or if there are changes to your individual circumstances, financial goals, time horizon, etc., then it’s a good time to consider setting a new target. Especially when expecting large cash flows in or our of your investment or retirement accounts, there’s a natural opportunity to adjust your retirement savings or taxable accounts as trading is required regardless.

How to rebalance your 401(k) or investment portfolio

Rebalancing involves adjusting your current allocation by selling investments to get back to your preferred asset mix.

First, compare your original target asset allocations to your current portfolio holdings. If the variance is outside of your desired threshold, then it may be time to rebalance to restore your accounts to target allocations. To do this, you’ll need to sell investments (ETFs and mutual funds for example) that are overweight and buy positions that are shy of target percentages.

Rebalancing tips

- In practice, consider the drift of your portfolio from a top-down perspective. Meaning, start with your current weighting to broad-based asset classes like stocks and bonds. Then work down, perhaps going to U.S. equity versus international developed stocks, all the way down to the target for each individual holding.

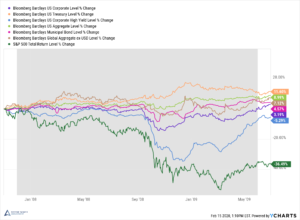

- Depending on the target asset allocation, there can be a number of ways for a portfolio to drift. So consider other factors in your preferred allocation, such as style (value versus growth equities), market cap, or in fixed income, credit quality (high-yield or investment-grade bonds), and time to maturity.

- Consider the merits of reducing trading costs and turnover by rebalancing at the portfolio level versus account-by-account. There might not be a need to rebalance if each individual account rolls up to one properly diversified portfolio.

As you can see, there’s a lot to consider, so especially with a taxable account and possible tax implications, rebalancing can be both art and science.

Confirm your target asset allocation is the right one

Creating a diversified mix that is aligned with your risk tolerance, and stays that way, is a complex and time-consuming process. Many busy professionals don’t have the time or interest in managing their money. That’s a good point to consider seeking professional advice from a financial advisor.

So before you rebalance your 401(k) or other accounts, objectively try to assess your comfort and skill in investment management. Your 401(k) might be your largest asset (aside from a home). If you’re not confident your original asset allocation is the best one, it likely doesn’t make sense to rebalance back to this potentially flawed allocation.

The costs of rebalancing

Does it cost money to rebalance? Maybe. Trading costs vary by platform and commissions may apply if you’re not working with a fee-only advisor. Both can add up and reduce returns.

Capital gains tax must also must be considered when investing with a brokerage account (versus a retirement account). Consider the pros and cons of rebalancing in conjunction with tax-loss harvesting.

As discussed earlier, getting your portfolio in balance is art and science. Assessing your potential capital gains tax liability is important so you can balance the potential for higher risk with the cost of paying taxes after selling assets. It’s not always worth making a change.

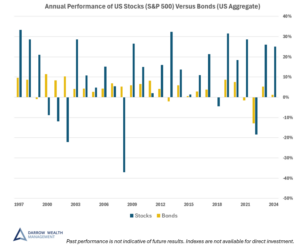

Managing investments means making trade-offs

As in just about anything in life, there are trade-offs to consider when managing your money. Generally, more stocks mean more risk. But for those seeking to maximize returns, equities have historically been outperformers over bonds. A prudent investment strategy includes the right mix of both to weather market volatility.

Coming up with an asset allocation and effective rebalancing strategy can be complicated. As a practical matter, individual investors don’t always have the right tools to aggregate multiple investment accounts at different financial institutions, their holdings, and investment options. And that’s before even considering the overlap of the underlying funds (ever wonder how much Microsoft you really own through various ETFs and mutual funds?).

Selecting the specific investment products for your accounts can be daunting and evaluating which outperforming asset should be sold during rebalancing also requires a lot of consideration and experience. For help managing your investments and the rest of your personal financial life, please contact a Darrow Wealth advisor to schedule a consultation.

[Last reviewed October 2024]